- Saudi Arabia

- /

- Pharma

- /

- SASE:4016

Undiscovered Gems in Middle East Stocks for October 2025

Reviewed by Simply Wall St

As most Gulf markets ease amid economic uncertainty and geopolitical tensions, the region's financial landscape remains influenced by fluctuating oil prices and potential U.S. Federal Reserve rate cuts. Despite these challenges, discerning investors can find opportunities in small-cap stocks that demonstrate resilience and growth potential within the Middle East's dynamic market environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

We'll examine a selection from our screener results.

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank Of Sharjah P.J.S.C. operates as a provider of commercial and investment banking products and services in the United Arab Emirates, with a market capitalization of AED4.32 billion.

Operations: The company generates revenue primarily from its Commercial Banking segment, contributing AED373.76 million, and its Investment and Treasury segment, which brings in AED342.43 million.

BoS, a small cap player in the Middle East banking sector, has seen an impressive earnings growth of 1067.8% over the past year, surpassing the industry average of 14.4%. Despite this growth, it faces challenges with a high level of bad loans at 6.6%, while maintaining a low allowance for these non-performing loans at just 86%. The bank's price-to-earnings ratio stands attractively at 9x compared to the AE market's 12.3x. Recent leadership changes include appointing Adnan Sajwani as Acting Chief Compliance Officer to enhance regulatory compliance and financial crime prevention efforts.

Middle East Pharmaceutical Industries (SASE:4016)

Simply Wall St Value Rating: ★★★★★☆

Overview: Middle East Pharmaceutical Industries Company focuses on the research, development, manufacture, and marketing of generic medicines and pharmaceutical preparations in Saudi Arabia and internationally, with a market cap of SAR2.59 billion.

Operations: Middle East Pharmaceutical Industries generates revenue primarily from three segments: private customers (SAR286.25 million), public customers (SAR95.00 million), and export customers (SAR50.82 million). The company's focus on generic medicines and pharmaceutical preparations contributes to its financial structure, with a notable emphasis on the private customer segment as the largest revenue source.

