Amid mixed performances in the Middle Eastern markets, driven by fluctuating oil prices and geopolitical developments such as the Gaza ceasefire deal, investors are keenly observing dividend stocks for stable returns. In this context, identifying solid dividend-paying stocks becomes crucial as they offer potential income streams while navigating market uncertainties.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.37% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.49% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.22% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.40% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.37% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.97% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.35% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 8.26% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.05% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.98% | ★★★★★☆ |

Click here to see the full list of 68 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Dubai Refreshment (P.J.S.C.) (DFM:DRC)

Simply Wall St Dividend Rating: ★★★★☆☆

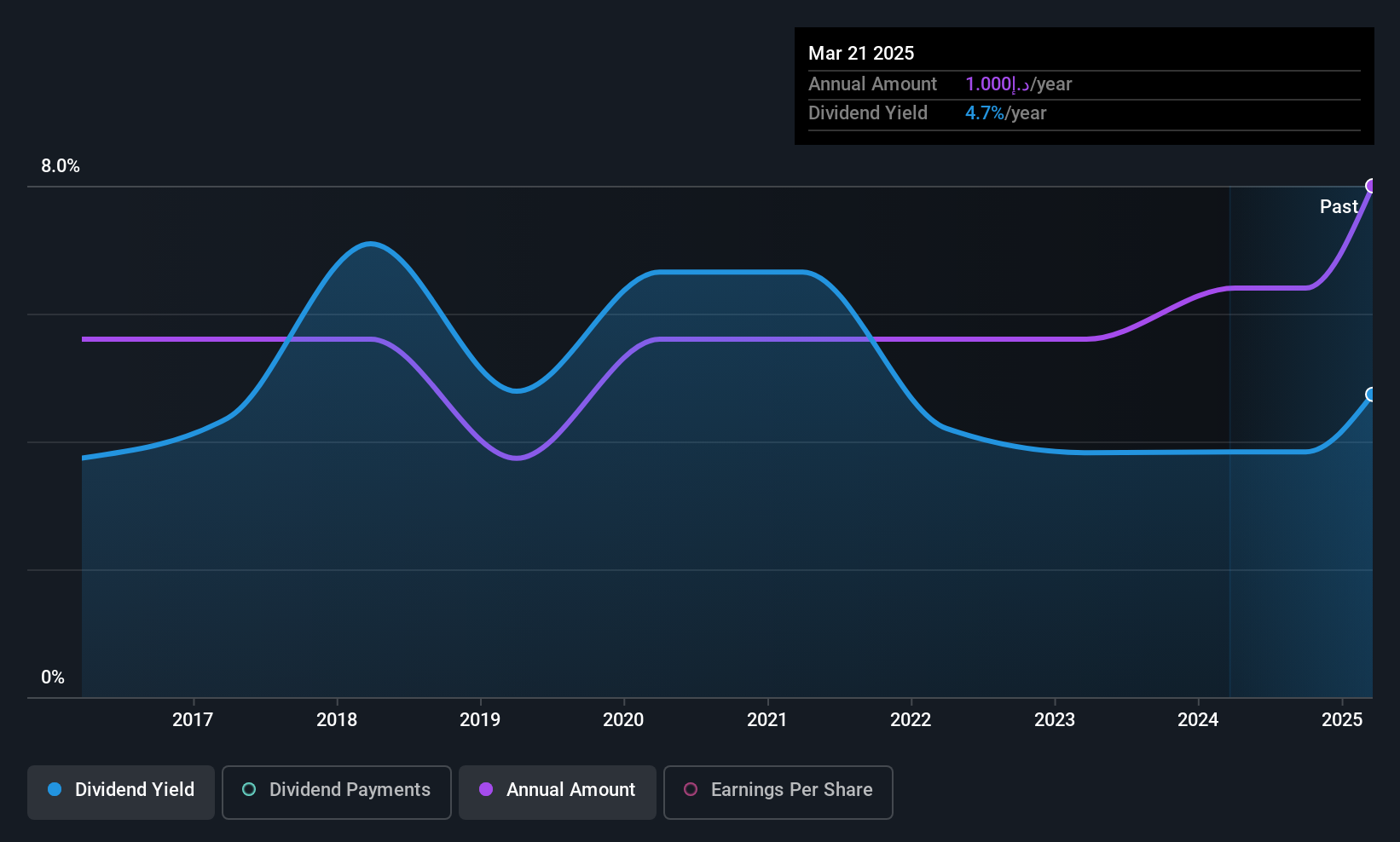

Overview: Dubai Refreshment (P.J.S.C.) is involved in bottling and selling Pepsi Cola International products both in the United Arab Emirates and internationally, with a market cap of AED2.03 billion.

Operations: Dubai Refreshment (P.J.S.C.) generates revenue of AED850.52 million from the canning, bottling, distribution, and trading of soft drinks and related beverage products.

Dividend Yield: 4.4%

Dubai Refreshment (P.J.S.C.) reported strong earnings growth for Q2 2025, with sales increasing to AED 238.44 million and net income rising to AED 47.88 million. Despite a volatile dividend history, the company's current dividend payments are well-covered by earnings and cash flows, with payout ratios of 63% and 42.5%, respectively. However, its dividend yield of 4.44% is lower than the top quartile in the AE market, reflecting potential limitations for income-focused investors.

- Take a closer look at Dubai Refreshment (P.J.S.C.)'s potential here in our dividend report.

- The analysis detailed in our Dubai Refreshment (P.J.S.C.) valuation report hints at an deflated share price compared to its estimated value.

Atreyu Capital Markets (TASE:ATRY)

