- Turkey

- /

- Commercial Services

- /

- IBSE:AKYHO

Middle Eastern Market Gems: Gulf Pharmaceutical Industries P.S.C Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern markets have recently experienced positive momentum, with most Gulf indices closing higher amid expectations of a U.S. rate cut and signs of an end to the government shutdown. For investors interested in exploring smaller or newer companies, penny stocks—despite their somewhat outdated name—still hold potential value. These stocks can offer growth opportunities at lower price points, especially when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.47 | SAR1.39B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.694 | ₪336.53M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.04 | AED2.08B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.60 | AED633.42M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED377.69M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.23 | AED13.73B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.824 | AED2.36B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.806 | AED493.29M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.671 | ₪209.67M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

Gulf Pharmaceutical Industries P.S.C (ADX:JULPHAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gulf Pharmaceutical Industries P.S.C., along with its subsidiaries, is involved in the manufacturing and sale of pharmaceuticals, cosmetics, and medical compounds across the UAE, GCC countries, and internationally with a market cap of AED1.39 billion.

Operations: The company's revenue primarily comes from its manufacturing segment, which generated AED640.8 million.

Market Cap: AED1.39B

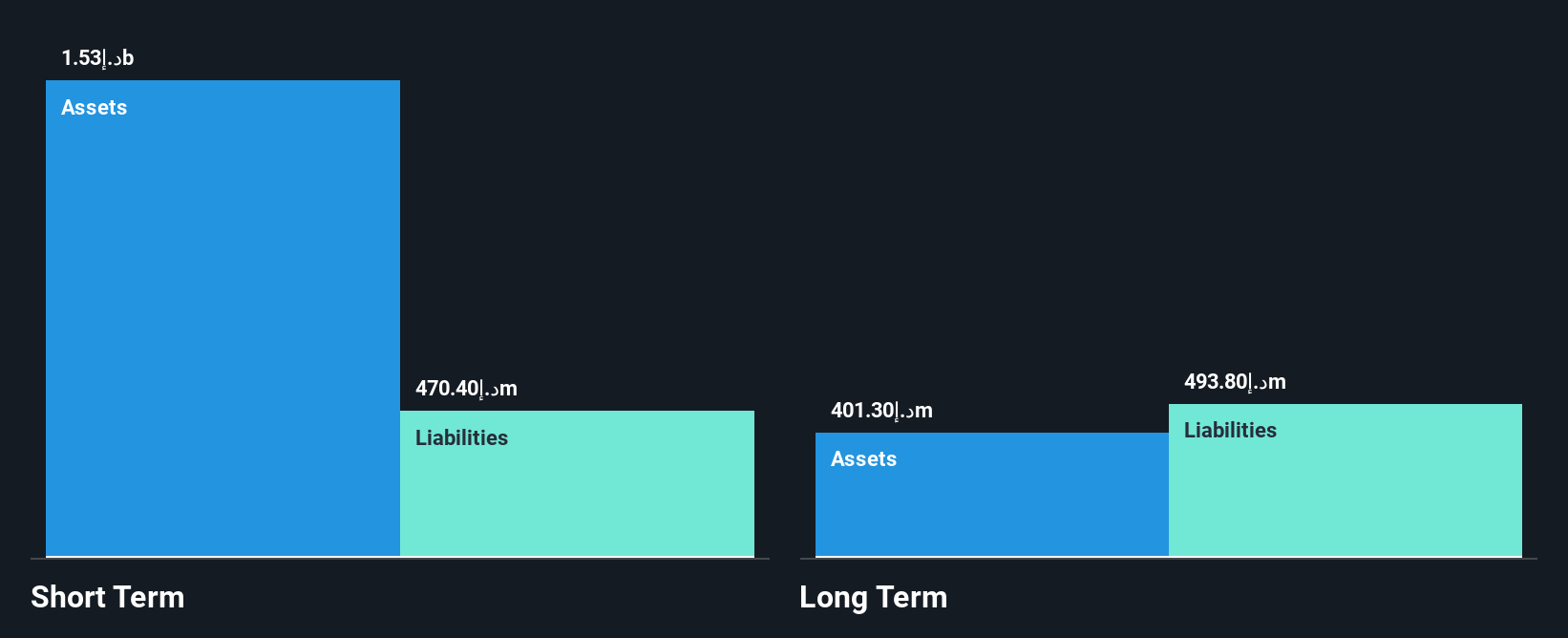

Gulf Pharmaceutical Industries P.S.C. has shown significant improvement in its financial health, transitioning to profitability with a net income of AED 157.9 million for the first half of 2025, compared to a loss the previous year. The company's debt management is commendable, with a reduced debt-to-equity ratio now at 39.9%. Its short-term assets comfortably cover both short and long-term liabilities, indicating solid liquidity. Despite low return on equity at 4.9%, its operating cash flow covers debt well at 52%. Recent inclusion in major indices like S&P Pan Arab Composite highlights its growing market recognition.

