As most Gulf markets face pressure from weak oil prices and the potential for oversupply, investors are increasingly looking for stability in dividend stocks that can offer consistent returns amidst market fluctuations. In this environment, identifying Middle Eastern stocks yielding over 3.7% becomes crucial for investors seeking reliable income streams while navigating the current economic landscape.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.36% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.54% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.81% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.63% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.60% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.52% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.55% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.56% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.87% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.09% | ★★★★★☆ |

Click here to see the full list of 65 stocks from our Top Middle Eastern Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Ayalon Insurance (TASE:AYAL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ayalon Insurance Company Ltd, operating through its subsidiaries, offers a range of insurance products in Israel and has a market cap of ₪2.41 billion.

Operations: Ayalon Insurance Company Ltd generates revenue through various segments including Health (₪638.15 million), General Insurance - Compulsory Vehicle Insurance (₪335.99 million), General Insurance - Property Branches and Others (₪424.26 million), General Insurance - Automobile Property Insurance (₪704.65 million), and Life Insurance and Long-Term Savings - Life Insurance (₪1.19 billion).

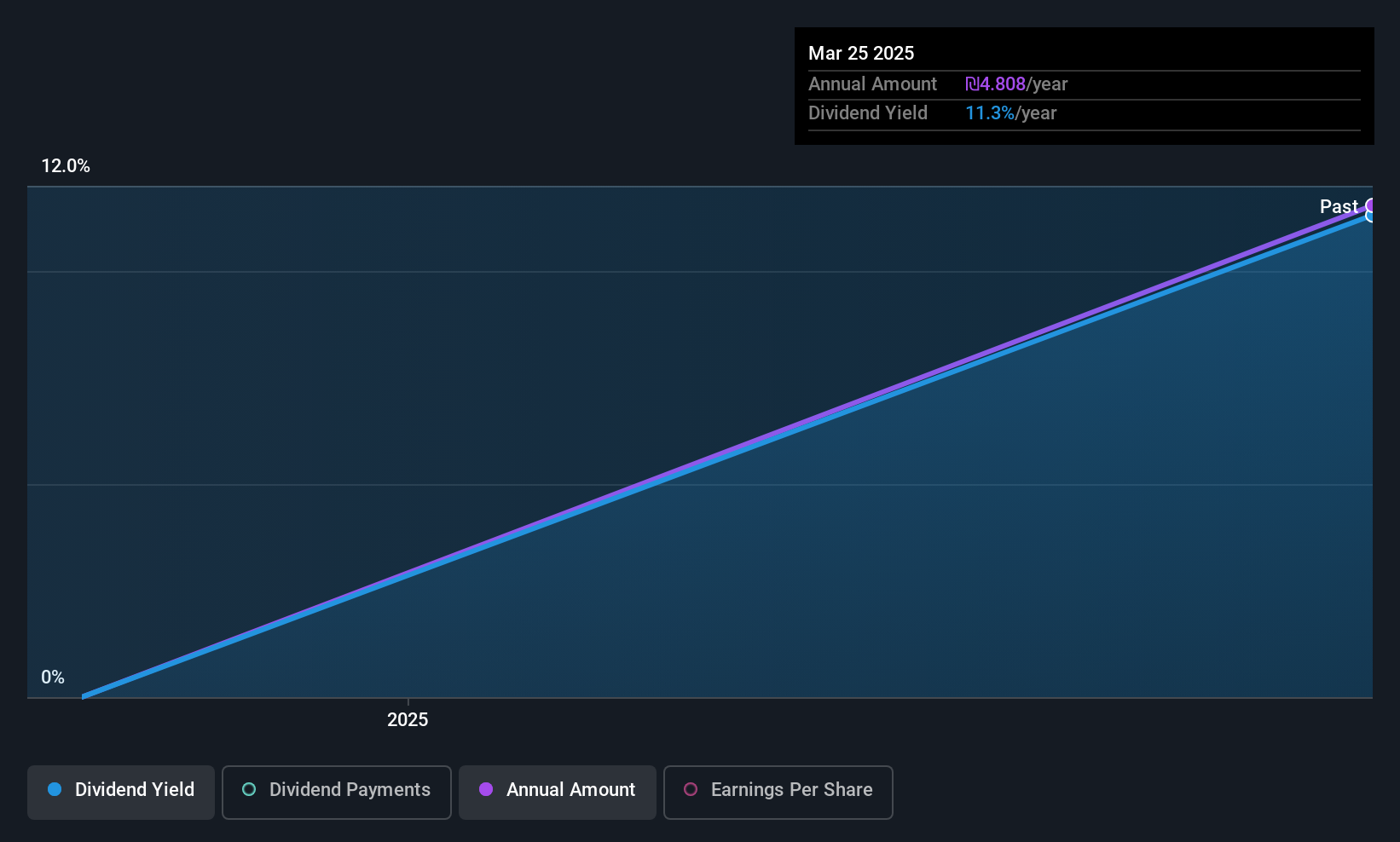

Dividend Yield: 5.4%

Ayalon Insurance, recently added to the S&P Global BMI Index, trades at 24.6% below its estimated fair value. Its dividend yield of 5.43% ranks in the top 25% of Israeli dividend payers. Though dividends are newly initiated and their reliability remains uncertain, they are well-covered by earnings and cash flows with payout ratios of 30.9% and 38.8%, respectively, suggesting sustainability despite recent share price volatility and rapid earnings growth over five years.

- Take a closer look at Ayalon Insurance's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ayalon Insurance shares in the market.

Mizrahi Tefahot Bank (TASE:MZTF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mizrahi Tefahot Bank Ltd., along with its subsidiaries, offers a variety of international, commercial, domestic, and personal banking services to individuals and businesses in Israel and abroad, with a market cap of ₪58.07 billion.

Operations: Mizrahi Tefahot Bank Ltd. generates revenue through its diverse banking services, including international, commercial, domestic, and personal banking for both individual and business clients in Israel and globally.

