- United Arab Emirates

- /

- Insurance

- /

- ADX:HAYAH

Middle Eastern Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

Most Gulf markets have recently retreated due to weak oil prices, although expectations of a potential U.S. Federal Reserve rate cut have tempered some losses. Despite the vintage feel of the term "penny stocks," these investments still hold relevance, particularly for those interested in smaller or newer companies that offer growth at lower price points. This article explores several penny stocks in the Middle East that combine strong financial foundations with potential for substantial returns, presenting opportunities to uncover hidden value in quality companies.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.32 | SAR1.33B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.88 | ₪206.48M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.02 | AED2.06B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.34 | AED14.16B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.789 | AED2.26B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.82 | AED498.77M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.696 | ₪211.63M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 79 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

HAYAH Insurance Company P.J.S.C (ADX:HAYAH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HAYAH Insurance Company P.J.S.C. offers health and life insurance solutions both in the United Arab Emirates and internationally, with a market capitalization of AED306 million.

Operations: HAYAH Insurance Company P.J.S.C. does not report specific revenue segments.

Market Cap: AED306M

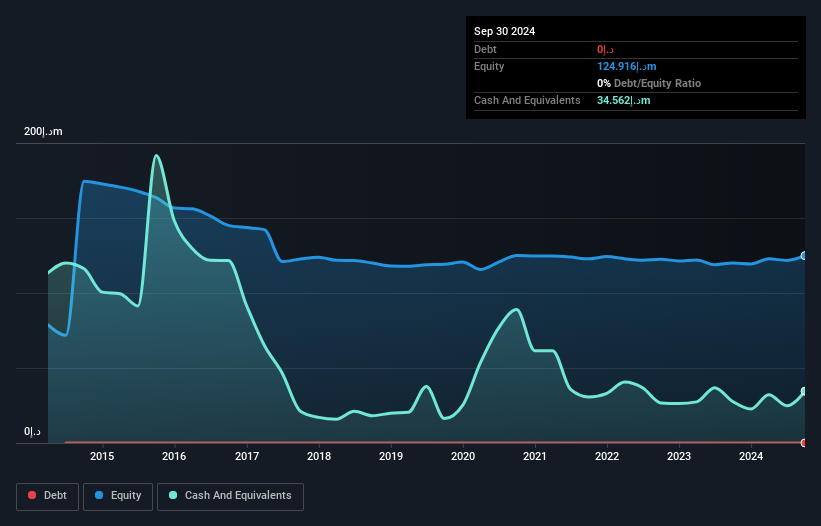

HAYAH Insurance Company P.J.S.C. operates in a challenging environment with recent earnings showing a net loss of AED 2.82 million for the first nine months of 2025, compared to a profit the previous year. Despite being debt-free and having sufficient cash runway for over three years, HAYAH remains unprofitable with declining earnings over the past five years at an annual rate of 26.4%. The company's short-term assets do not cover its long-term liabilities, and its share price has been highly volatile recently, reflecting broader market uncertainties in penny stocks within the region.

- Dive into the specifics of HAYAH Insurance Company P.J.S.C here with our thorough balance sheet health report.

- Gain insights into HAYAH Insurance Company P.J.S.C's past trends and performance with our report on the company's historical track record.

Big Tech 50 R&D-Limited Partnership (TASE:BIGT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Big Tech 50 R&D-Limited Partnership focuses on investing in technology companies in Israel and has a market cap of ₪20.59 million.

Operations: The company reported a revenue segment of Blank Checks totaling -$2.08 million.

Market Cap: ₪20.59M

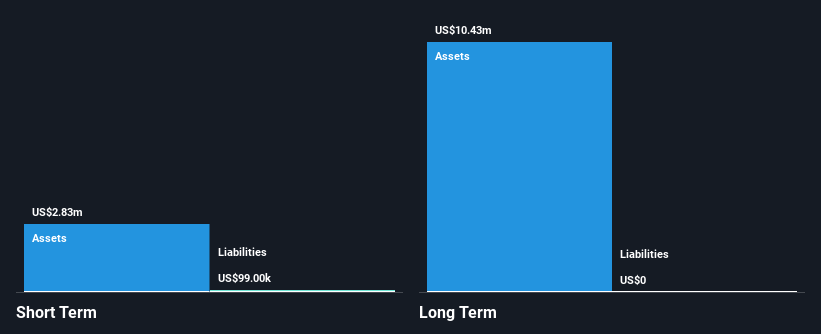

Big Tech 50 R&D-Limited Partnership, with a market cap of ₪20.59 million, is pre-revenue and unprofitable but reported a net income of US$0.806 million for the half-year ended June 2025, reversing a loss from the previous year. Despite having no long-term liabilities and sufficient cash runway for over three years, its share price remains highly volatile. The company has experienced board members with an average tenure of 4.7 years but lacks data on management experience. Although it offers a high dividend yield of 23.45%, this is not well covered by earnings or free cash flows due to its current financial position.

- Jump into the full analysis health report here for a deeper understanding of Big Tech 50 R&D-Limited Partnership.

- Evaluate Big Tech 50 R&D-Limited Partnership's historical performance by accessing our past performance report.

SavorEat (TASE:SVRT-M)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SavorEat Ltd. is a company that produces cellulose-based meat substitutes designed to mimic the eating experience of real meat, with a market cap of ₪4.22 million.

Operations: SavorEat Ltd. has not reported any specific revenue segments.

Market Cap: ₪4.22M

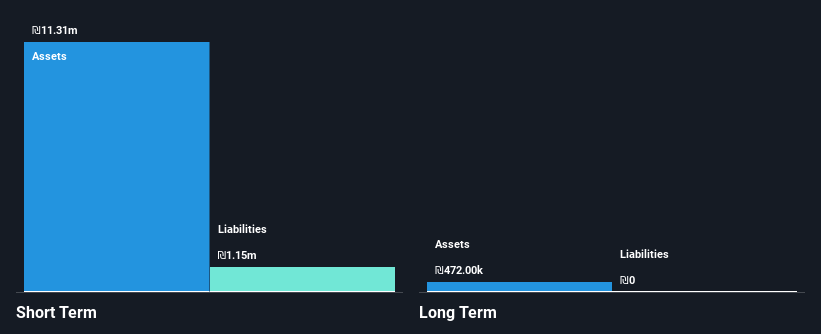

SavorEat Ltd., with a market cap of ₪4.22 million, remains pre-revenue and unprofitable, reporting a net loss of ILS 4.92 million for the half year ended June 2025. The company has no debt and its short-term assets of ₪6.2 million exceed its short-term liabilities significantly, yet it faces less than a year of cash runway if current cash flow trends persist. Despite high volatility in share price over recent months, shareholder dilution has not been significant over the past year. Its board is experienced with an average tenure of 5.8 years but lacks substantial revenue streams currently.

- Click to explore a detailed breakdown of our findings in SavorEat's financial health report.

- Learn about SavorEat's historical performance here.

Where To Now?

- Gain an insight into the universe of 79 Middle Eastern Penny Stocks by clicking here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HAYAH Insurance Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:HAYAH

HAYAH Insurance Company P.J.S.C

Provides health and life insurance solutions in the United Arab Emirates and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success