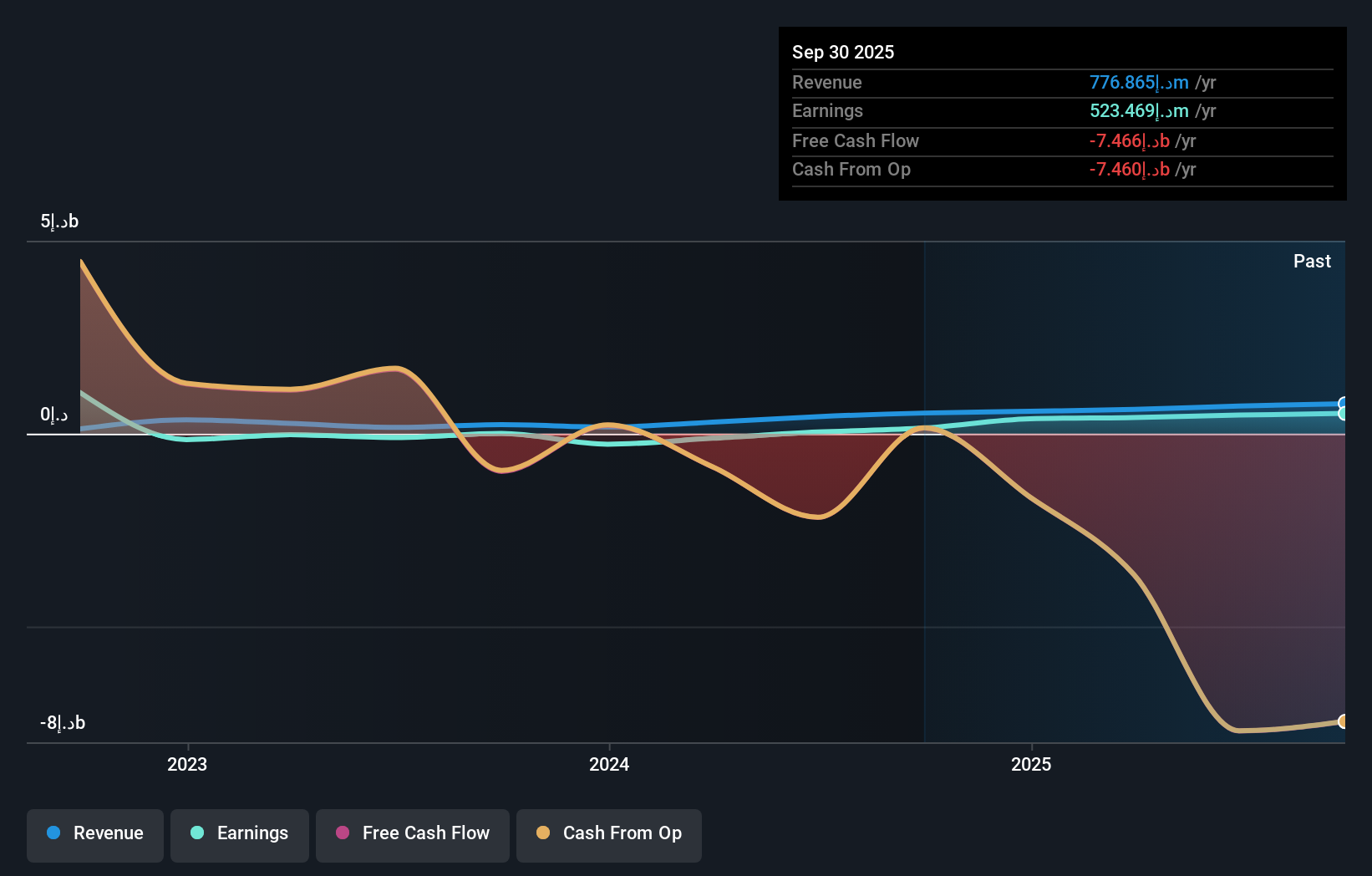

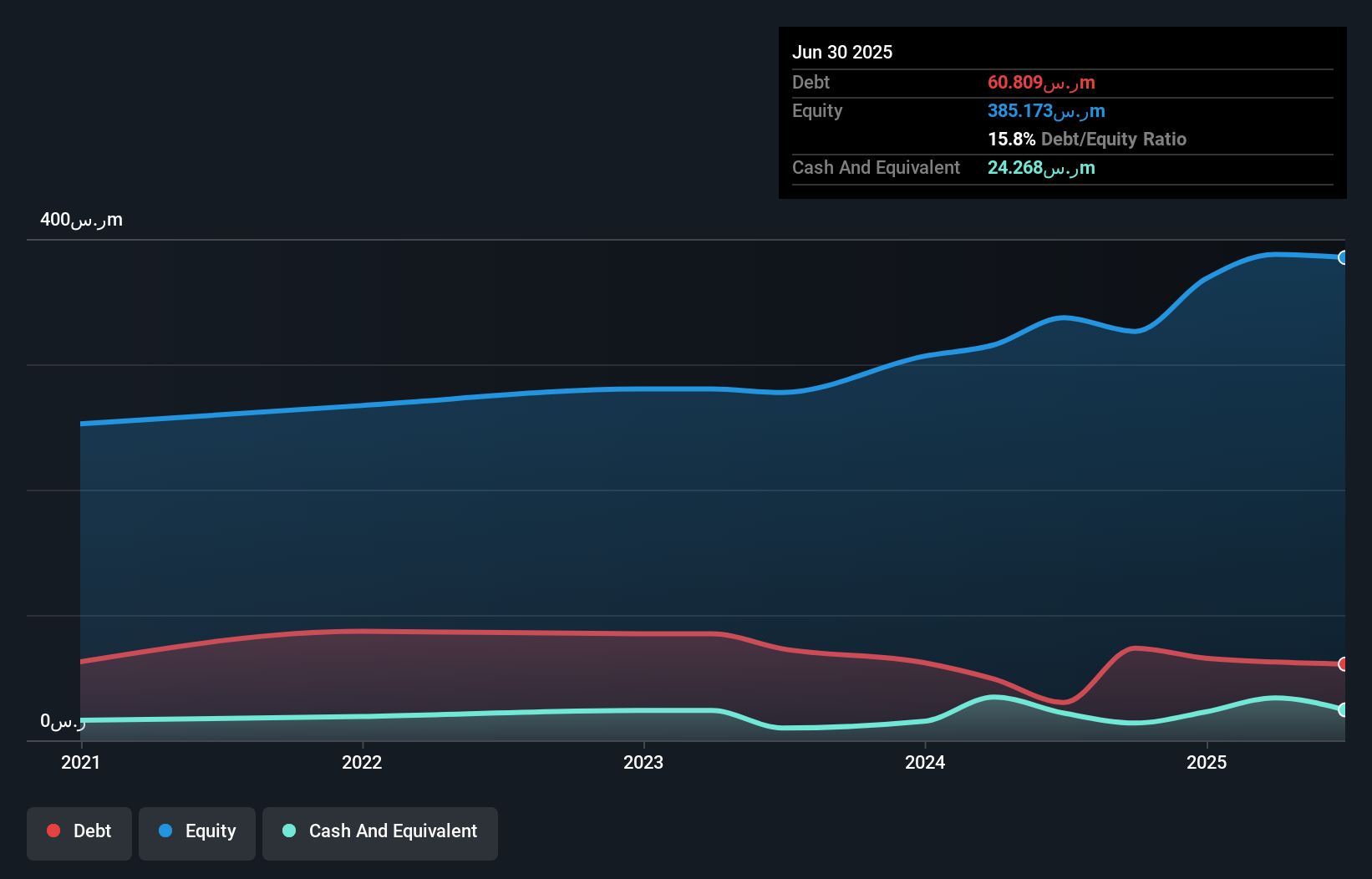

Middle East Pharmaceutical Industries has shown promising growth, with earnings up 16.9% over the past year, outpacing the industry average of 4.9%. The company maintains a satisfactory net debt to equity ratio of 9.5%, reflecting prudent financial management. Recent earnings reports reveal sales for the second quarter at SAR 117.66 million, an increase from SAR 101.13 million last year, and net income at SAR 24.81 million compared to SAR 21.81 million previously. A strategic agreement with Adalvo Limited positions Avalon Pharma for expansion in MENA markets, potentially enhancing its portfolio with GLP-1 products targeting chronic obesity and weight loss.

Equital (TASE:EQTL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Equital Ltd. operates through its subsidiaries in the real estate, oil and gas, and residential construction sectors both in Israel and internationally, with a market cap of ₪5.45 billion.

Operations: Revenue primarily stems from the oil and gas sector in Israel, contributing ₪1.79 billion, followed by property rental and management in Israel at ₪945.25 million. The net profit margin trend displays fluctuations over recent periods, reflecting variability in operational efficiency and cost management strategies.

