- Israel

- /

- Capital Markets

- /

- TASE:TASE

Tel-Aviv Stock Exchange (TASE:TASE): Assessing Valuation After Strong Q3 Results and Global Growth Initiatives

Reviewed by Simply Wall St

The Tel-Aviv Stock Exchange (TASE:TASE) delivered strong third-quarter results, with substantial gains in both revenue and earnings. Investors are reacting to higher profitability, record margins, and efforts to expand trading access globally.

See our latest analysis for Tel-Aviv Stock Exchange.

The strong quarterly results and momentum-building strategic moves have fueled a tremendous rally in Tel-Aviv Stock Exchange shares, with a 1-year total shareholder return of 116.5% and a remarkable five-year total return of nearly 589%. Short-term share price gains have also been outstanding, reflecting growing confidence in TASE’s global ambitions and operational progress.

If this kind of performance has you thinking broader, now is a perfect moment to expand your search and discover fast growing stocks with high insider ownership

But with Tel-Aviv Stock Exchange shares posting extraordinary returns and recent financial results surpassing expectations, investors may wonder whether the stock is attractively undervalued or if the market has already priced in the next wave of growth.

Price-to-Earnings of 53x: Is it justified?

Tel-Aviv Stock Exchange is trading at a Price-to-Earnings ratio of 53x, which is significantly above the market and industry averages. This draws attention to its valuation premium at a last close of ₪88.57.

The Price-to-Earnings (P/E) ratio measures how much investors are willing to pay for each unit of reported earnings. For capital markets companies, the P/E can reflect expectations of future growth, profitability, and sector leadership.

A multiple this high means investors are paying more for current profits compared to most other firms in the region. This raises questions about whether future earnings growth or unique business advantages fully justify the premium price, especially as profitability surges and global expansion plans unfold.

Compared to its Asian Capital Markets industry peers, which trade at a 21x P/E, TASE’s ratio appears expensive. Against the peer group average of 22.6x, this premium is even more pronounced, indicating that the market has high expectations for Tel-Aviv Stock Exchange’s growth and operational execution.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 53x (OVERVALUED)

However, rising valuations and an 8% intrinsic discount present potential risks if growth expectations are not met or if global market conditions shift unexpectedly.

Find out about the key risks to this Tel-Aviv Stock Exchange narrative.

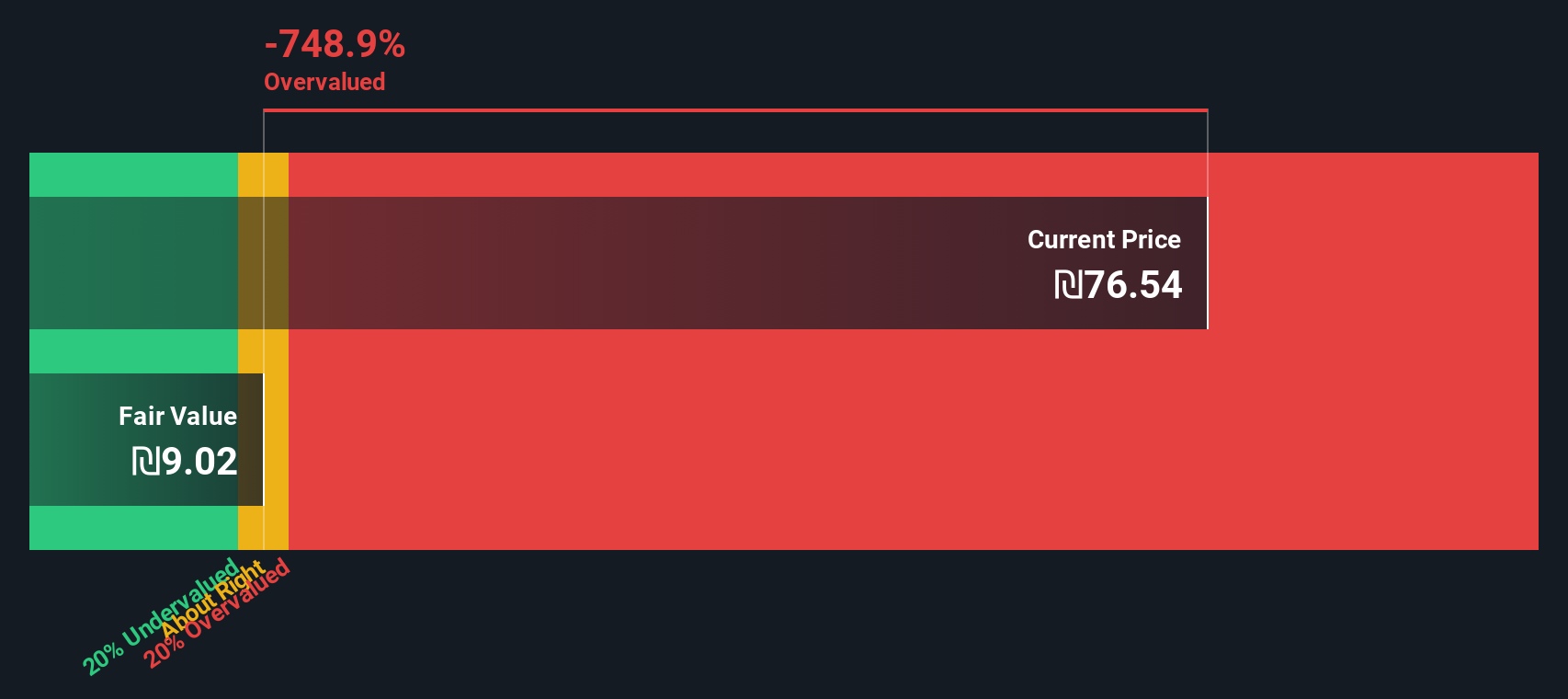

Another View: Discounted Cash Flow Tells a Different Story

Taking a step back, our SWS DCF model paints a very different picture for Tel-Aviv Stock Exchange’s valuation. According to this approach, the shares are currently priced well above their estimated fair value. This suggests they may actually be overvalued by a wide margin. Could the market be too optimistic about TASE’s future?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tel-Aviv Stock Exchange for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tel-Aviv Stock Exchange Narrative

If you’d like to see things differently or want to test your own analysis, you can build your own perspective on Tel-Aviv Stock Exchange in just minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tel-Aviv Stock Exchange.

Looking for more investment ideas?

Don’t miss out on what’s next. Expand your horizons now with handpicked opportunities from Simply Wall Street’s screener to stay ahead of the market.

- Get ahead of the curve and access these 25 AI penny stocks promising rapid advances in artificial intelligence and automation.

- Target higher potential by finding these 886 undervalued stocks based on cash flows that could be overlooked for strong cash flow value.

- Boost your income by tapping into these 16 dividend stocks with yields > 3% for reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tel-Aviv Stock Exchange might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TASE

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives