- Israel

- /

- Healthcare Services

- /

- TASE:BKFR

Bait Bakfar (TASE:BKFR): One-Off Gain Masks Lower Margins, Testing Bull Narrative on Profit Quality

Reviewed by Simply Wall St

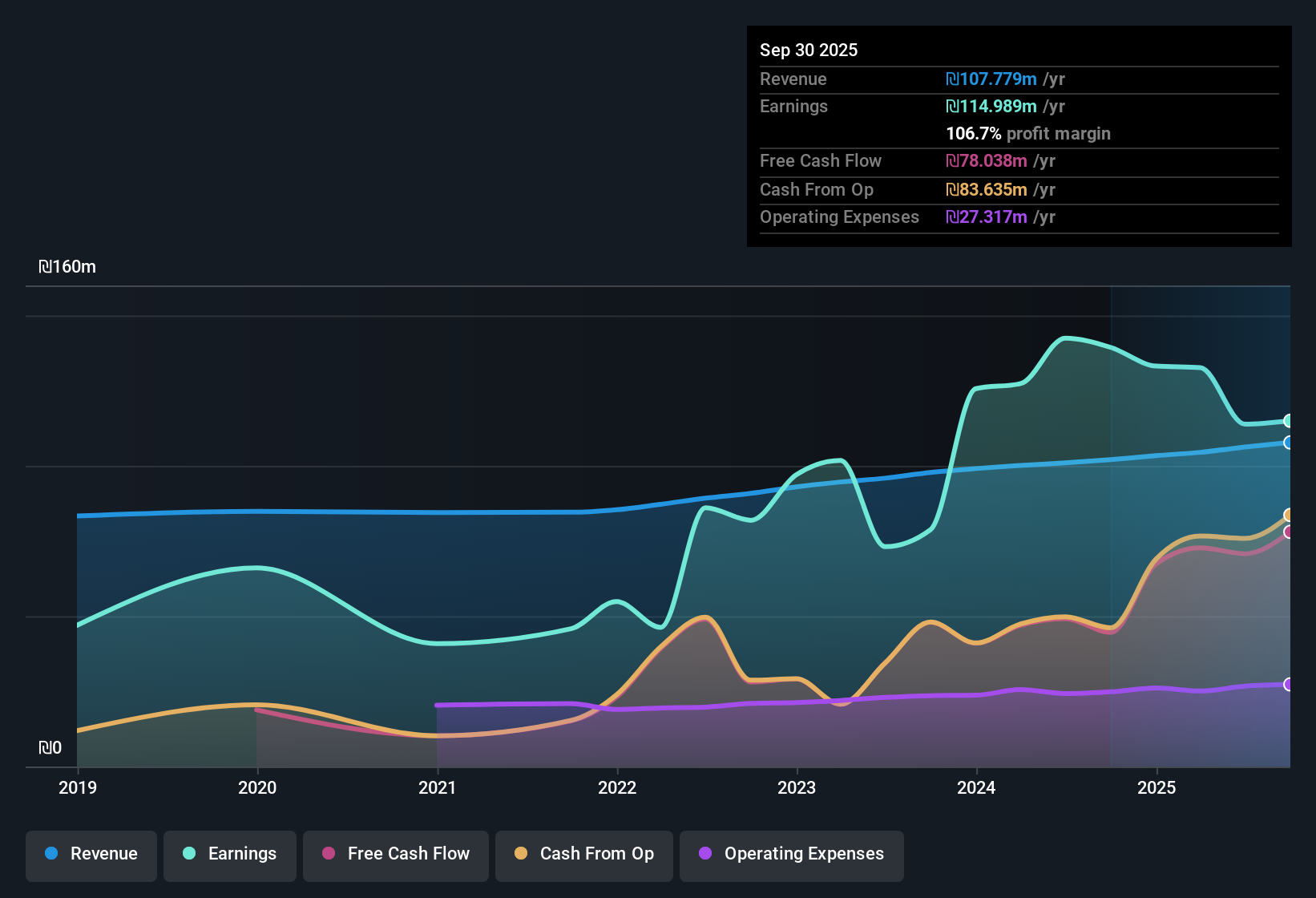

Bait Bakfar (TASE:BKFR) just released its Q3 2025 results, reporting revenue of ₪27.3 million and basic EPS of ₪0.22 for the quarter. The company has seen revenue trend steadily higher over the past year, with recent quarters posting figures of ₪26.4 million, ₪26.1 million, and ₪25.6 million. Basic EPS fluctuated from ₪0.06 to ₪0.49 across those same periods. Despite some earnings volatility, especially with the impact of non-recurring gains, investors will be watching margins closely as profitability dynamics shift.

See our full analysis for Bait Bakfar.Next, let's see how this quarter's results hold up when put head-to-head against the main narratives followed by the market. This comparison can reveal where the numbers and the story either match up or diverge.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain of ₪116.9 Million Drives Twelve-Month Net Profit

- The company’s trailing twelve month net income reached ₪113.9 million, a figure that includes a significant impact from a single one-off gain of ₪116.9 million.

- The general market opinion is that while the gain inflated net profit, it masks the fact that net profit margins are now lower than last year and actual earnings growth over the past twelve months was negative.

- This disconnect highlights that operational performance alone does not explain the headline profit figure, making it more challenging for investors to gauge the company’s true earnings power going forward.

- Despite the headline number, recent quarter results such as Q3 2025 (net income of ₪15.4 million) are far below the annual total, reinforcing concerns about sustainability raised by the presence of non-recurring items.

Share Price Above DCF Fair Value Despite Low PE Ratio

- Bait Bakfar trades at ₪14.74 per share, well above its DCF fair value estimate of ₪8.18, even though the company’s trailing P/E ratio of 9.1x is attractively below the IL market average (15.1x) and Asian Healthcare (19.5x).

- Consensus narrative emphasizes that this low P/E suggests affordability for investors, but the premium to fair value tempers that case.

- The share price disconnects from fundamentals, especially as the P/E may be distorted by the recent one-off gain and negative earnings growth in the last year.

- Compared to typical sector valuations, the apparent discount could mislead investors if they overlook the impact of non-recurring items on profits.

Five-Year Earnings Growth Outpaces Recent Downturn

- Over the last five years, Bait Bakfar delivered average annual earnings growth of 24.9%, compared to a negative earnings change across the most recent twelve months.

- The prevailing view acknowledges the strong long-term track record, but points out the recent slide challenges expectations of ongoing high growth.

- The dramatic drop in year-over-year earnings, even beyond non-recurring gains, calls for extra caution about whether historical success can continue at the same pace.

- For investors, this contrast between robust multi-year growth and the current earnings dip raises the question of whether recent volatility is a temporary blip or the start of a new trend.

Bulls and bears are watching to see if Bait Bakfar can return to its strong historical growth, or if the recent negative trend points to a long-term shift.See what the community is saying about Bait Bakfar

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bait Bakfar's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Bait Bakfar faces a worrying disconnect between reported profits and underlying earnings growth, which raises concerns about overstated performance and sustainability.

If paying a premium over fair value worries you, use our these 920 undervalued stocks based on cash flows to focus on companies trading below their intrinsic worth and avoid valuation traps.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bait Bakfar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:BKFR

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.