- Israel

- /

- Capital Markets

- /

- TASE:MRIN

Y.D. More Investments (TASE:MRIN): Assessing Valuation Following TA-125 Index Inclusion

Reviewed by Simply Wall St

Y.D. More Investments (TASE:MRIN) was just added to the TA-125 Index. This change tends to draw investor attention because index inclusion often brings increased trading activity and fund inflows.

See our latest analysis for Y.D. More Investments.

The recent buzz around Y.D. More Investments isn’t just about index inclusion, as shares have surged over 230% so far this year, with a one-year total shareholder return topping 340%. This momentum suggests investors see plenty of growth potential ahead.

If this kind of explosive move has you thinking bigger, now could be the ideal time to broaden your search and discover fast growing stocks with high insider ownership

But with the stock already boasting triple-digit gains, is Y.D. More Investments still flying under the radar? Or has the market fully accounted for its future prospects, leaving little room for upside?

Price-to-Earnings of 31.2x: Is it justified?

Y.D. More Investments is currently trading at a price-to-earnings (P/E) ratio of 31.2x, which is much higher than both its industry and peer averages. This suggests investors are paying a steep premium for current and future earnings.

The price-to-earnings ratio shows how much investors are willing to pay for each ₪1 of earnings generated by the company. In the context of capital markets companies, a higher multiple is usually reserved for firms with exceptional growth or profitability prospects.

Given Y.D. More Investments’ strong growth rates in earnings, with an increase of 75% over the past year and an average of 35% per year over five years, the elevated P/E could signal optimism about the company’s ability to maintain this trajectory. However, at 31.2x earnings, this far exceeds the Asian Capital Markets industry average of 21x and the peer average of 20.4x. The market appears to have bid up the stock well above common valuation benchmarks for its sector, setting a high bar for future growth to justify the price.

With the current P/E well above the industry and peer group, investors should look closely at what is driving this premium and whether the growth outlook justifies it. Market valuations could adjust quickly if expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 31.2x (OVERVALUED)

However, a sudden dip in growth rates or a shift in investor sentiment could quickly cool off the current enthusiasm surrounding Y.D. More Investments.

Find out about the key risks to this Y.D. More Investments narrative.

Another View: The SWS DCF Model Suggests Overvaluation

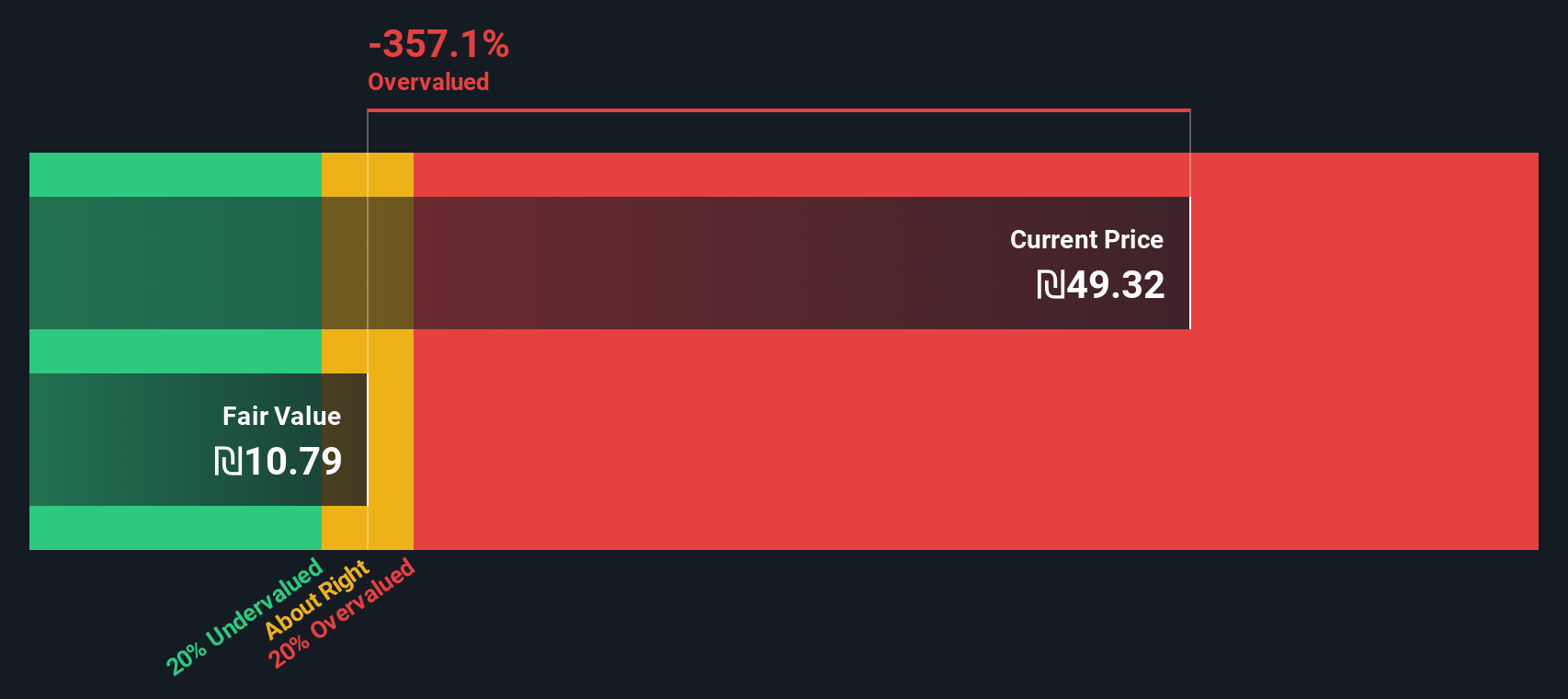

Looking beyond earnings multiples, our SWS DCF model estimates that Y.D. More Investments is trading well above its fair value. The calculated fair value is ₪10.79, while the current price stands at ₪49.32. This stark difference raises important questions about whether recent optimism is sustainable or a sign of overheating.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Y.D. More Investments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Y.D. More Investments Narrative

If you see the story differently or want to dig deeper into the numbers yourself, you can quickly create your own custom narrative in just a few minutes. Do it your way

A great starting point for your Y.D. More Investments research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Thousands of investors are finding their next big winners by tapping into targeted screeners on Simply Wall Street. Don’t let exceptional opportunities slip by unnoticed. Power up your search right now.

- Boost your portfolio with reliable income by checking out these 14 dividend stocks with yields > 3% offering attractive yields above 3% and strong fundamentals behind each pick.

- Position yourself at the forefront of healthcare breakthroughs by exploring these 32 healthcare AI stocks delivering innovation in AI-driven medicine and digital health solutions.

- Capitalize on fast-evolving digital trends by reviewing these 82 cryptocurrency and blockchain stocks at the center of blockchain and crypto adoption worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MRIN

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives