- Israel

- /

- Real Estate

- /

- TASE:GCT

G City (TASE:GCT) Net Loss Narrows to 11 Million ILS, Testing Resilience Narrative

Reviewed by Simply Wall St

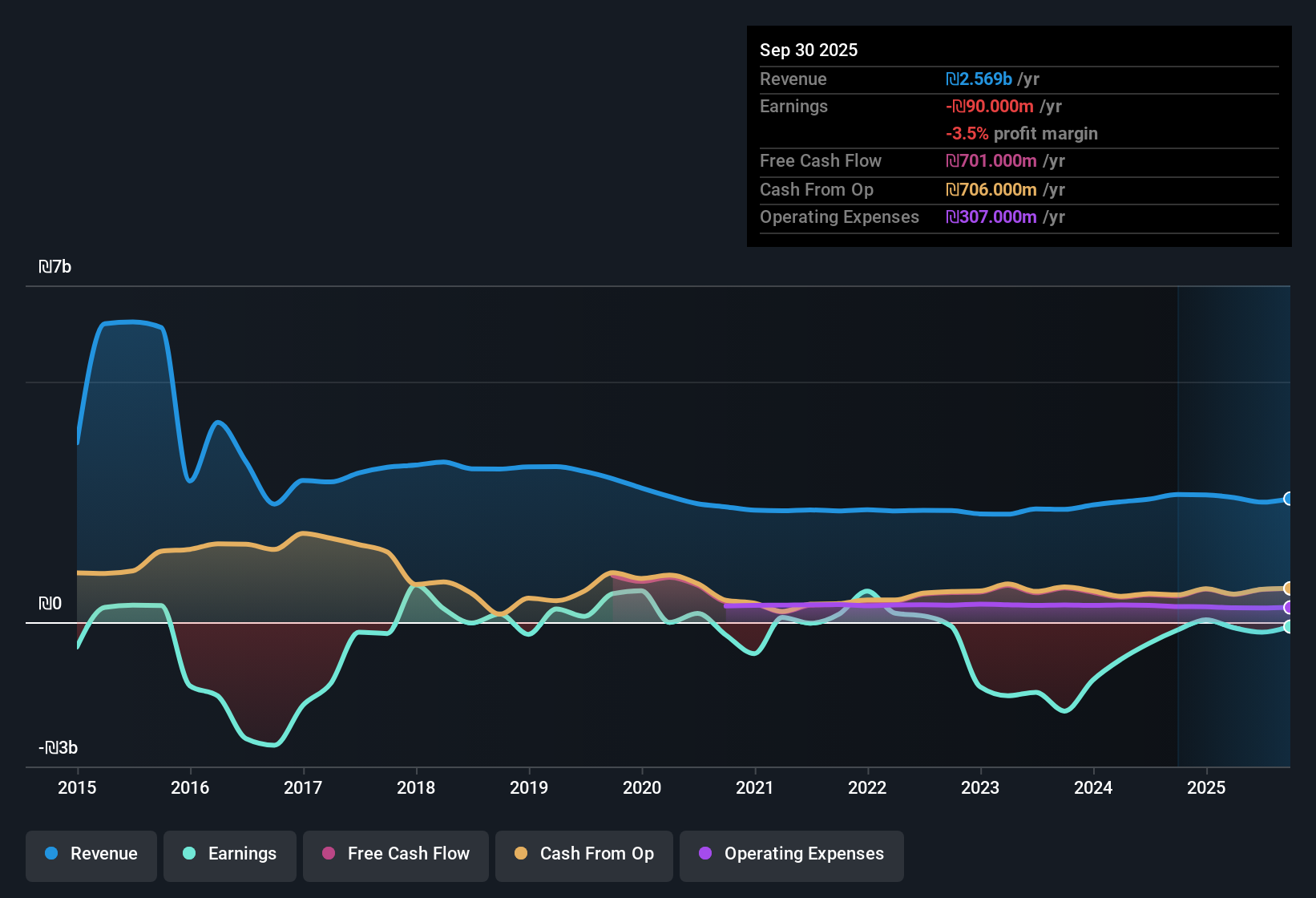

G City (TASE:GCT) just posted its Q3 2025 results, reporting revenue of 704 million ILS and a basic EPS of -0.06 ILS. The company has seen revenue ranging from 568 million ILS to 704 million ILS per quarter over the past year, with quarterly EPS consistently in negative territory except for Q2. Margins remain pressured as profitability remains lackluster, giving investors plenty to consider.

See our full analysis for G City.Next, we compare these figures with the widely followed narratives to see where the latest earnings confirm or contradict market expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Losses Narrow Despite Revenue High

- G City's net loss for Q3 2025 was 11 million ILS, a sharp reduction compared to the 246 million ILS loss in Q1 and 131 million ILS loss in Q3 of the previous year.

- While the business model focuses on supermarket-anchored urban shopping centers, which are intended to offer stability, ongoing net losses continue to weigh on the bullish thesis of resilience, as the annual rate of net loss growth stands at 13.6%.

- Essential service tenants often help protect income, but recent data shows profits are not materializing at the portfolio level, raising questions about the depth of this defensive cushion.

- Bulls often highlight diversification as a strength, yet net losses remain elevated across quarters. This suggests that geographic spread has not overcome sector headwinds.

Dividend Yield Appealing, But Coverage Weak

- The trailing 12-month dividend yield is 4.94%, but this payout is not supported by earnings as G City remains unprofitable and has reported negative net income for the past year.

- The argument for stability from long-term, essential retail tenants is tested by the lack of profit coverage, with bears pointing out that dividend sustainability is at risk without a turnaround in underlying profitability.

- For example, net income has been negative in five of the last six quarters, which increases the likelihood that future dividends could come under pressure if losses persist.

- Bears counter optimism about defensive real estate with concerns that current distribution levels may not be maintained without improvement in core results.

Valuation Discount Stands Out in Sector

- G City trades at a price-to-sales ratio of 0.8x, which is below the peer average of 5.8x and the Israel real estate industry average of 3.8x.

- The prevailing market view sees this sizable valuation discount as notable; however, investors remain cautious as near-term profitability issues and share price volatility have so far overshadowed the appeal of a low multiple.

- While the discount could create upside if fundamentals stabilize, persistent net losses (90 million ILS over the prior twelve months) continue to challenge the ability of valuation alone to attract new buyers.

- Despite the share price trading 61.8% below DCF fair value, the lack of earnings momentum has made the discount more a sign of risk than a straightforward bargain.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on G City's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite a sector-low valuation, G City's ongoing net losses and weak dividend coverage highlight concerns about the sustainability of its payouts.

If you want to focus on companies that combine strong yield with robust earnings, check out these 1920 dividend stocks with yields > 3% for options with healthier dividend foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:GCT

G City

Through its subsidiaries, engages in the ownership, development, and management of supermarket-anchored urban shopping centers and commercial center and retail-based mixed-use properties in Israel, North America, Brazil, and Northern and Central Europe.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.