- Unlock comprehensive insights into our analysis of Gulf Pharmaceutical Industries P.S.C stock in this financial health report.

- Gain insights into Gulf Pharmaceutical Industries P.S.C's future direction by reviewing our growth report.

Akdeniz Yatirim Holding (IBSE:AKYHO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Akdeniz Yatirim Holding A.S. operates across diverse sectors including technology, renewable energy, defense, software and hardware, plastic, agriculture and animal husbandry, chlorine dioxide production, environment, and waste systems in Turkey with a market cap of TRY786.89 million.

Operations: The company generates revenue from its security services segment, totaling TRY116.60 million.

Market Cap: TRY786.89M

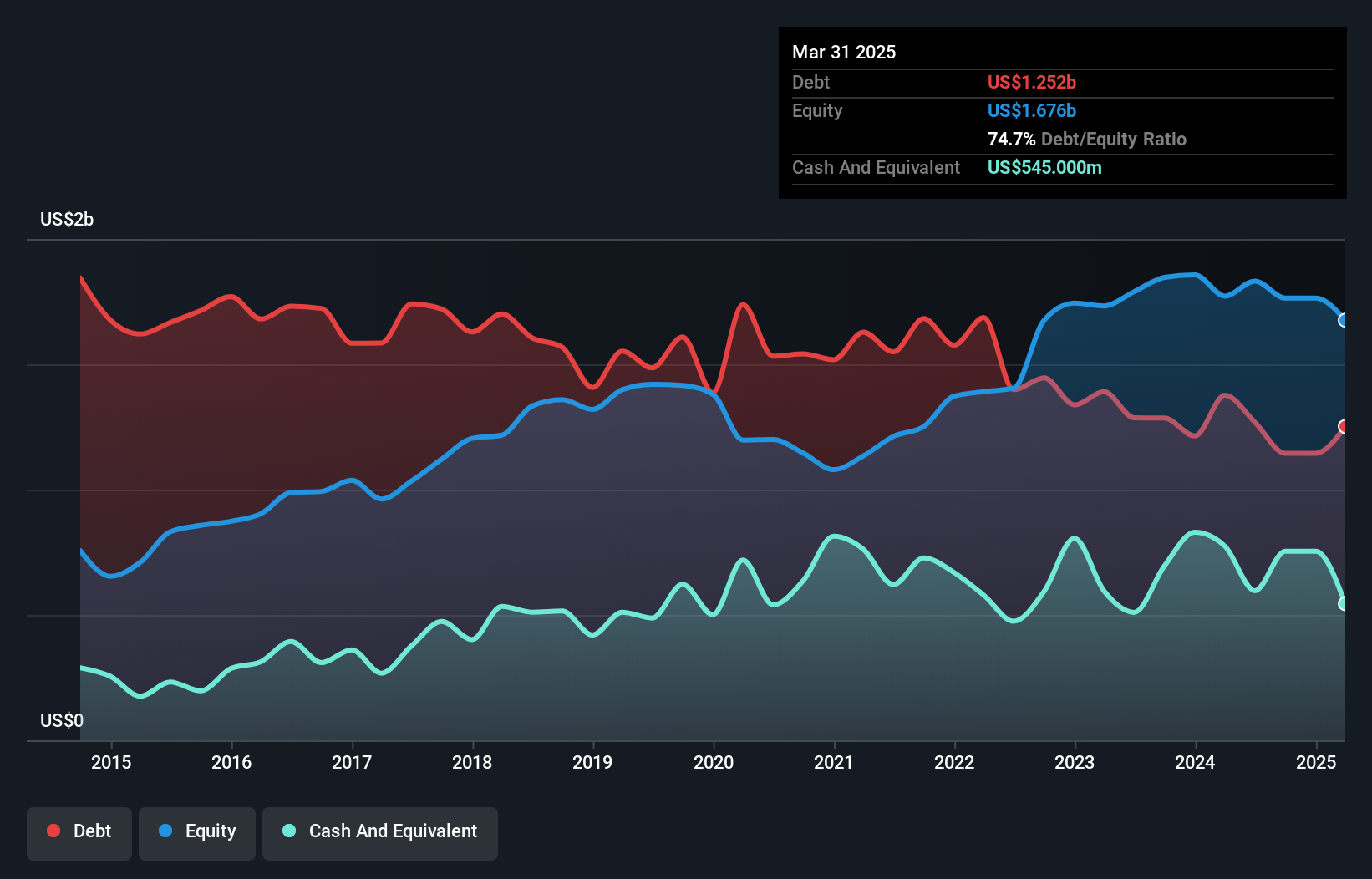

Akdeniz Yatirim Holding A.S., with a market cap of TRY786.89 million, operates across various sectors in Turkey but remains unprofitable, experiencing increased losses over the past five years. Despite generating TRY116.60 million from its security services segment, it lacks meaningful revenue overall and faces challenges with less than a year of cash runway based on current free cash flow trends. While its net debt to equity ratio is satisfactory at 0.2%, indicating prudent debt management, the company struggles with negative return on equity and declining earnings growth compared to industry standards. Recent financial reports show fluctuating sales and persistent net losses.

