- United Arab Emirates

- /

- Capital Markets

- /

- ADX:WAHA

Middle Eastern Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

The Middle Eastern markets have recently seen a positive shift, with UAE stock indices edging higher due to rising oil prices and hopes for a U.S. Federal Reserve rate cut. Amid these developments, investors are exploring various opportunities, including those in the realm of penny stocks. Although the term "penny stocks" might seem outdated, it still signifies potential growth avenues in smaller or newer companies that combine affordability with financial resilience.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.34 | SAR1.36B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.89 | ₪207.2M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.00 | AED2.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR5.10 | SAR992M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.45 | AED14.58B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.829 | AED504.85M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.717 | ₪213.28M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm managing assets in sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate and capital markets with a market cap of AED3.05 billion.

Operations: The company's revenue from Private Investments (Excluding Waha Land) is AED188.88 million.

Market Cap: AED3.05B

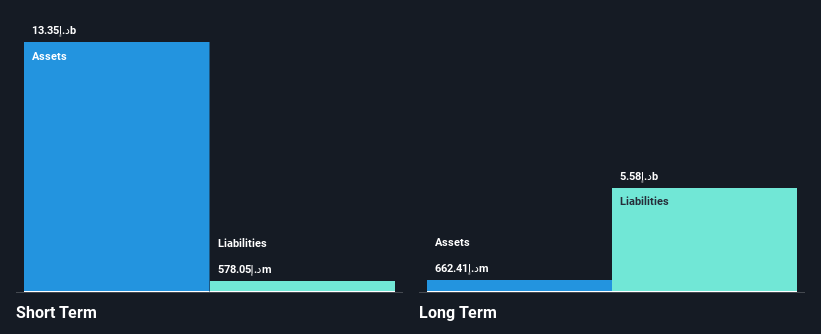

Al Waha Capital PJSC, with a market cap of AED3.05 billion, recently reported Q3 2025 revenue of AED373.19 million and net income of AED134.38 million, showing improved profitability from the previous year despite a decline in revenue. The firm has substantial short-term assets (AED13.2 billion) exceeding both short-term and long-term liabilities, indicating robust liquidity management. However, its operating cash flow remains negative, raising concerns about debt coverage despite having more cash than total debt. While the dividend yield is high at 6.14%, it isn't well covered by free cash flows, suggesting potential sustainability issues moving forward.

- Unlock comprehensive insights into our analysis of Al Waha Capital PJSC stock in this financial health report.

- Gain insights into Al Waha Capital PJSC's past trends and performance with our report on the company's historical track record.

E.E.A.M.I (TASE:EEAM-M)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E.E.A.M.I Ltd develops, sells, and maintains robotic cleaning solutions for PV modules in Israel, India, and internationally with a market cap of ₪21.84 million.

Operations: No specific revenue segments are reported for E.E.A.M.I Ltd.

