- Israel

- /

- Real Estate

- /

- TASE:MLD-M

Shareholders May Be Wary Of Increasing MirLand Development Corporation Plc's (TLV:MLD-M) CEO Compensation Package

Key Insights

- MirLand Development's Annual General Meeting to take place on 25th of September

- Salary of US$351.7k is part of CEO Roman Rozental's total remuneration

- Total compensation is similar to the industry average

- MirLand Development's EPS declined by 81% over the past three years while total shareholder loss over the past three years was 87%

The results at MirLand Development Corporation Plc (TLV:MLD-M) have been quite disappointing recently and CEO Roman Rozental bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 25th of September. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for MirLand Development

How Does Total Compensation For Roman Rozental Compare With Other Companies In The Industry?

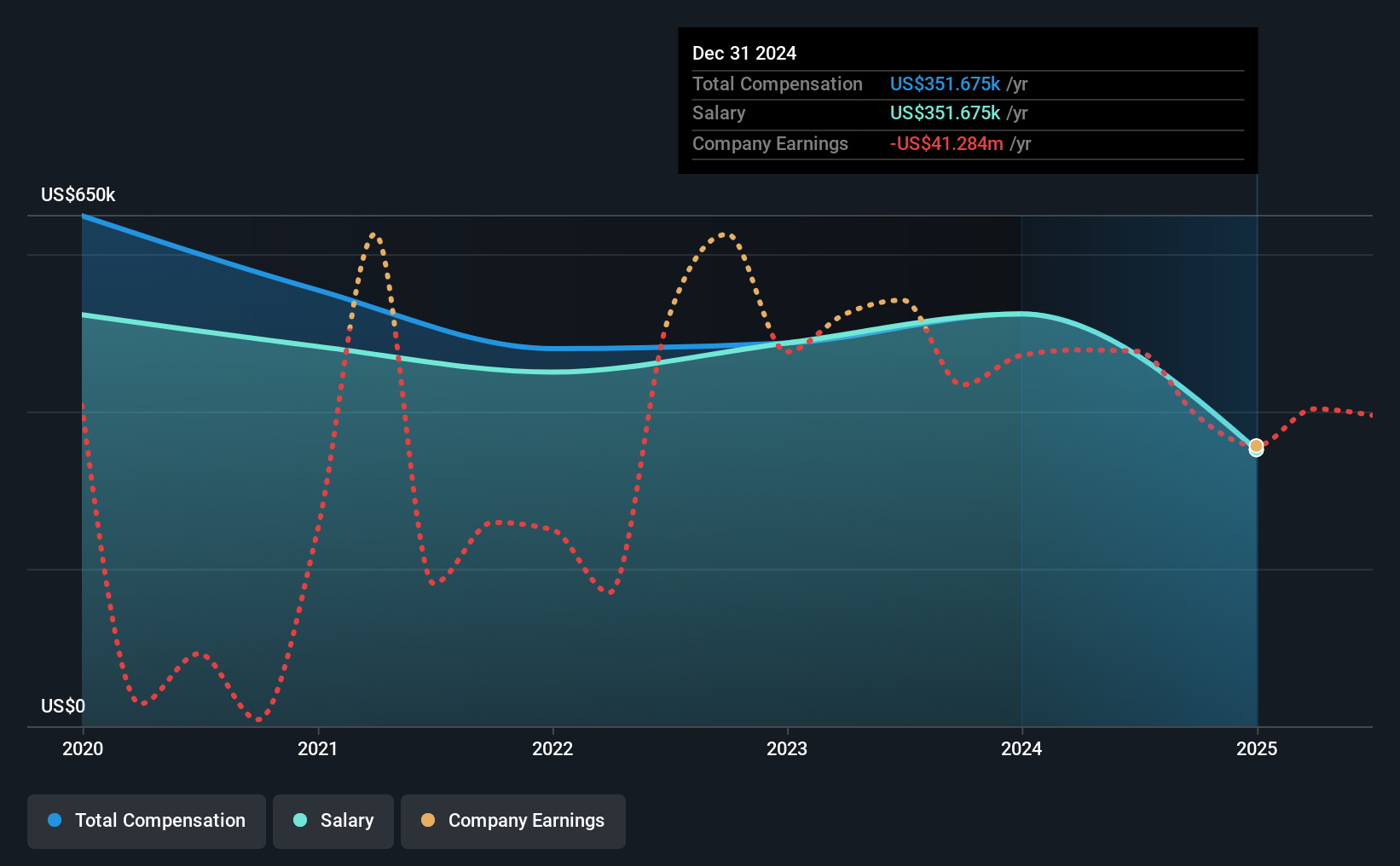

According to our data, MirLand Development Corporation Plc has a market capitalization of ₪720k, and paid its CEO total annual compensation worth US$352k over the year to December 2024. We note that's a decrease of 33% compared to last year. It is worth noting that the CEO compensation consists entirely of the salary, worth US$352k.

In comparison with other companies in the Israel Real Estate industry with market capitalizations under ₪668m, the reported median total CEO compensation was US$438k. So it looks like MirLand Development compensates Roman Rozental in line with the median for the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$352k | US$524k | 100% |

| Other | - | - | - |

| Total Compensation | US$352k | US$524k | 100% |

On an industry level, roughly 62% of total compensation represents salary and 38% is other remuneration. Speaking on a company level, MirLand Development prefers to tread along a traditional path, disbursing all compensation through a salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at MirLand Development Corporation Plc's Growth Numbers

Over the last three years, MirLand Development Corporation Plc has shrunk its earnings per share by 81% per year. In the last year, its revenue is down 59%.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has MirLand Development Corporation Plc Been A Good Investment?

The return of -87% over three years would not have pleased MirLand Development Corporation Plc shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

MirLand Development rewards its CEO solely through a salary, ignoring non-salary benefits completely. Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 6 warning signs for MirLand Development (of which 4 make us uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Important note: MirLand Development is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MLD-M

MirLand Development

Engages in the acquisition, development, construction, rental, and sale of commercial and residential real estate properties in Russia.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026