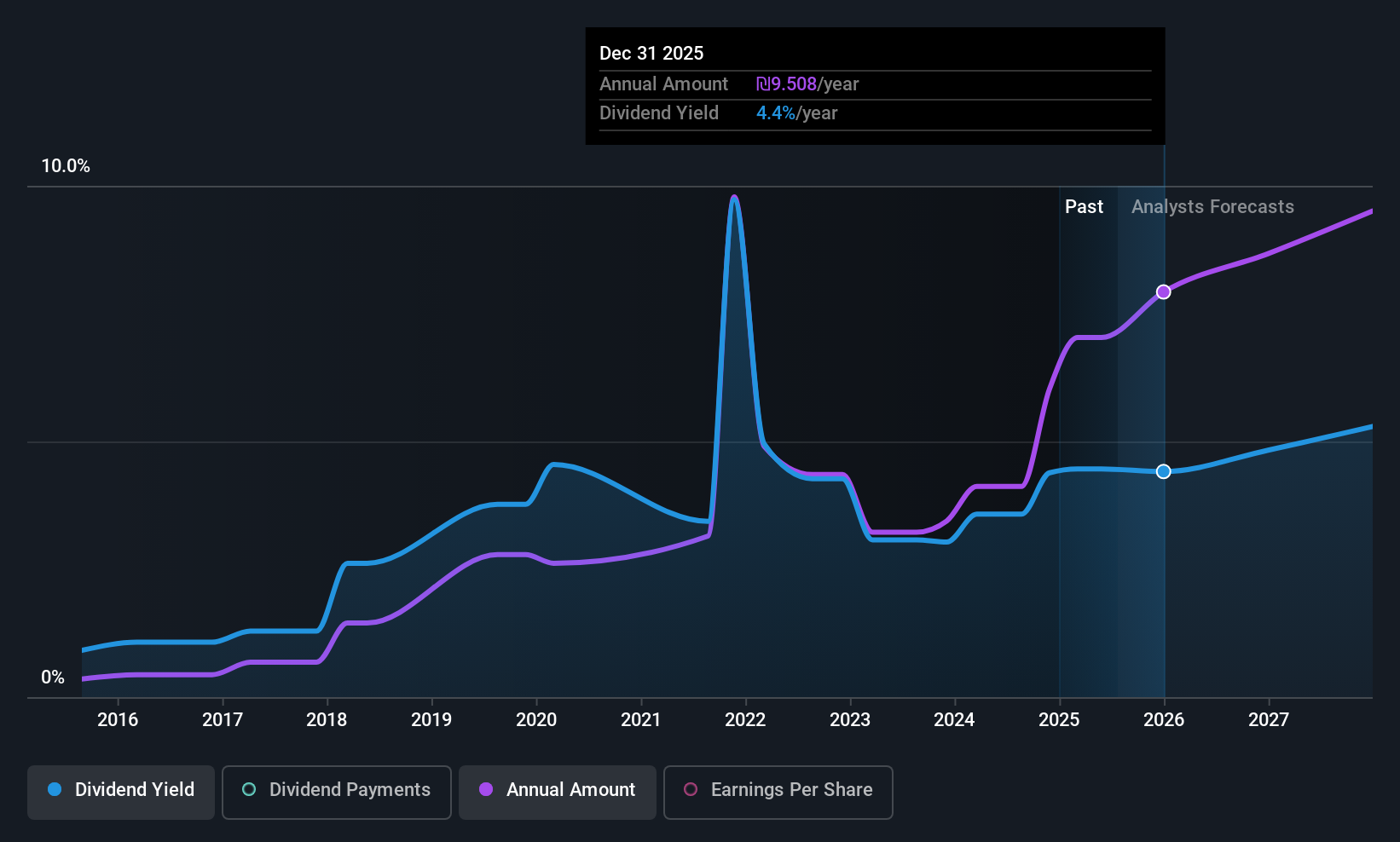

Dividend Yield: 3.8%

Mizrahi Tefahot Bank's dividend payments have been volatile over the past decade, yet they are well-covered by a low payout ratio of 45.2%, indicating sustainability. Despite a relatively low dividend yield of 3.78% compared to top-tier Israeli payers, the bank's dividends have grown over ten years and are forecasted to remain covered by earnings in three years with a 43.5% payout ratio. Recent net income growth supports this stability, although revenue showed slight decline recently.

- Get an in-depth perspective on Mizrahi Tefahot Bank's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Mizrahi Tefahot Bank's share price might be too optimistic.

Plasson Industries (TASE:PLSN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Plasson Industries Ltd develops, manufactures, and markets technical products both in Israel and internationally with a market cap of ₪1.95 billion.

Operations: Plasson Industries Ltd generates revenue through its development, manufacturing, and marketing of technical products across various sectors in Israel and globally.

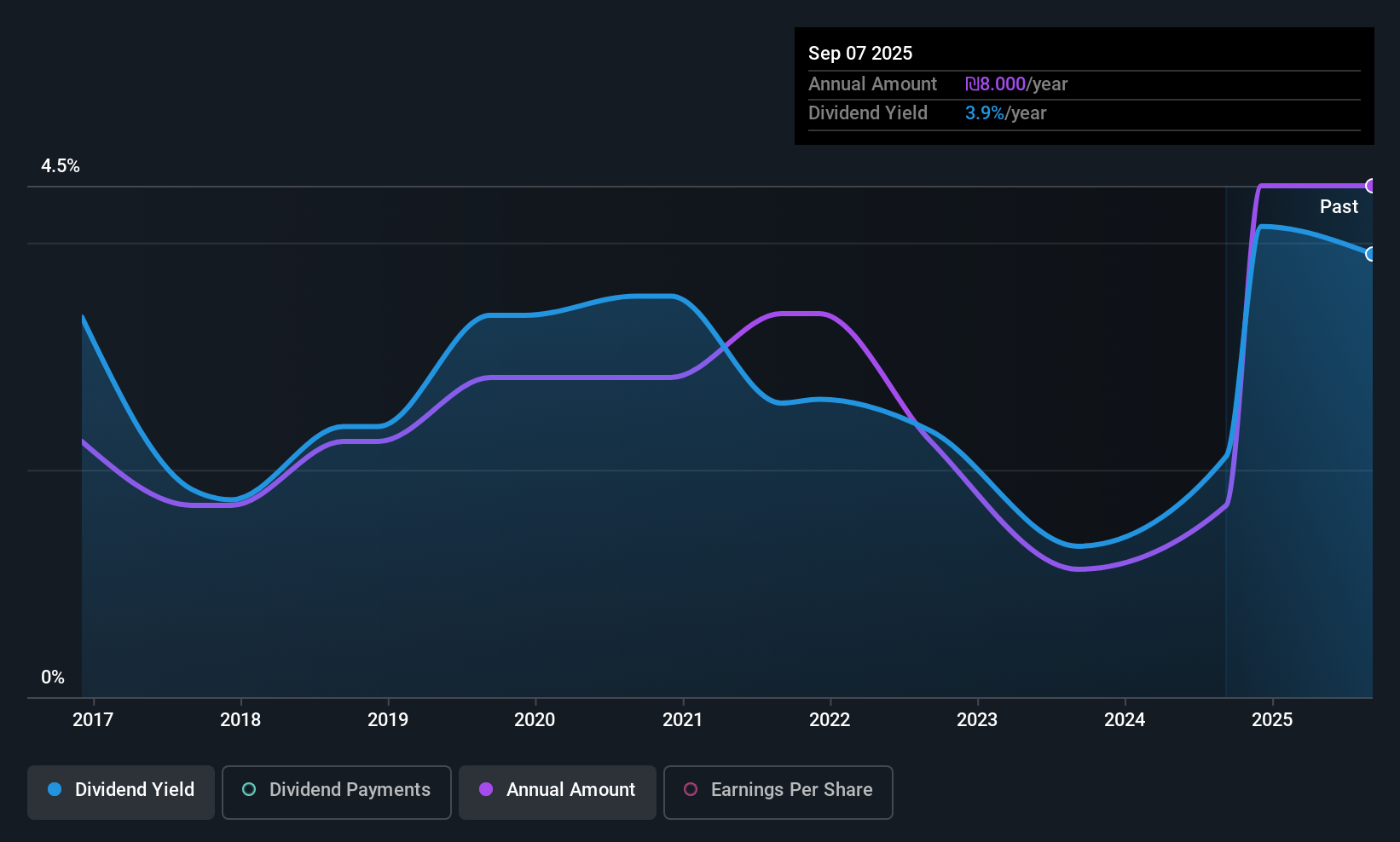

Dividend Yield: 3.9%

Plasson Industries' dividend payments have grown over the past decade, though they remain volatile and unreliable. With a payout ratio of 43.8% and cash payout ratio of 48.2%, dividends are well-covered by earnings and cash flows, indicating sustainability despite a lower yield of 3.93% compared to top-tier Israeli payers. Recent financial results show increased sales and net income, suggesting potential for continued dividend support amidst market fluctuations.

- Navigate through the intricacies of Plasson Industries with our comprehensive dividend report here.

- According our valuation report, there's an indication that Plasson Industries' share price might be on the cheaper side.

Summing It All Up

- Unlock more gems! Our Top Middle Eastern Dividend Stocks screener has unearthed 62 more companies for you to explore.Click here to unveil our expertly curated list of 65 Top Middle Eastern Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MZTF

Mizrahi Tefahot Bank

Provides a range of international, commercial, domestic, and personal banking services to individuals and businesses in Israel and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success