- Israel

- /

- Consumer Durables

- /

- TASE:NTGR

Netanel Group (TASE:NTGR) Returns to Net Profit in Q3, Challenging Three-Quarter Loss Narrative

Reviewed by Simply Wall St

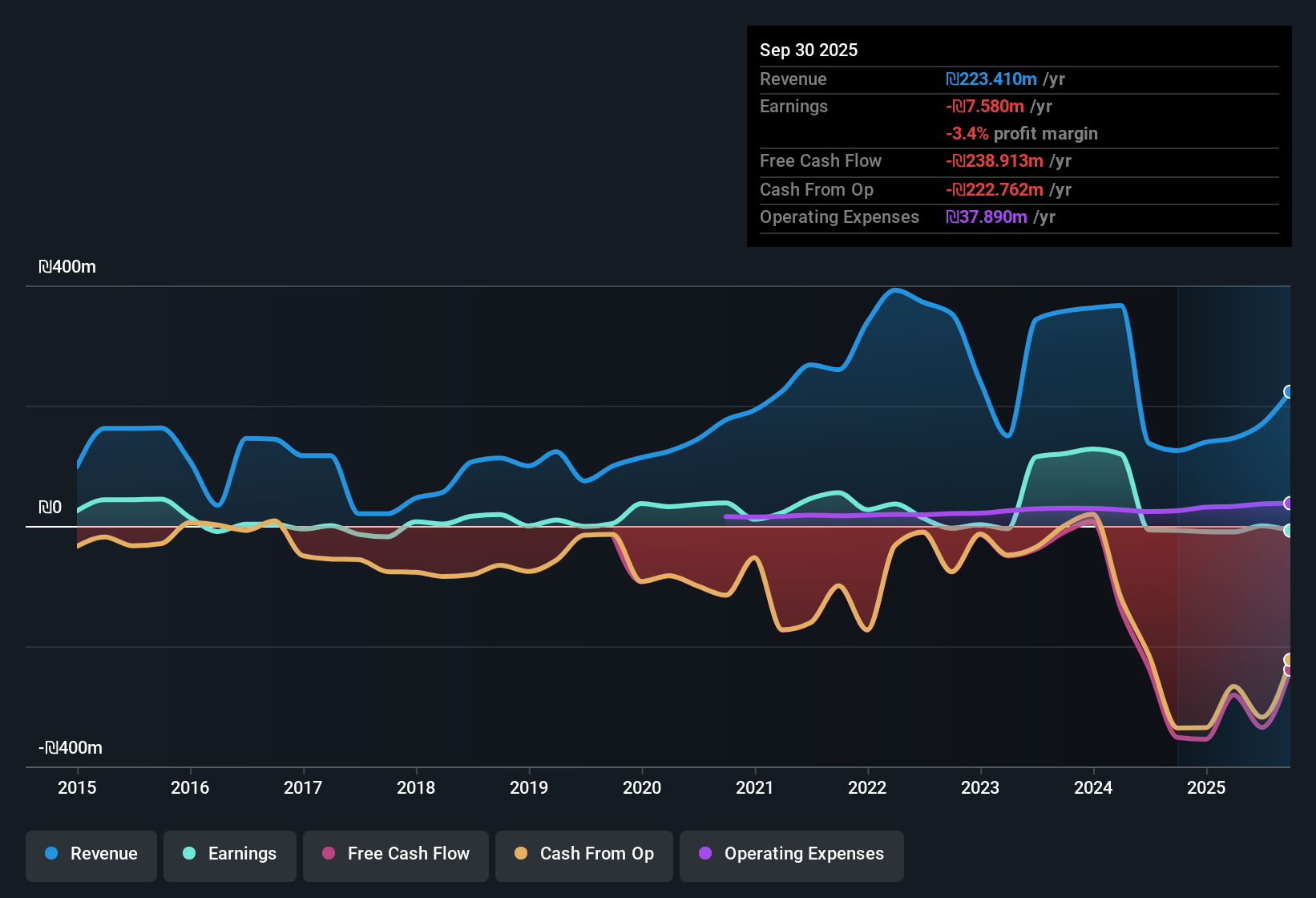

Netanel Group (TASE:NTGR) just released its Q3 2025 financials, reporting revenue of 46.24 million ILS and net income (excluding extraordinary items) of 5.26 million ILS for the period. Looking back, the company’s revenue has ranged from 22.99 million ILS to 50.40 million ILS per quarter over the past year. Net income has fluctuated from a loss of 5.24 million ILS to the most recent profit. Margins improved as the business returned to profitability following a series of losses, a development that is likely to attract investors’ attention this earnings season.

See our full analysis for Netanel Group.Next, this report will review how these results compare to the main narratives that have shaped market expectations for Netanel Group. This analysis can help investors gauge how closely the consensus may be shifting.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Turns Positive for First Time in a Year

- Trailing twelve month net income (excluding extraordinary items) reached 0.387 million ILS, a notable recovery from the previous four quarters, all of which showed losses, including -10.112 million ILS as recently as Q1 2025.

- Market opinion highlights that this turnaround marks a shift to profitability for Netanel Group. The margin improvement stands in stark contrast to the multi-year trend of average annual earnings declines of 4.5% over the past five years.

- This upward move in profit quality, although recent, is presented as high quality in analysis and provides a potential foundation for sustained gains if underlying drivers hold.

- What stands out, however, is that despite the recent profit, the long-term record of contracting earnings could temper optimism among risk-aware investors who are currently reassessing the stock's trajectory.

Revenue Swings Reveal Volatility

- Quarterly revenue has fluctuated sharply over the past six quarters, from a low of 22.99 million ILS (Q2 2024) to a high of 50.40 million ILS (Q4 2024), before settling at 46.24 million ILS in the latest quarter.

- Analysis points out that, while bulls might focus on the sharp rebound from last year's lows, the ongoing volatility coupled with sector sensitivity to interest rates and construction costs suggests that revenue predictability remains a challenge.

- Bulls emphasize the company's longstanding presence and exposure to recurring leasing and urban renewal projects as strategic defensive levers during sector swings.

- Yet, critics would note that revenue variability may still make it difficult for investors to confidently forecast future growth without further evidence of stabilization.

Premium Valuation Despite Peer Discount

- Netanel Group’s price-to-sales ratio of 2.1x stands notably above the Asian Consumer Durables industry average of 1.1x but below direct peers, which average 5x.

- Current valuation analysis contrasts bullish hopes for a sector premium with subdued growth. The market grants Netanel Group a higher multiple than the industry in recognition of recent profitability but remains cautious due to weaker long-term trends and ongoing risks with covering interest payments.

- The company’s interest expenses are not fully covered by earnings, introducing a clear financial risk even after the return to profit.

- Investors must weigh the premium pricing against both the durability of the margin turnaround and the potential for further downside if an earnings decline resumes.

Consensus around Netanel Group's outlook is evolving, with recent financial recovery challenging the company's longer-term pattern of weakness and prompting closer scrutiny of both risks and opportunities by investors. For a data-driven breakdown of how narratives are shaping up, see the latest from our analyst community. 📊 Read the full Netanel Group Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Netanel Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Netanel Group turned a profit this quarter, its unpredictable revenues and inability to fully cover interest payments still cast doubt on future stability.

If you want exposure to companies with stronger finances and less risk from debt, check out solid balance sheet and fundamentals stocks screener (1938 results) that prioritize resilience and healthy balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netanel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NTGR

Netanel Group

Engages in the construction business in Israel and the United States.

Questionable track record with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.