Market Cap: ₪21.84M

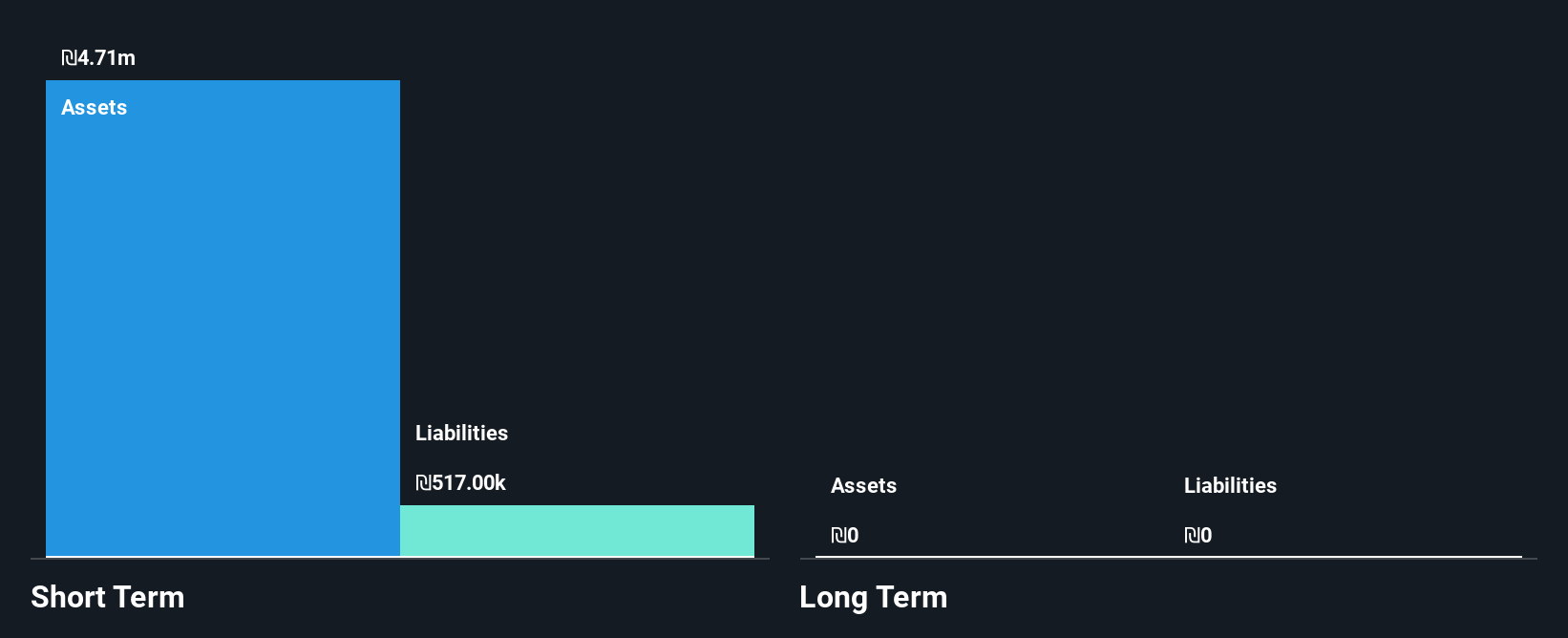

E.E.A.M.I Ltd, with a market cap of ₪21.84 million, operates in the robotic cleaning solutions sector but remains pre-revenue, generating less than US$1m. Despite its lack of revenue, the company has achieved profitability recently due to a significant one-off gain of ₪3.3M impacting financial results up to June 2025. The firm is debt-free and maintains strong liquidity with short-term assets of ₪4.7M exceeding liabilities by a wide margin. However, its share price has been highly volatile over the past three months and both its board and management team are relatively inexperienced with short average tenures.

- Dive into the specifics of E.E.A.M.I here with our thorough balance sheet health report.

- Evaluate E.E.A.M.I's historical performance by accessing our past performance report.

Ratio Petroleum Energy - Limited Partnership (TASE:RTPT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ratio Petroleum Energy - Limited Partnership is involved in the exploration, development, and production of oil and gas with a market cap of ₪63.63 million.

Operations: Ratio Petroleum Energy - Limited Partnership has not reported any revenue segments.

Market Cap: ₪63.63M

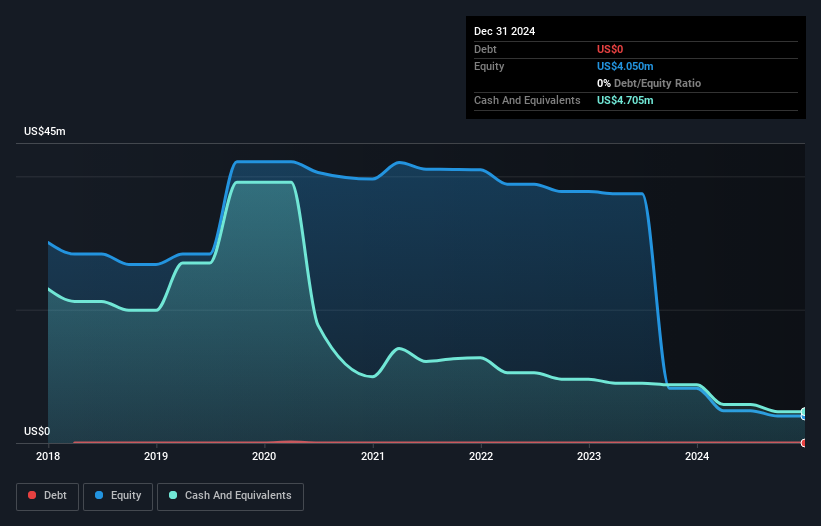

Ratio Petroleum Energy - Limited Partnership, with a market cap of ₪63.63 million, is pre-revenue, generating less than US$1m. Despite being unprofitable and experiencing increased losses over the past five years, the company benefits from a robust financial position with short-term assets of $4.9M surpassing liabilities and no debt on its balance sheet. The experienced board has an average tenure of nine years, contributing to stability in governance. Furthermore, Ratio Petroleum's cash runway extends beyond three years if free cash flow continues to grow at historical rates, offering some financial resilience amidst its current challenges in profitability.

- Click to explore a detailed breakdown of our findings in Ratio Petroleum Energy - Limited Partnership's financial health report.

- Examine Ratio Petroleum Energy - Limited Partnership's past performance report to understand how it has performed in prior years.

Key Takeaways

- Unlock more gems! Our Middle Eastern Penny Stocks screener has unearthed 75 more companies for you to explore.Click here to unveil our expertly curated list of 78 Middle Eastern Penny Stocks.

- Ready For A Different Approach? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:WAHA

Al Waha Capital PJSC

A private equity firm which manages assets across several sectors, including financial services and fintech, healthcare, energy, infrastructure, industrial real estate and capital markets.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026