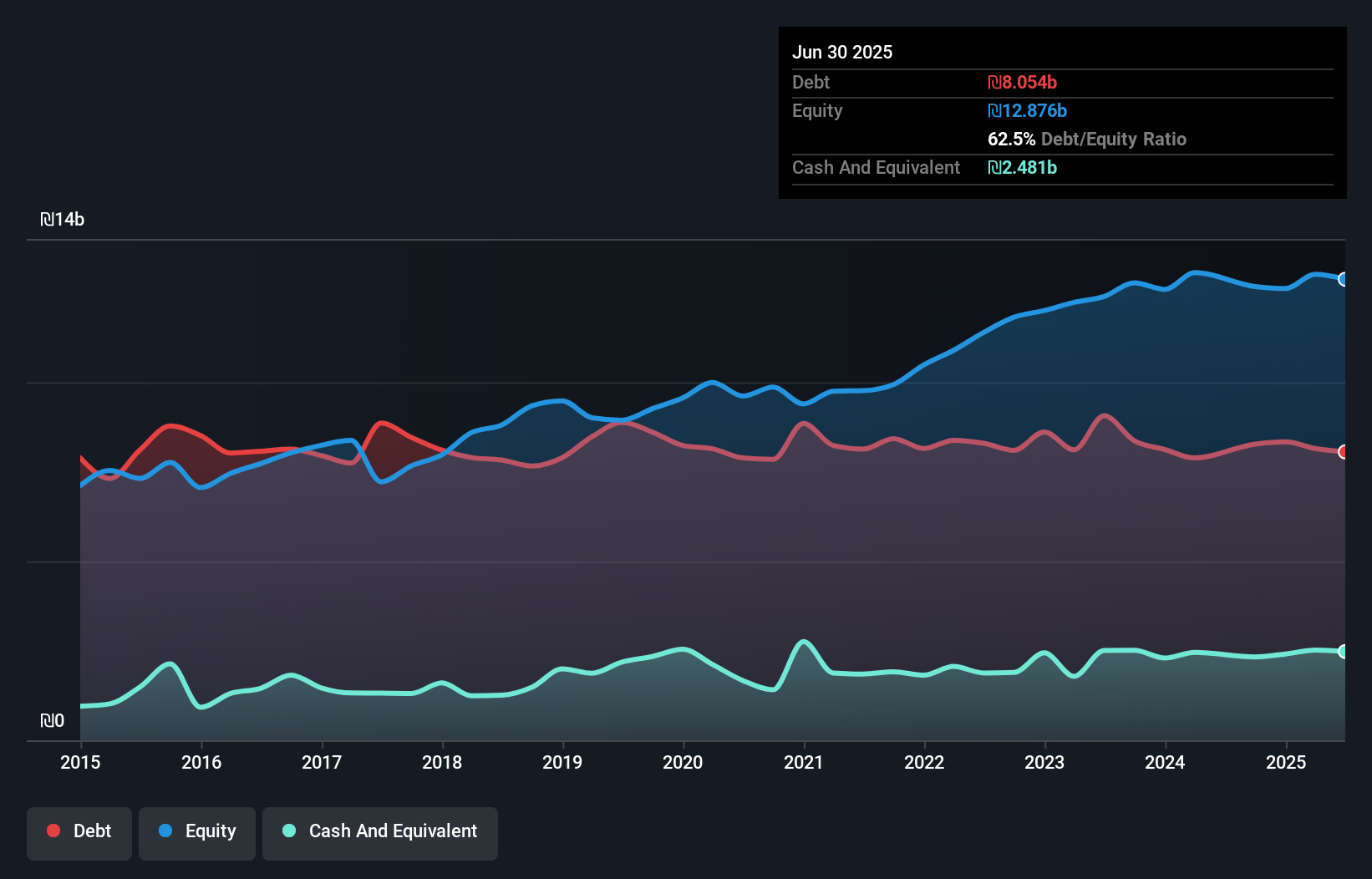

Equital, a promising player in the Middle East market, showcases strong financial health with its debt to equity ratio dropping from 82% to 62.5% over five years. Trading at 68% below estimated fair value, it offers potential for value seekers. The company's earnings grew by an impressive 16.3% last year, outpacing the oil and gas industry average of just 0.3%. Equital's interest payments are well covered by EBIT at a robust 8.9 times coverage, indicating sound financial management. Recently added to the S&P Global BMI Index, Equital reported net income of ILS 136 million for Q2 compared to ILS 81.74 million last year.

Make It Happen

- Discover the full array of 204 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4016

Middle East Pharmaceutical Industries

Engages in the research, development, manufacture, and marketing of generic medicines and pharmaceutical preparations in the Kingdom of Saudi Arabia and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026