- Israel

- /

- Real Estate

- /

- TASE:ADGR

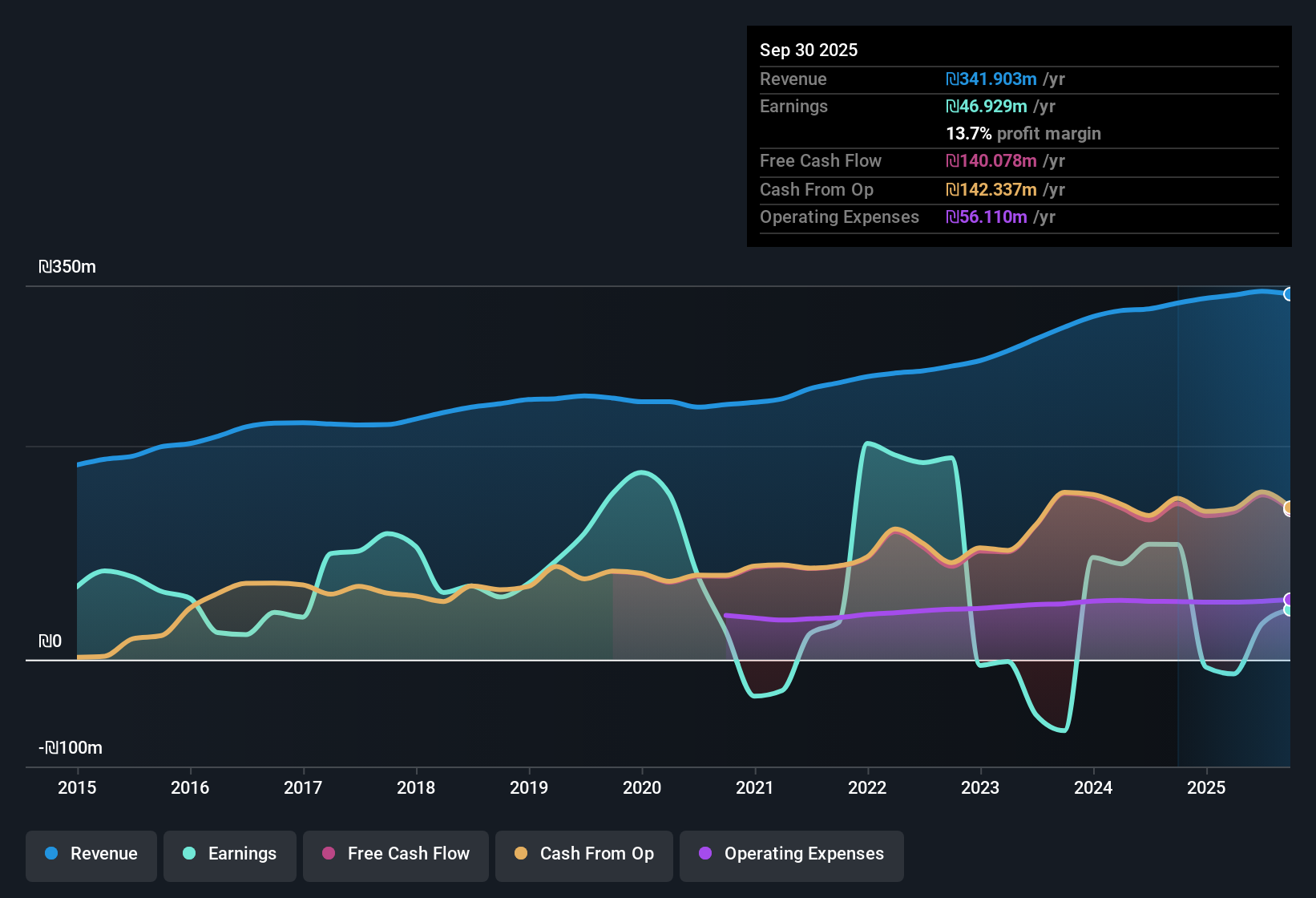

Adgar (TASE:ADGR) Net Profit Margin Falls to 13.7%, Challenging Bullish Narratives

Reviewed by Simply Wall St

Adgar Investments and Development (TASE:ADGR) has just posted its Q3 2025 results, with revenue of ₪84.2 million and basic EPS of ₪0.09. Over the past few quarters, total revenue has hovered consistently: ₪85.9 million in Q2 2025 and ₪84.8 million in Q1 2025. EPS moved from ₪0.16 to -₪0.02 across those periods. Margins continue to be the swing factor for investors, as profitability trends sit at the center of the latest financial story.

See our full analysis for Adgar Investments and Development.Next up, let’s see how these numbers measure up against the most discussed narratives surrounding Adgar. Some popular takes might hold, while others could be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Slide to 13.7%

- Net profit margin reached 13.7% over the last year, down from 32.3% in the previous year, showing profitability tightening far more than headline profit or loss numbers suggest.

- The prevailing market narrative highlights risks from narrowing margins. This steeper-than-expected margin compression is seen as a red flag for the company’s earnings quality.

- The 13.7% profit margin is notably weaker than peers and last year’s performance, directly challenging the idea that past one-off losses were the main issue.

- What stands out is that despite steady revenue around ₪340 to ₪345 million for the last twelve months, profitability did not keep pace, and bottom-line improvement has stalled.

Shares Trade at a 15.6% DCF Discount

- Adgar shares are trading at ₪4.85, roughly 15.6% below the current DCF fair value estimate of ₪5.75, creating a discount that value investors may notice.

- While this price-to-value gap might sound positive for patient investors, the data remind us that the stock’s price-to-earnings ratio of 17x is materially higher than the Israeli real estate industry average (13.7x) and peer group (13.2x), signaling that the current valuation already carries a premium in some respects.

- This tension between price discount to DCF and an above-average PE ratio keeps Adgar in “bargain bin” territory for some, but not all, market watchers.

- It is hard to call the stock truly inexpensive unless earnings growth or margin recovery materializes to close the gap to sector norms.

EPS Volatility and Interest Burden

- Over the past three quarters, EPS swung from -₪0.02 to ₪0.16 and then down to ₪0.09, while interest coverage slipped, as noted in the analysis, with earnings unable to comfortably cover interest payments.

- Critics highlight the recurring risk that volatile earnings and insufficient interest cover could limit both dividend flexibility and growth prospects moving forward.

- The last twelve months included a one-off loss of ₪24.0 million, but persistent declines in profit coverage make it hard for investors to ignore financial stress signals.

- Despite positive net income in three of the last four quarters, the narrative is shaped by fears that even brief downturns can quickly pressure Adgar’s ability to manage debt costs.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Adgar Investments and Development's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Adgar’s declining profit margins, volatility in earnings, and uncomfortable interest coverage ratio highlight persistent concerns about its financial resilience and stability.

If you want to focus on companies with less debt and proven financial strength, check out solid balance sheet and fundamentals stocks screener (1931 results) that are built for tougher markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ADGR

Adgar Investments and Development

Engages in the real estate business in Israel, Canada, Poland, and Belgium.

Slight risk and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success