Indian Exchange Growth Companies With Up To 39% Insider Ownership

Reviewed by Simply Wall St

The Indian market has shown robust performance, rising 2.7% over the last week and achieving a notable 45% increase over the past year. With earnings expected to grow by 16% annually, companies with high insider ownership can be particularly appealing, as this often signals strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.5% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 37.8% | 22.9% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.1% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Let's uncover some gems from our specialized screener.

Dollar Industries (NSEI:DOLLAR)

Simply Wall St Growth Rating: ★★★★☆☆

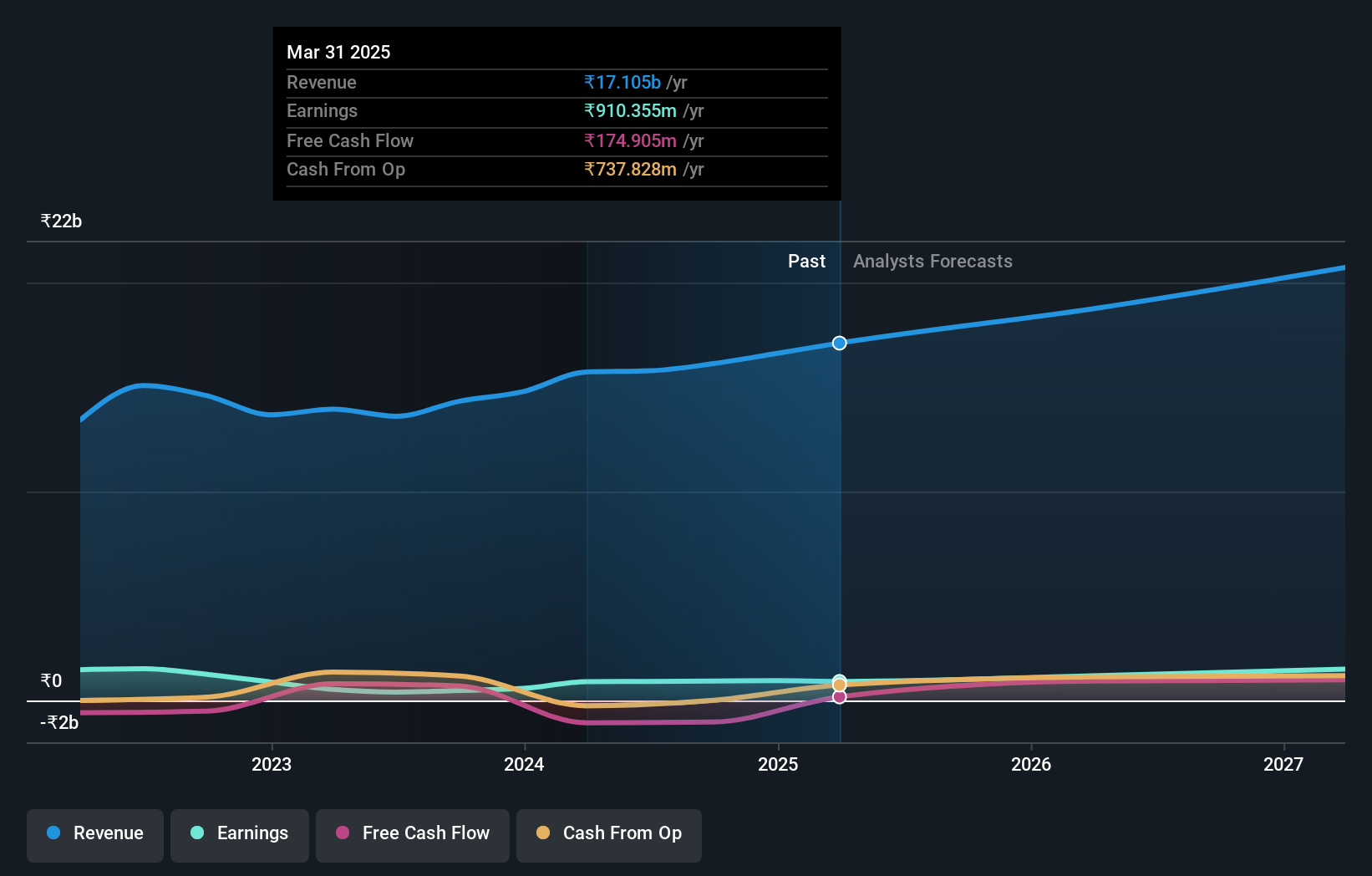

Overview: Dollar Industries Limited specializes in manufacturing and selling a range of hosiery products including knitted innerwear, casual wear, and thermal wear, both in India and internationally, with a market capitalization of approximately ₹32.78 billion.

Operations: The company generates revenue primarily from garments, hosiery goods, and rainwear products, totaling ₹15.72 billion.

Insider Ownership: 10.1%

Dollar Industries in India, known for high insider ownership, shows promising financial growth with a significant earnings forecast increase of 29.9% annually. Despite this, its dividend sustainability is questioned due to poor cash flow coverage. The company recently reported a substantial year-over-year revenue and net income increase in Q4 2024, indicating robust short-term performance. However, concerns about its low forecasted Return on Equity at 17.8% suggest potential challenges in maintaining long-term profitability efficiency.

- Take a closer look at Dollar Industries' potential here in our earnings growth report.

- The analysis detailed in our Dollar Industries valuation report hints at an inflated share price compared to its estimated value.