Simply Wall St Dividend Rating: ★★★★☆☆

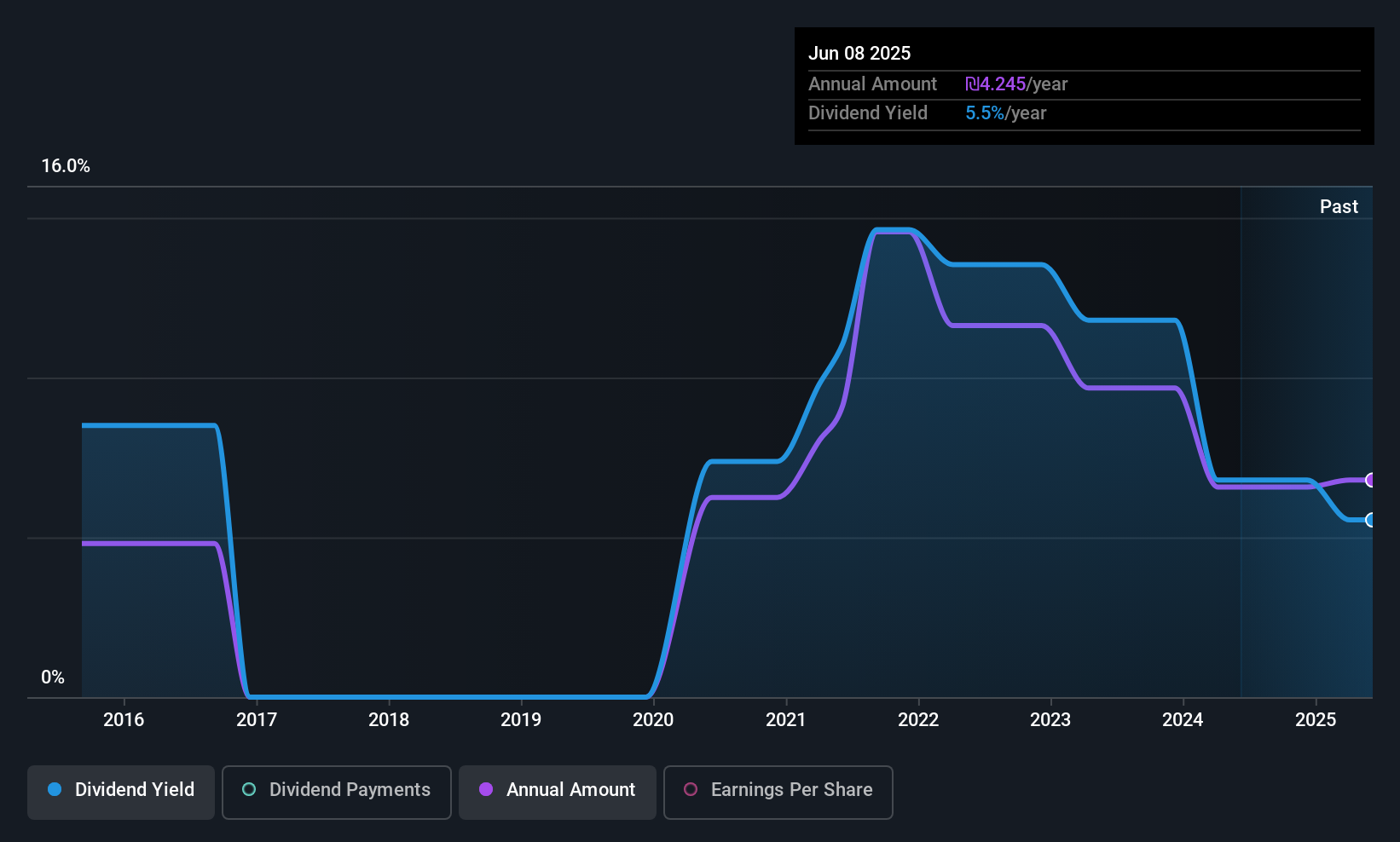

Overview: Atreyu Capital Markets Ltd, with a market cap of ₪1.18 billion, operates in Israel offering investment management services through its subsidiaries.

Operations: Atreyu Capital Markets Ltd generates revenue of ₪105.53 million from its investment management services in Israel through its subsidiaries.

Dividend Yield: 5.3%

Atreyu Capital Markets recently joined the S&P Global BMI Index, enhancing its visibility. The company reported solid earnings growth for Q2 2025, with revenue rising to ILS 27.54 million and net income reaching ILS 26.36 million. Despite a low payout ratio of 36%, indicating dividends are well-covered by earnings, the dividend history has been volatile over the past decade. Its current yield of 5.31% is slightly below top-tier IL market payers, yet dividends remain covered by cash flows at an 84.7% cash payout ratio.

- Click here and access our complete dividend analysis report to understand the dynamics of Atreyu Capital Markets.

- Upon reviewing our latest valuation report, Atreyu Capital Markets' share price might be too optimistic.

Telsys (TASE:TLSY)

Simply Wall St Dividend Rating: ★★★★☆☆

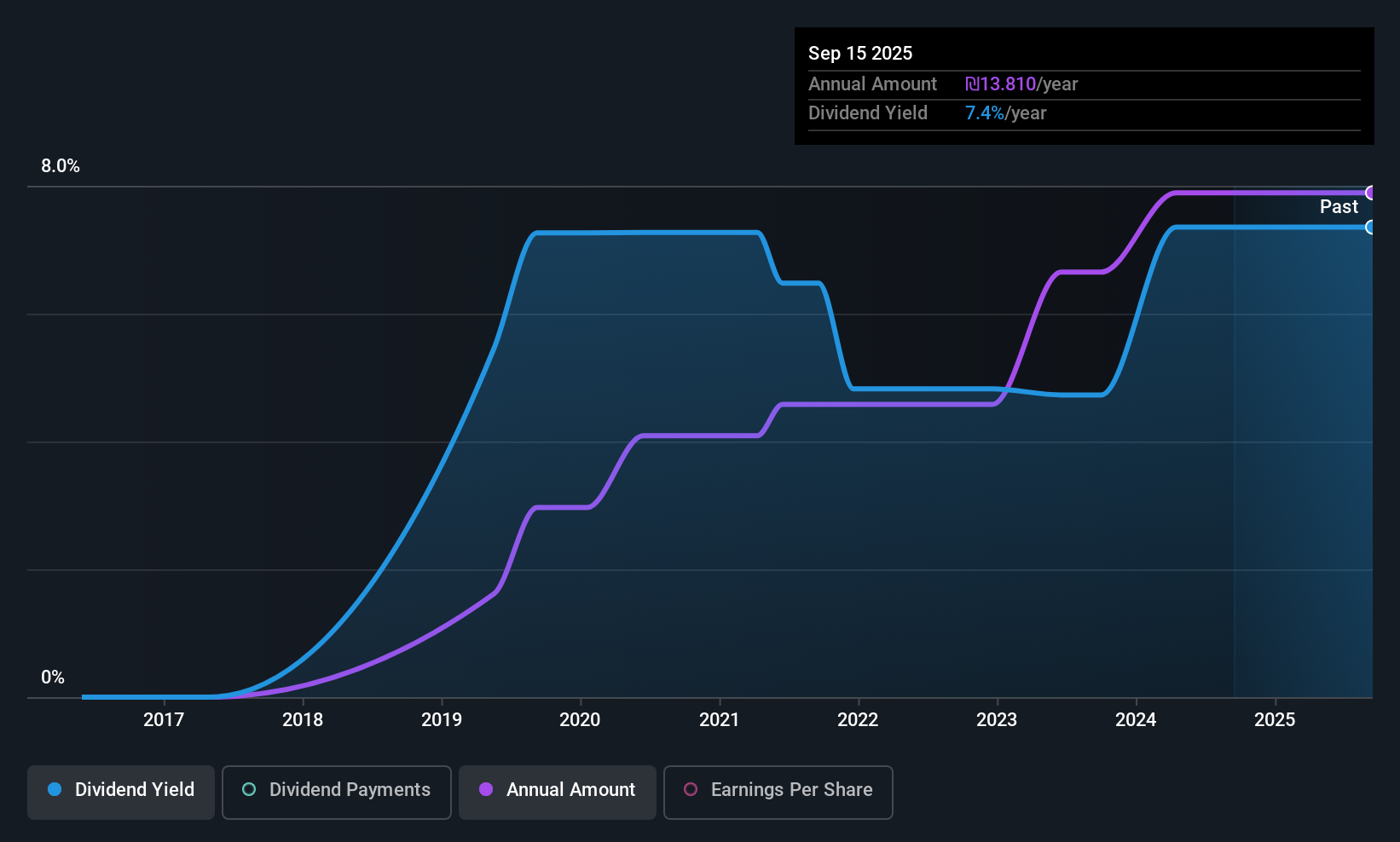

Overview: Telsys Ltd. is a company that markets and distributes electronic components in Israel, with a market cap of ₪1.76 billion.

Operations: Telsys Ltd. generates revenue from its SOM Sector at ₪277.49 million and Distribution at ₪143.68 million.

Dividend Yield: 7.1%

Telsys Ltd. reported robust earnings growth, with Q2 2025 sales at ILS 111.95 million and net income at ILS 32.63 million, reflecting a solid financial position for dividends. The company maintains a low payout ratio of 14%, ensuring dividends are well-covered by earnings, while the cash payout ratio stands at 87.4%. Although Telsys has paid dividends for only seven years, its yield of 7.12% ranks among the top in the IL market, demonstrating reliable growth with minimal volatility.

- Click here to discover the nuances of Telsys with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Telsys shares in the market.

Make It Happen

- Take a closer look at our Top Middle Eastern Dividend Stocks list of 68 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DRC

Dubai Refreshment (P.J.S.C.)

Engages in bottling and selling Pepsi Cola International products in the United Arab Emirates and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success