Rimoni Industries (TASE:RIMO) Net Margin Drops to 20.9%, Challenging Dividend Sustainability Narrative

Reviewed by Simply Wall St

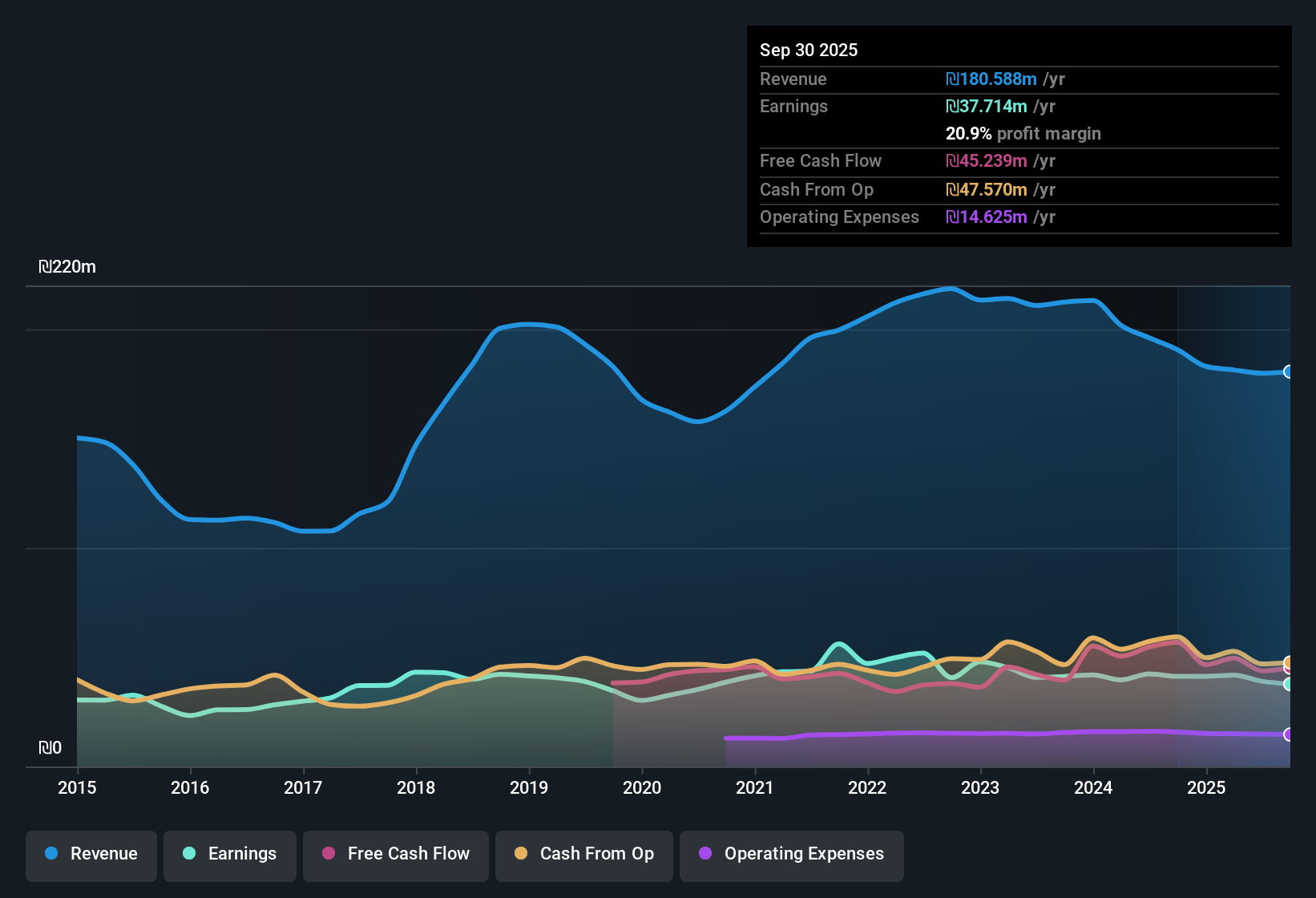

Rimoni Industries (TASE:RIMO) just posted its Q3 2025 results, with revenue coming in at 47.5 million ILS and EPS of 1.00 ILS for the quarter. Historically, the company has seen total revenue swing between 40.3 million ILS and 47.8 million ILS over the last six quarters, while EPS has ranged from 1.00 ILS to 1.52 ILS. Operating margins have been steady, reflecting a consistent performance despite the variability in earnings and sales.

See our full analysis for Rimoni Industries.Now, let's see how these results compare to the prevailing narratives from the market and Simply Wall St community. Some long-held views may get backed up, while others could be turned on their heads.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Down Slightly, Still Strong

- Net profit margin for the last year stands at 20.9%, down from the previous year's 21.6%. This continues to demonstrate healthy profitability for the sector.

- For investors weighing the company's strengths and weaknesses, the market tends to view Rimoni’s steady, high margins as a defensive trait. Points often highlighted are its established position serving multiple sectors and a reputation for technical precision, countered by a lack of evident earnings growth recently.

- Bulls might appreciate that these margins reflect diversification across medical, automotive, and tech, but need to consider that neither the one- nor five-year period shows accelerating profit growth.

- Profitability’s resilience may reassure conservative investors, even as declining margins temper more optimistic expectations.

Trading at a Deep Discount

- The company’s share price of ₪47.90 is 14.3% below its DCF fair value estimate of ₪55.88. Its price-to-earnings ratio of 10.7x is less than half the industry average of 21.7x.

- Consensus narrative notes that while Rimoni’s discounted valuation compared to both peers and estimated fair value could appeal to value-focused investors, the appeal is balanced by caution about earnings and dividend sustainability.

- Being priced far below sector averages looks tempting, particularly for value investors seeking a margin of safety.

- However, the narrative highlights that sustained earnings declines and questions around the high dividend’s coverage add necessary caution to the value thesis.

Dividend Yield Raises Tough Questions

- The trailing dividend yield clocks in at 10.44%, a figure well above most sector peers, but analysis flags this as not being well covered by current earnings or free cash flow.

- Community views and analysis both point out that even though Rimoni's attractive dividend might draw in yield-seekers, the persistent pressure on profit and free cash flow means the payout’s sustainability is very much in doubt.

- Dividend-focused investors who rely on headline yields could be caught off-guard if cash coverage remains stretched and the payout proves unsustainable.

- Bears highlight that a high yield itself is not a guarantee. Without earnings growth or coverage, cuts may loom if conditions do not improve.

See our latest analysis for Rimoni Industries.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Rimoni Industries's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Rimoni’s weakening profit growth and concerns about unsustainable dividends may leave investors uneasy about the long-term reliability of returns.

If you want income backed by real financial strength, check out these 1932 dividend stocks with yields > 3% to find better-yielding stocks with more dependable payouts and coverage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:RIMO

Rimoni Industries

Engages in the design, engineering, and manufacture of molds, and precise injection molding and assemblies for the medical, automotive, agricultural, high-tech, and consumer industries in Israel.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success