- Israel

- /

- Renewable Energy

- /

- TASE:NOFR

Nofar Energy (TASE:NOFR) Q2 Net Loss Deepens, Challenging Optimism Over Profitability Turnaround

Reviewed by Simply Wall St

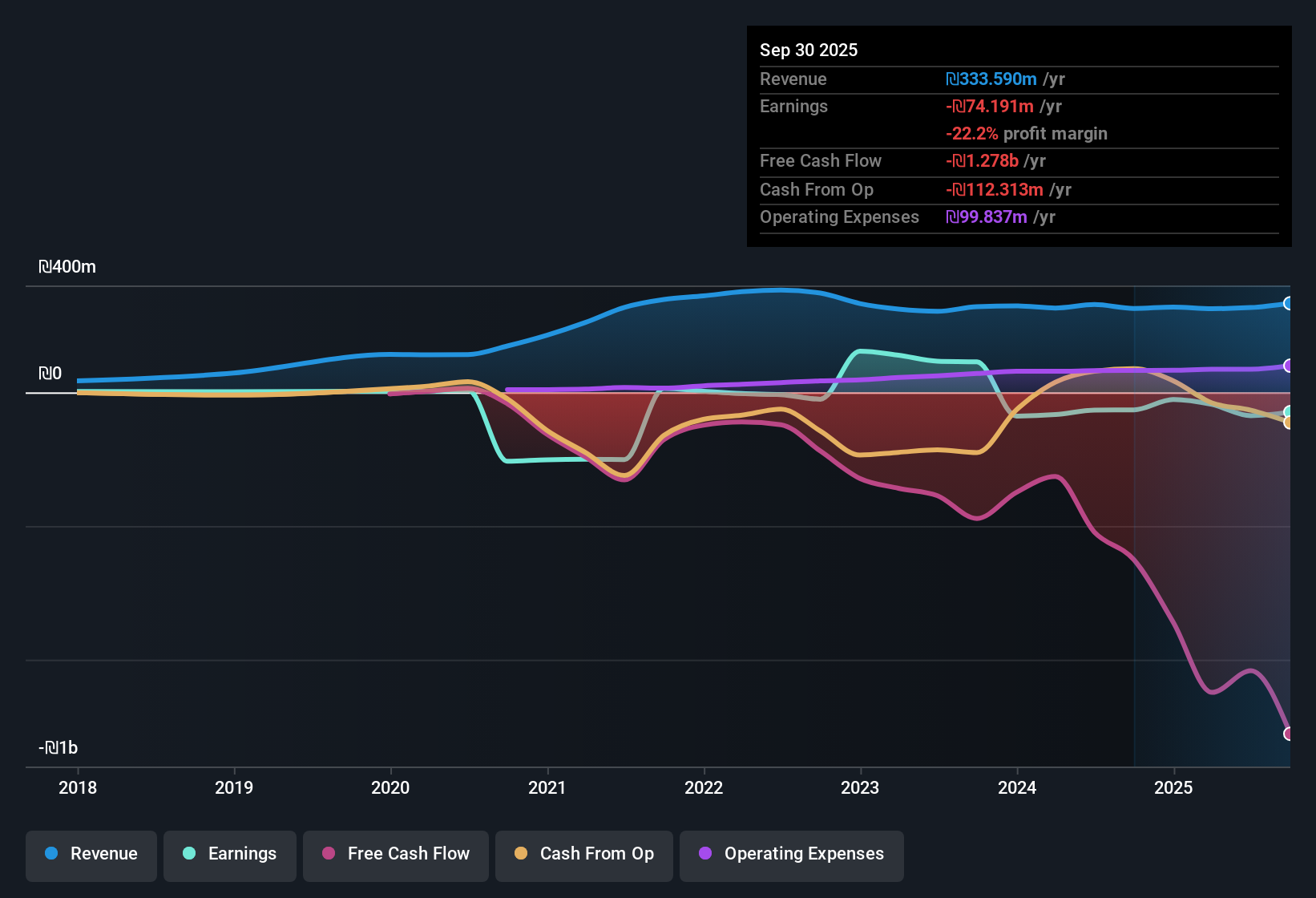

O.Y. Nofar Energy (TASE:NOFR) has just posted its Q2 2025 results, reporting revenue of 105.7 million ILS and a basic EPS of -1.34 ILS for the quarter, alongside a net income loss of 47.5 million ILS. Historically, the company’s revenue moved from 101.5 million ILS in Q2 2024 to 105.7 million ILS this quarter. EPS fell from -0.15 ILS to -1.34 ILS over the same periods. Margins continue to be a focal point, with the latest figures highlighting persistent pressure on profitability.

See our full analysis for O.Y. Nofar Energy.Now, let’s see how these fresh financial numbers line up against the broad narratives that typically shape market opinion on NOFR. Some assumptions may get upheld, while others could face a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow But Persist

- Over the last twelve months, Nofar Energy reduced annual losses by 33%, yet still reported a net loss of 87.47 million ILS for the trailing period.

- Bears highlight that despite this progress, the lack of margin improvement and ongoing unprofitability keep the company from delivering consistent returns to shareholders.

- Bearish arguments point to the persistent gap between revenue increases and net loss, with losses staying significant even as sales grew to 317.27 million ILS TTM.

- The lack of positive EPS in five out of the last six quarters challenges expectations for an imminent turnaround in the company’s core profitability.

High Price-to-Sales, Industry Context

- Nofar’s price-to-sales ratio stands at 10.6x, much lower than its peer average of 17x but almost five times higher than the broader Asian Renewable Energy sector at 2.2x.

- This valuation disconnect leads to debate around whether investors are overpaying for growth that has yet to translate into real profits.

- Analysts note that while the lower multiple versus peers could signal value, the company’s higher price compared to the industry underlines concerns about future cash flow visibility.

- Share price at 94.60 ILS provides a test for how much of the growth story is already priced in if earnings remain negative.

Cash Runway Remains Tight

- The company operated with less than one year of cash runway over the past twelve months, highlighting pressure on short-term liquidity and funding options.

- Market observers stress that this limited buffer makes Nofar especially vulnerable to rising costs or project delays.

- Any prolonged period of negative net income, like the 47.51 million ILS loss in the most recent quarter, could force management to consider external financing or scale back expansion plans.

- With no material rewards highlighted in the past year, sustaining operations may require improvements in margins or access to additional capital.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on O.Y. Nofar Energy's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Nofar Energy’s continued unprofitability, tight cash runway, and lack of margin progress point to significant challenges with financial resilience and liquidity.

If you’re concerned about these issues, discover companies with stronger financial health by checking out our solid balance sheet and fundamentals stocks screener (1938 results) for more robust alternatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NOFR

O.Y. Nofar Energy

Develops, designs, licenses, constructs, and operates photovoltaic systems on rooftops in Israel.

Overvalued with worrying balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.