Kafrit Industries (TASE:KAFR) Net Profit Margin Holds Steady, Reinforcing Case for Resilient Profitability

Reviewed by Simply Wall St

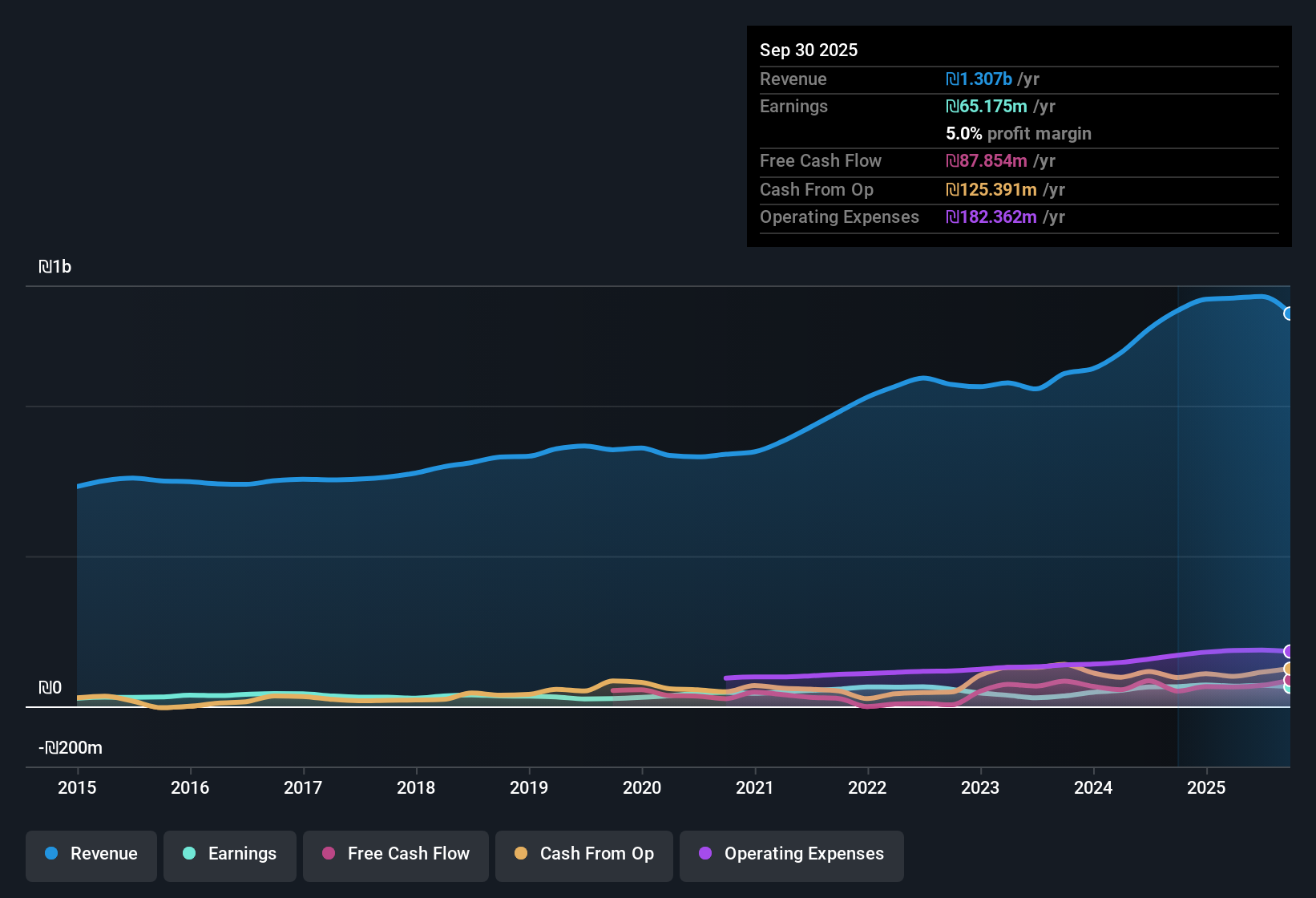

Kafrit Industries (1993) (TASE:KAFR) has just posted its Q2 2025 results, reporting total revenue of 356.1 million ILS and basic EPS of 0.97 ILS for the quarter. Looking back, the company has seen revenue rise from 330.1 million ILS in Q1 2024 to 356.1 million ILS in Q2 2025, with basic EPS over the same period stepping up from 0.71 ILS to 0.97 ILS. Margins have held firm, setting the stage for how investors are weighing the latest results.

See our full analysis for Kafrit Industries (1993).Next, we are putting these earnings head-to-head with the prevailing market narratives to see where the numbers back up the story, and where they might raise new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Holds Steady at 5.1%

- Kafrit Industries posted a trailing twelve month net profit margin of 5.1%, matching last year's level, while total revenue for the same period reached 1.36 billion ILS.

- Market watchers note that the stable margin directly addresses worries from previous years about cost pressures. The latest 8.4% earnings growth over the last year supports Kafrit’s reputation for maintaining profitability.

- This outpaces the company’s five-year growth average of 5.4%, lending real-world support to claims that Kafrit’s operating model withstands normal market cycles.

- Although the margin remains unchanged, earnings expansion suggests a shift in efficiency or mix, which is often seen as positive for defensive industrial companies.

Shares Trade Below Peer Valuations

- Kafrit’s Price-To-Earnings ratio is 9.6x, which is well below the Israeli market average of 15.1x and the Asian Chemicals industry average of 21.8x. This highlights a relative value disconnect.

- Investors focused on valuation highlight that, while the share price (27.90 ILS) stands above the DCF fair value (11.83 ILS), Kafrit’s discounted multiple compared to industry peers adds to the case for upside.

- Consensus commentary points out that this lower multiple, when combined with steady profit margins, is helping limit downside risk in a sector that often experiences cyclical fluctuations.

- However, the premium to DCF value creates some debate, especially for value-oriented investors looking for a wider safety margin between price and intrinsic worth.

Debt Load and Dividend Instability Remain Concerns

- The company continues to be identified by a high level of debt and an unstable dividend record, both highlighted as primary risk factors in the last twelve months.

- Those taking a balanced market view note that, while Kafrit’s strong earnings growth limits immediate concern, the leverage and unpredictable dividends serve as meaningful counterweights.

- With no major risks flagged in the data, attention remains on the ongoing ability to pay down debt and improve dividend reliability if profits hold near current levels.

- The fact that net income has consistently remained above 12 million ILS per quarter provides a buffer, but dividend-minded investors may still exercise caution until the track record stabilizes.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kafrit Industries (1993)'s growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite stable profit margins and strong earnings growth, Kafrit’s elevated debt and volatile dividends remain significant concerns for risk-aware investors.

If you want companies with greater financial reliability, check out solid balance sheet and fundamentals stocks screener (1938 results) to discover businesses built on stronger balance sheets and more predictable fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kafrit Industries (1993) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:KAFR

Kafrit Industries (1993)

Offers customized masterbatches and compounds in Israel, China, Germany, Canada, and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.