NICE (TASE:NICE): A Fresh Look at Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for NICE.

Despite a sharp 4.61% gain in its latest trading day, NICE’s share price return is still down over 32% year to date, and the 1-year total shareholder return sits at -34%. Momentum has been under pressure, even as the company maintains solid financials and continues to execute on its strategy.

If you’re interested in finding other opportunities beyond the headlines, now is a great moment to broaden your search and spot fast growing stocks with high insider ownership

With NICE trading well below its analyst price target and long-term returns under pressure, the big question remains: is the stock currently a bargain, or has the market already factored in all its future growth potential?

Most Popular Narrative: 43.4% Undervalued

NICE’s most widely followed valuation narrative sees the fair value almost 43% higher than the last close, pointing to major upside if its business performance delivers as projected. The gap between this estimate and NICE’s current price sets the stage for a closer look at the drivers behind the bullish outlook.

The rapid growth in demand for AI-driven customer experience solutions, manifested by 42% year-over-year growth in AI and self-service ARR and the upcoming integration of Cognigy's conversational AI capabilities, provides visibility into sustained increases in high-margin, recurring cloud revenue and expanded ARPU.

Want to know why the bulls believe NICE could re-rate fast? The core of this narrative hints at aggressive assumptions around future sales, expanding margins, and a higher profit multiple than industry norms. Discover the exact figures and logic that build this outsized fair value target in the full story.

Result: Fair Value of ₪750.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if margin pressure persists or if regulatory risks around AI adoption begin to impact profitability and future growth.

Find out about the key risks to this NICE narrative.

Another View: What Do the Ratios Say?

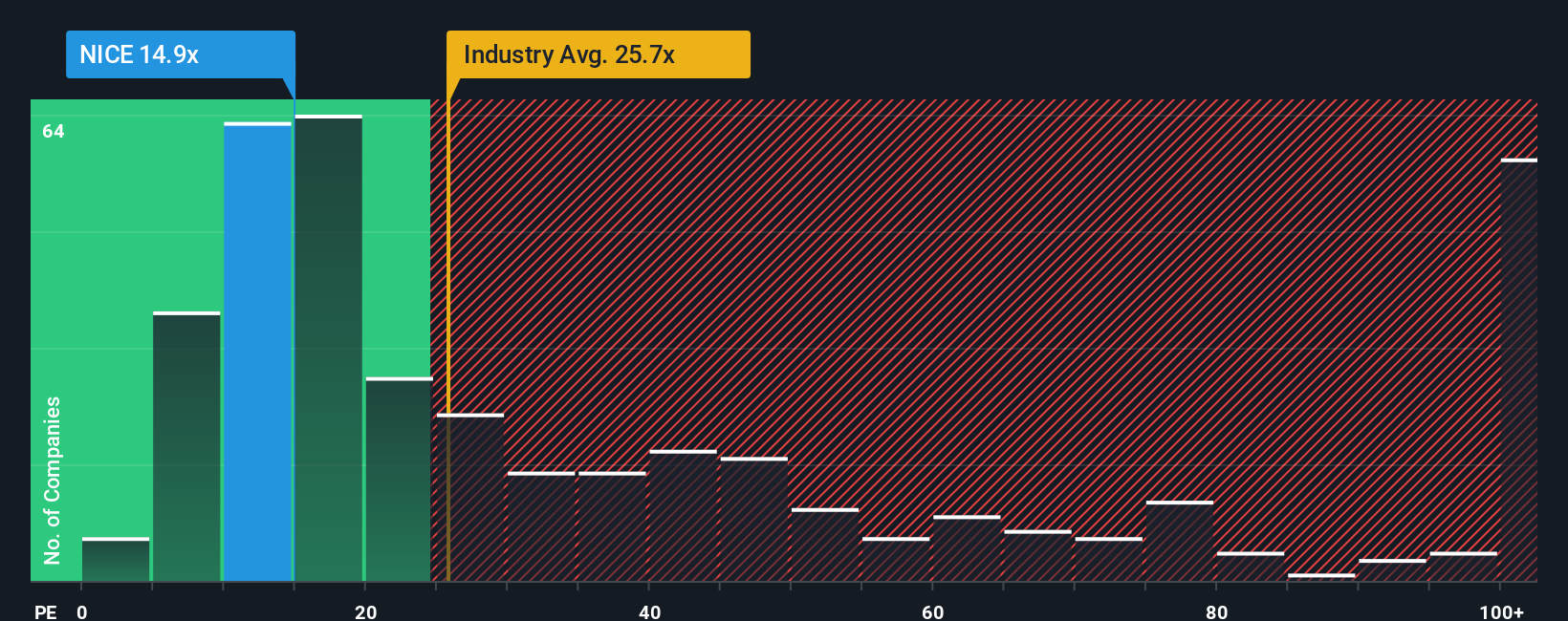

Looking at valuation from another angle, NICE trades at 14.4 times earnings, which is much lower than both the Asian Software industry average of 27.7 and its peer average of 45.7. However, this is still above our fair ratio of 12.3. This gap suggests potential opportunity, but also signals valuation risk if the market shifts toward that fair ratio. Could this lower multiple signal a hidden value or is it a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NICE Narrative

If you have a different perspective or want to dig deeper into the figures, you can build your own narrative from scratch in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding NICE.

Looking for More Investment Ideas?

Smart investors seize opportunity where others hesitate. Keep your edge and get a head start on tomorrow's winners using the Simply Wall Street Screener before the market catches up.

- Capture passive income potential and secure a stable yield by browsing these 16 dividend stocks with yields > 3% with over 3% annual returns across market leaders.

- Unlock tomorrow's tech giants by checking out these 24 AI penny stocks that are powering transformation in artificial intelligence and automation across industries.

- Stay ahead of value trends and identify hidden gems ready for re-rating by reviewing these 873 undervalued stocks based on cash flows based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NICE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NICE

NICE

Provides AI-powered cloud platforms for customer engagement, and financial crime and compliance worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives