- Israel

- /

- Electronic Equipment and Components

- /

- TASE:TLSY

Telsys (TASE:TLSY) Net Profit Margins Climb to 26.9%, Reinforcing Quality Narrative

Reviewed by Simply Wall St

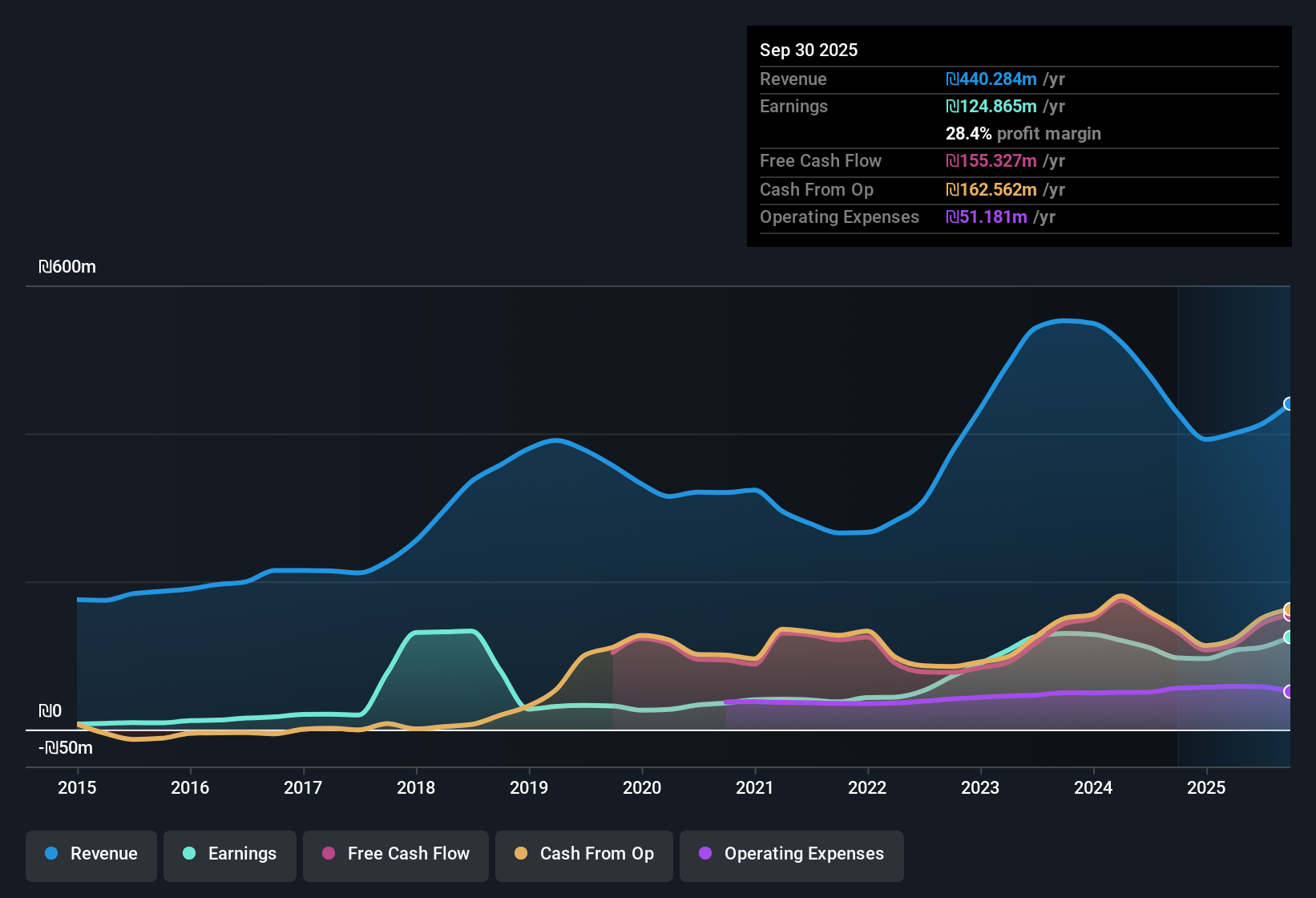

Telsys (TASE:TLSY) just announced its Q3 2025 results, posting total revenue of 111.9 million ILS and basic EPS of 3.6 ILS. Net income came in at 32.6 million ILS. Over the past few quarters, revenue increased from 87.1 million ILS in Q3 2024 to 111.9 million ILS in Q3 2025. Basic EPS rose from 1.96 ILS to 3.6 ILS in the same period. Profit margins have held strong, highlighting consistent operational efficiency for investors tracking long-term performance.

See our full analysis for Telsys.Now, it is time to see how these latest figures compare to the prevailing narratives shaping market sentiment and investor expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Rise to 26.9%, Outpacing Previous Year

- Telsys reported net profit margins at 26.9% over the past year, up from 23.1% previously. This illustrates a meaningful uplift in profitability that extends beyond headline EPS growth.

- The prevailing market view highlights how these robust margins are especially notable against a backdrop of only 0.4% earnings growth over the last year, which is below the five-year average of 25.1%.

- The margin improvement signals operational efficiency, even as short-term growth has cooled. This aligns with the view that Telsys remains fundamentally high-quality.

- While high five-year average growth demonstrates earnings momentum, the recent moderation may temper expectations for rapid near-term expansion.

- To see what the community is saying about Telsys, check out the full range of perspectives in our Consensus Narrative. 📊 Read the full Telsys Consensus Narrative.

Valuation Stays Attractive Versus Sector Peers

- The price-to-earnings ratio stands at 17.8x, which is well below the Asian Electronic industry average of 25.5x and key competitors at 27.4x.

- Market opinion underscores that this relative value, along with the stock’s 33.9% discount to the DCF fair value of 330.01 ILS, heavily supports the investment case that Telsys is favorably priced.

- A P/E meaningfully below sector norms can draw investors searching for overlooked opportunities in electronics distributors.

- The sizable gap to DCF fair value points toward possible re-rating potential if sentiment shifts or operational trends improve further.

Five-Year Growth Rate Remains a Standout

- Earnings per share have averaged 25.1% annual growth over the last five years, illustrating the company's longer-term profit engine even as recent annual growth slowed to 0.4%.

- This long-term expansion plays into the investment narrative that Telsys is a resilient compounder, as reflected in consistently rising net income figures and the ability to steadily grow through electronics market cycles.

- Despite a softer most recent year, the multi-year trajectory outpaces many peers, positioning Telsys as a potential beneficiary if sector tailwinds resume.

- The rising trend in trailing twelve-month net income, which reached 111.1 million ILS in Q3 2025 from 95.7 million ILS at Q4 2024, reinforces the underlying growth thesis.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Telsys's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Telsys boasts strong historical growth and robust margins, its most recent annual earnings growth slowed sharply compared to its impressive five-year trend.

If you want more consistent performance across market cycles, check out stable growth stocks screener (2075 results) to focus on companies delivering reliable expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telsys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TLSY

Telsys

Telsys Ltd. markets and distributes electronic components and open tools in Israel.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.