- Israel

- /

- Real Estate

- /

- TASE:BLSR

Blue Square Real Estate (TASE:BLSR) Net Profit Margin Boosted by One-Off Gain, Testing Sustainability Narratives

Reviewed by Simply Wall St

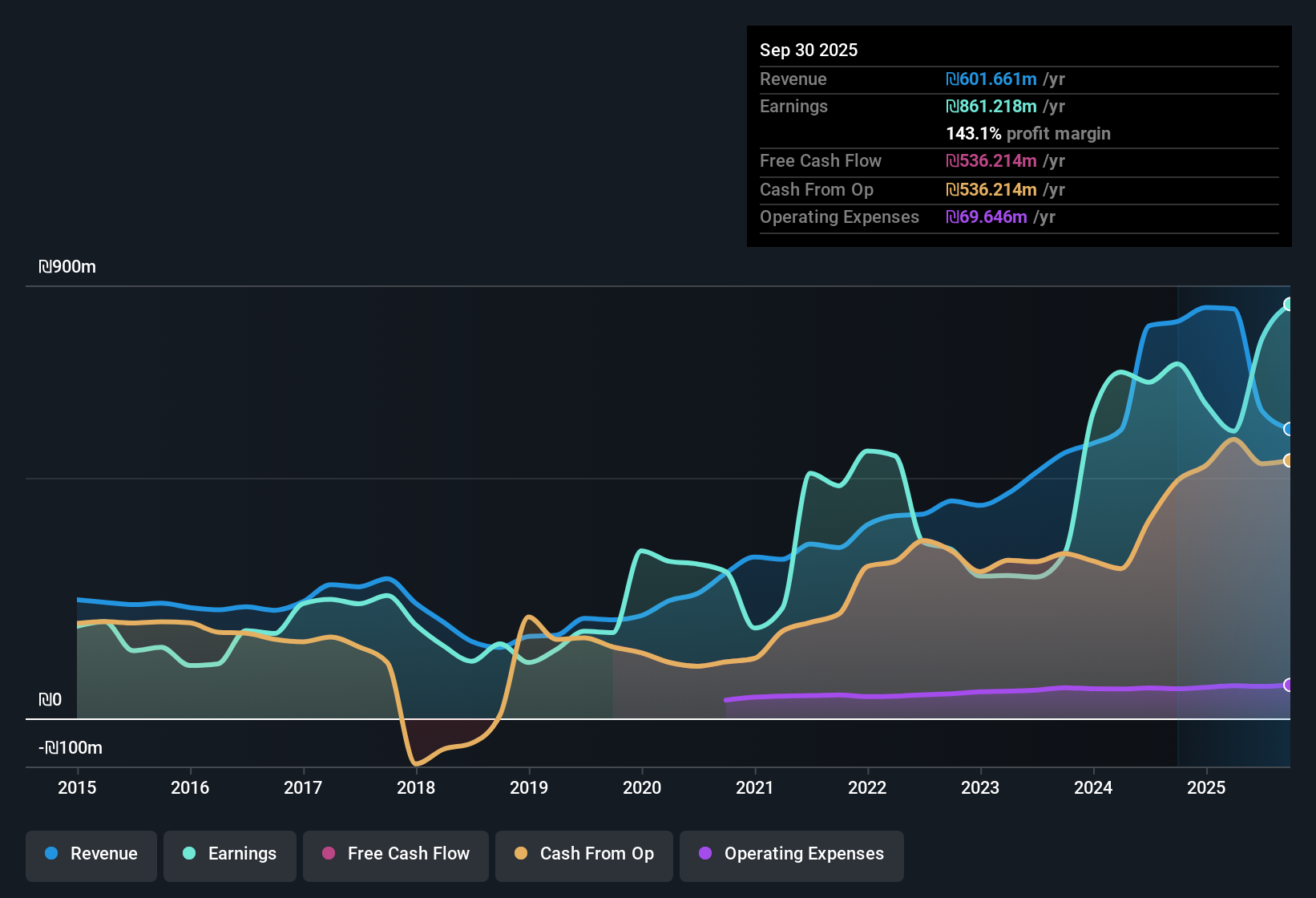

Blue Square Real Estate (TASE:BLSR) just published its Q3 2025 results, posting total revenue of ₪154.56 million and basic EPS of ₪24.99. For historical context, over the past six quarters, revenue has ranged from ₪150.89 million to ₪366.10 million, while EPS has tracked between ₪6.37 and ₪24.99. Margins remain a key focal point for investors as they weigh the implications of these current results.

See our full analysis for Blue Square Real Estate.Next up, we will put these numbers side by side with the prevailing narratives to see which stories hold up and which ones are being put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Lifts Net Profit Margin to 85.6%

- Net profit margins for Blue Square Real Estate reached 85.6% over the last twelve months, a remarkable figure largely driven by a single non-recurring gain of ₪367.6 million.

- What stands out in the prevailing market analysis is how this outsized one-off boost makes last year’s profitability appear stronger than the company’s underlying long-term trajectory.

- Earnings grew 12.9% over the last year, but that is below the five-year annual average growth rate of 18.6%.

- This highlights a tension: while headline margins look resilient, the sustainability of those margins is questioned without repeat one-off gains.

- Investors are left weighing whether future periods can deliver margins close to this level once the impact of the exceptional gain fades.

Valuation Multiple Signals Potential Value, But Share Price Runs Ahead

- The company trades at a Price-To-Earnings ratio of 6x, which is less than half the industry average of 13.9x and below the peer average of 14.5x. This suggests that on a relative basis, shares appear inexpensive by earnings multiples.

- Despite this low valuation on earnings, the current share price of ₪390.9 sits well above the latest DCF fair value estimate of ₪292.7, challenging the notion that the stock is a straightforward bargain.

- Consensus narrative notes investors may be factoring in future growth or one-off upside, but this premium reduces the margin of safety for new buyers.

- It is a classic value trap question: the metric looks attractive, but the market price implies a higher standard for future performance.

- If the market is correct, future catalysts will need to justify a price well above modeled intrinsic value.

Even as valuation multiples suggest potential for value, consensus thinking asks whether the price is already baking in too much optimism. Find out how analysts view the current premium by reading the full consensus narrative. 📊 Read the full Blue Square Real Estate Consensus Narrative.

Debt Coverage and Dividend Stability Remain Material Risks

- Operating cash flow over the past year has not been enough to fully cover company debt, signaling ongoing balance sheet pressure despite the appearance of strong net income and margins.

- Bears argue that structural weaknesses like unstable dividend history and debt coverage concerns could become more visible if profit margins normalize.

- These factors underline why, even with robust headline profitability, investors cannot ignore liquidity and payout risks in their due diligence.

- Risks here have the potential to weigh on share price progression, especially if credit conditions tighten or operating cash flows do not improve.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Blue Square Real Estate's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite headline profitability, Blue Square Real Estate faces material risks from weak debt coverage and unstable dividends. These factors threaten the company's long-term resilience.

If you’re looking for stocks with less balance sheet risk and greater financial stability, check out solid balance sheet and fundamentals stocks screener (1938 results) that showcase sound fundamentals and healthier liquidity profiles built to weather uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Square Real Estate might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:BLSR

Established dividend payer with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.