- Jump into the full analysis health report here for a deeper understanding of Akdeniz Yatirim Holding.

- Understand Akdeniz Yatirim Holding's track record by examining our performance history report.

Oil Refineries (TASE:ORL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oil Refineries Ltd., with a market cap of ₪3.19 billion, operates in the production and sale of fuel products, intermediate materials, and aromatic products both in Israel and internationally.

Operations: The company's revenue is primarily derived from its refining segment, which generated $5.81 billion, and its polymers segment, contributing $766 million.

Market Cap: ₪3.19B

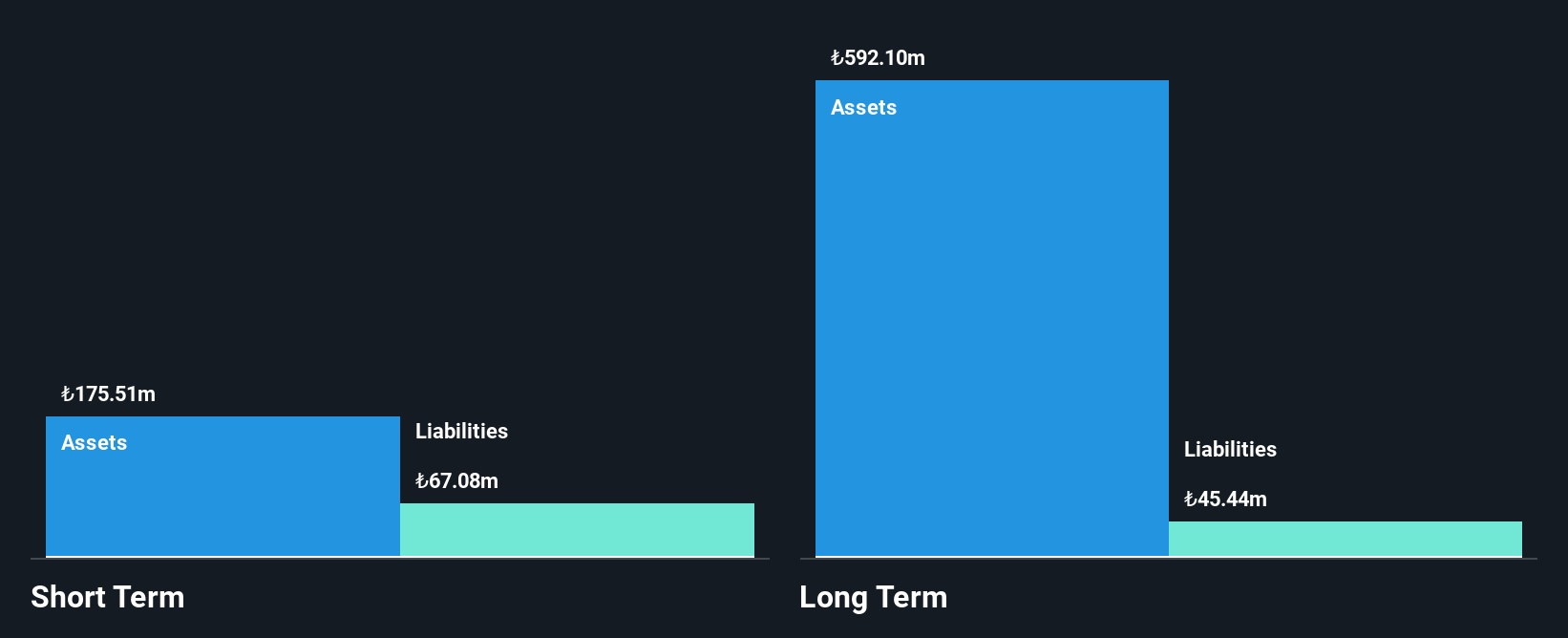

Oil Refineries Ltd., with a market cap of ₪3.19 billion, primarily generates revenue from its refining segment ($5.81 billion) and polymers segment ($766 million). The company faces challenges with unprofitable operations and negative return on equity (-3.99%). Despite stable weekly volatility (4%) and reduced debt-to-equity ratio over five years, its interest payments are not covered by EBIT, indicating financial strain. Short-term assets exceed both short- and long-term liabilities, suggesting liquidity strength. However, the dividend yield of 8.05% is unsustainable due to insufficient earnings coverage. The board and management team are experienced, providing some stability amid financial hurdles.

- Get an in-depth perspective on Oil Refineries' performance by reading our balance sheet health report here.

- Learn about Oil Refineries' historical performance here.

Next Steps

- Reveal the 78 hidden gems among our Middle Eastern Penny Stocks screener with a single click here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AKYHO

Akdeniz Yatirim Holding

Engages in the technology, renewable energy, defense, software and hardware, plastic, agriculture and animal husbandry, chlorine dioxide, environment, and waste systems sectors in Turkey.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives