- Israel

- /

- Medical Equipment

- /

- TASE:BWAY

Are Robust Financials Driving The Recent Rally In BrainsWay Ltd.'s (TLV:BWAY) Stock?

Most readers would already be aware that BrainsWay's (TLV:BWAY) stock increased significantly by 16% over the past week. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. Specifically, we decided to study BrainsWay's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for BrainsWay is:

8.9% = US$6.2m ÷ US$70m (Based on the trailing twelve months to September 2025).

The 'return' is the yearly profit. So, this means that for every ₪1 of its shareholder's investments, the company generates a profit of ₪0.09.

See our latest analysis for BrainsWay

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

BrainsWay's Earnings Growth And 8.9% ROE

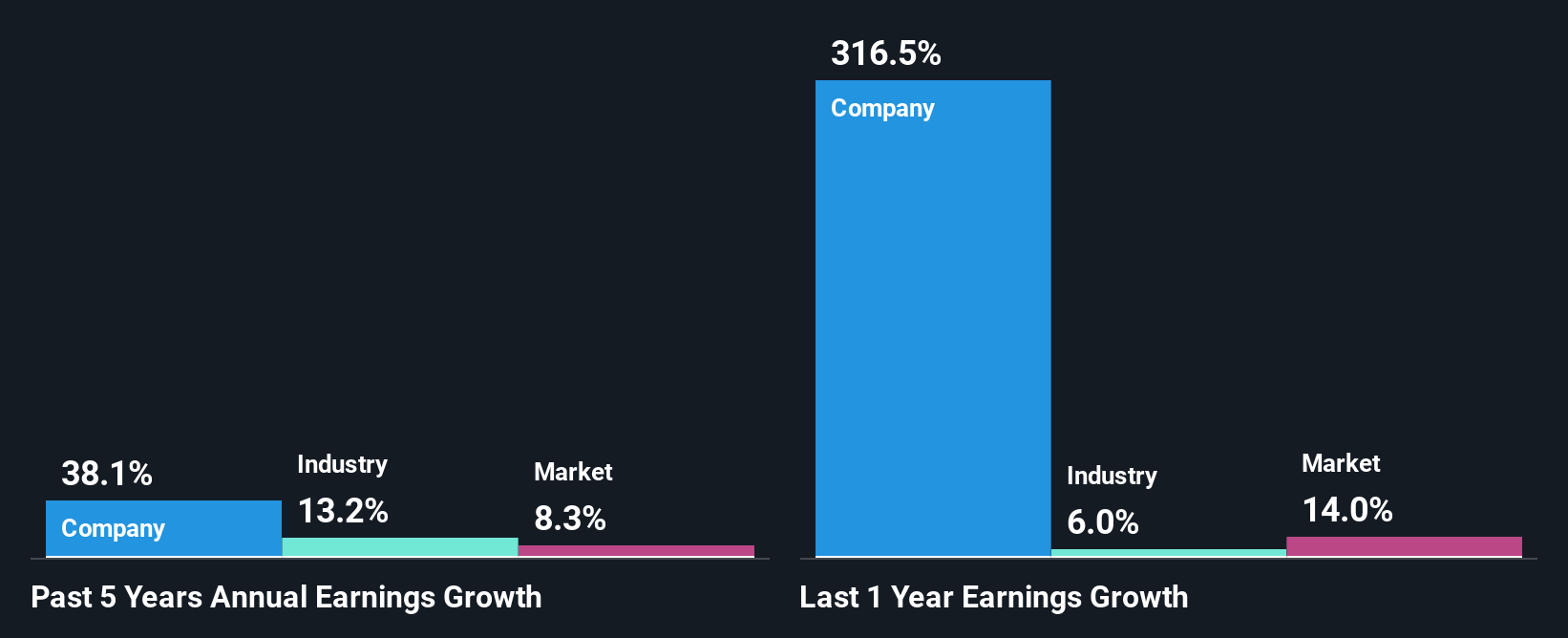

On the face of it, BrainsWay's ROE is not much to talk about. Although a closer study shows that the company's ROE is higher than the industry average of 2.8% which we definitely can't overlook. Especially when you consider BrainsWay's exceptional 38% net income growth over the past five years. Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. Hence, there might be some other aspects that are causing earnings to grow. E.g the company has a low payout ratio or could belong to a high growth industry.

Next, on comparing with the industry net income growth, we found that BrainsWay's growth is quite high when compared to the industry average growth of 13% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about BrainsWay's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is BrainsWay Efficiently Re-investing Its Profits?

Given that BrainsWay doesn't pay any regular dividends to its shareholders, we infer that the company has been reinvesting all of its profits to grow its business.

Summary

On the whole, we feel that BrainsWay's performance has been quite good. Particularly, we like that the company is reinvesting heavily into its business at a moderate rate of return. Unsurprisingly, this has led to an impressive earnings growth. On studying current analyst estimates, we found that analysts expect the company to continue its recent growth streak. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if BrainsWay might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:BWAY

BrainsWay

Develops and sells noninvasive neurostimulation treatments for mental health disorders in the United States, East Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026