Lumax Auto Technologies (NSEI:LUMAXTECH)

Simply Wall St Growth Rating: ★★★★★☆

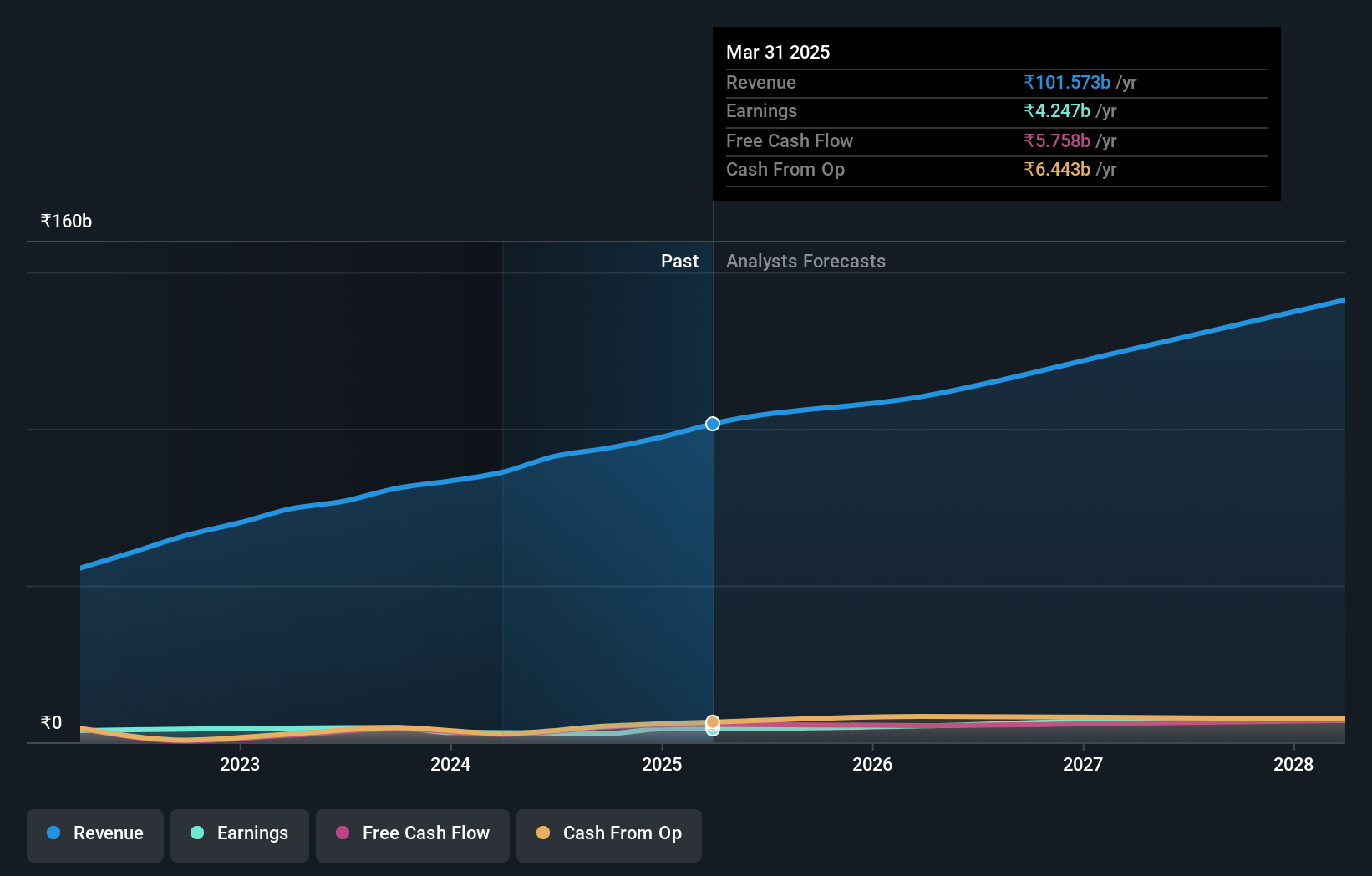

Overview: Lumax Auto Technologies Limited, operating in India, specializes in manufacturing and selling automotive components with a market capitalization of ₹36.24 billion.

Operations: The company generates ₹28.22 billion in revenue from the manufacturing and trading of automotive components.

Insider Ownership: 39.1%

Lumax Auto Technologies, with substantial insider ownership, is poised for notable growth in India. The company's earnings are expected to increase by 33.24% annually, outpacing the broader Indian market's forecast of 16% per year. Additionally, its revenue growth at 14.9% annually also exceeds the market average of 9.6%. Despite these positive trends, Lumax has an unstable dividend track record which could concern income-focused investors. Recent financial reports highlight a significant year-over-year increase in both revenue and net income for FY 2023-24.

- Get an in-depth perspective on Lumax Auto Technologies' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Lumax Auto Technologies implies its share price may be too high.

Sonata Software (NSEI:SONATSOFTW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sonata Software Limited offers information technology services and solutions across India, the United States, Europe, the Middle East, and Australia, with a market capitalization of approximately ₹156.58 billion.

Operations: The firm generates revenue from providing IT services and solutions across various global regions including India, the US, Europe, the Middle East, and Australia.

Insider Ownership: 37.9%

Sonata Software, despite a decline in net profit and unstable dividends, shows promising signs of growth with significant earnings forecasted to rise annually by 27.4%, outstripping the Indian market's average. Insider activity leans towards more buying than selling recently, indicating confidence from those within the company. Recent partnerships aim to enhance technological capabilities and market reach, potentially boosting future performance.

- Unlock comprehensive insights into our analysis of Sonata Software stock in this growth report.

- Our valuation report here indicates Sonata Software may be overvalued.

Summing It All Up

- Explore the 82 names from our Fast Growing Indian Companies With High Insider Ownership screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DOLLAR

Dollar Industries

Manufactures and sells hosiery products in knitted inner wears, casual wears, and thermal wears in India and internationally.

Solid track record with reasonable growth potential.