- Israel

- /

- Renewable Energy

- /

- TASE:KEN

Kenon Holdings (TASE:KEN): Evaluating the Valuation After a Period of Strong Share Price Gains

Reviewed by Simply Wall St

Kenon Holdings (TASE:KEN) shares have put in a steady climb recently, gaining nearly 8% over the past month and 18% in the past 3 months. Investors are taking notice, particularly as the company outperformed many of its local peers during this period.

See our latest analysis for Kenon Holdings.

Even after a brisk climb this year, Kenon Holdings’ momentum shows little sign of fading. With a 47% year-to-date share price return and a stunning 94% total shareholder return over the past year, investors appear to see long-term value, not just a short-term bounce.

If steady gains like this have piqued your interest, take the next step and discover fast growing stocks with high insider ownership.

With the stock riding high on recent returns, the real question now is whether Kenon Holdings still offers more upside ahead or if today’s price already reflects all of its projected growth potential.

Price-to-Earnings of 5.9x: Is it justified?

Kenon Holdings trades at a price-to-earnings (P/E) ratio of just 5.9x, sharply below both local and broader industry averages. With a last close of ₪178.9, investors are currently valuing the company at a substantial discount relative to its recent profits.

The price-to-earnings ratio measures how much investors are willing to pay for each shekel of earnings, which makes it a closely watched metric for established, profitable companies. A low P/E often signals the market is discounting future growth, but it can also indicate underappreciated value if company fundamentals remain strong.

In comparison, Kenon's P/E stands far beneath its peers. The average for its industry is 17.7x, and amongst direct peers, the P/E climbs to 54.2x. This gap implies that the market could be overlooking the company's profitability or expecting much weaker growth ahead, creating a potential disconnect that investors should examine closely.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 5.9x (UNDERVALUED)

However, persistent market skepticism or a sudden downturn in sector sentiment could quickly challenge Kenon Holdings’ recent momentum and attractive value signals.

Find out about the key risks to this Kenon Holdings narrative.

Another View: What Does the SWS DCF Model Suggest?

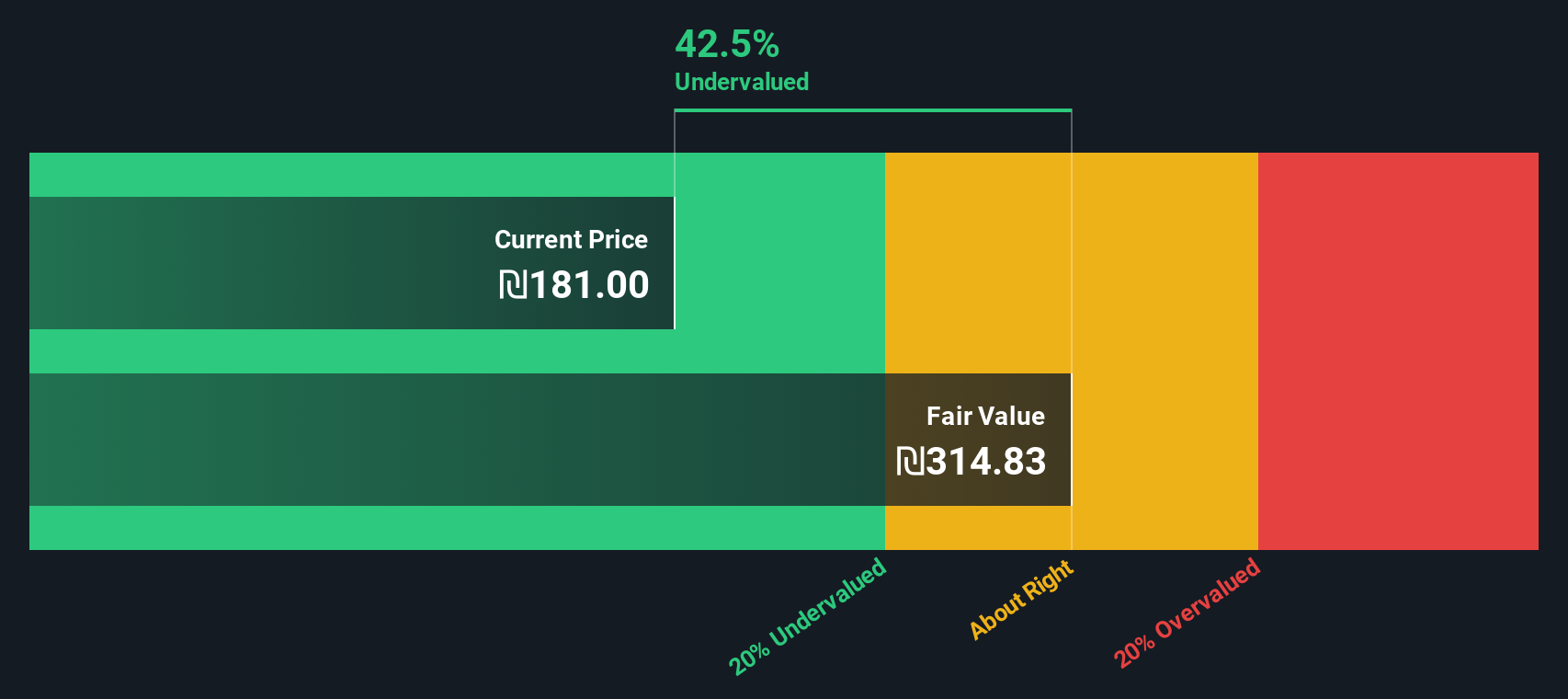

While Kenon Holdings' price-to-earnings ratio appears undervalued compared to peers, our DCF model presents an even more compelling case. The SWS DCF model estimates Kenon's fair value at ₪314.98 per share, which means the current price is trading at a steep 43.2% discount. Could this indicate a substantial mispricing, or is there a reason for the market's caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kenon Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 855 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kenon Holdings Narrative

If you see the story differently or want to dive into the data yourself, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your Kenon Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always stay ahead by uncovering fresh opportunities. Don’t let the next big trend pass you by. Put these unique stock screens to work and give your portfolio an edge.

- Target long-term gains by checking out these 855 undervalued stocks based on cash flows companies with strong fundamentals and attractive pricing before the wider market catches on.

- Capitalize on the explosive growth in digital finance by exploring these 82 cryptocurrency and blockchain stocks transforming how money moves and value is exchanged globally.

- Tap into technological innovation by reviewing these 25 AI penny stocks accelerating breakthroughs in artificial intelligence across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kenon Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:KEN

Kenon Holdings

Through its subsidiaries, operates as an owner, developer, and operator of power generation facilities in Israel and the United States.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives