- Israel

- /

- Construction

- /

- TASE:AFHL

Undiscovered Gems In The Middle East To Consider This December 2025

Reviewed by Simply Wall St

As the Middle East stock markets experience a positive shift with UAE indices edging higher due to rising oil prices and potential U.S. Federal Reserve rate cuts, investors are keenly observing opportunities that these economic conditions may present. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be crucial for those looking to capitalize on emerging market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 17.65% | 4.48% | 4.46% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 31.20% | 44.24% | ★★★★★★ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★★★ |

| C. Mer Industries | 76.92% | 13.56% | 68.93% | ★★★★★☆ |

| Y.D. More Investments | 50.84% | 28.28% | 35.02% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Afcon Holdings (TASE:AFHL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Afcon Holdings Ltd is involved in the development and execution of construction projects both in Israel and internationally, with a market cap of ₪1.55 billion.

Operations: Afcon Holdings generates revenue primarily through its construction projects in Israel and abroad. The company has a market capitalization of approximately ₪1.55 billion.

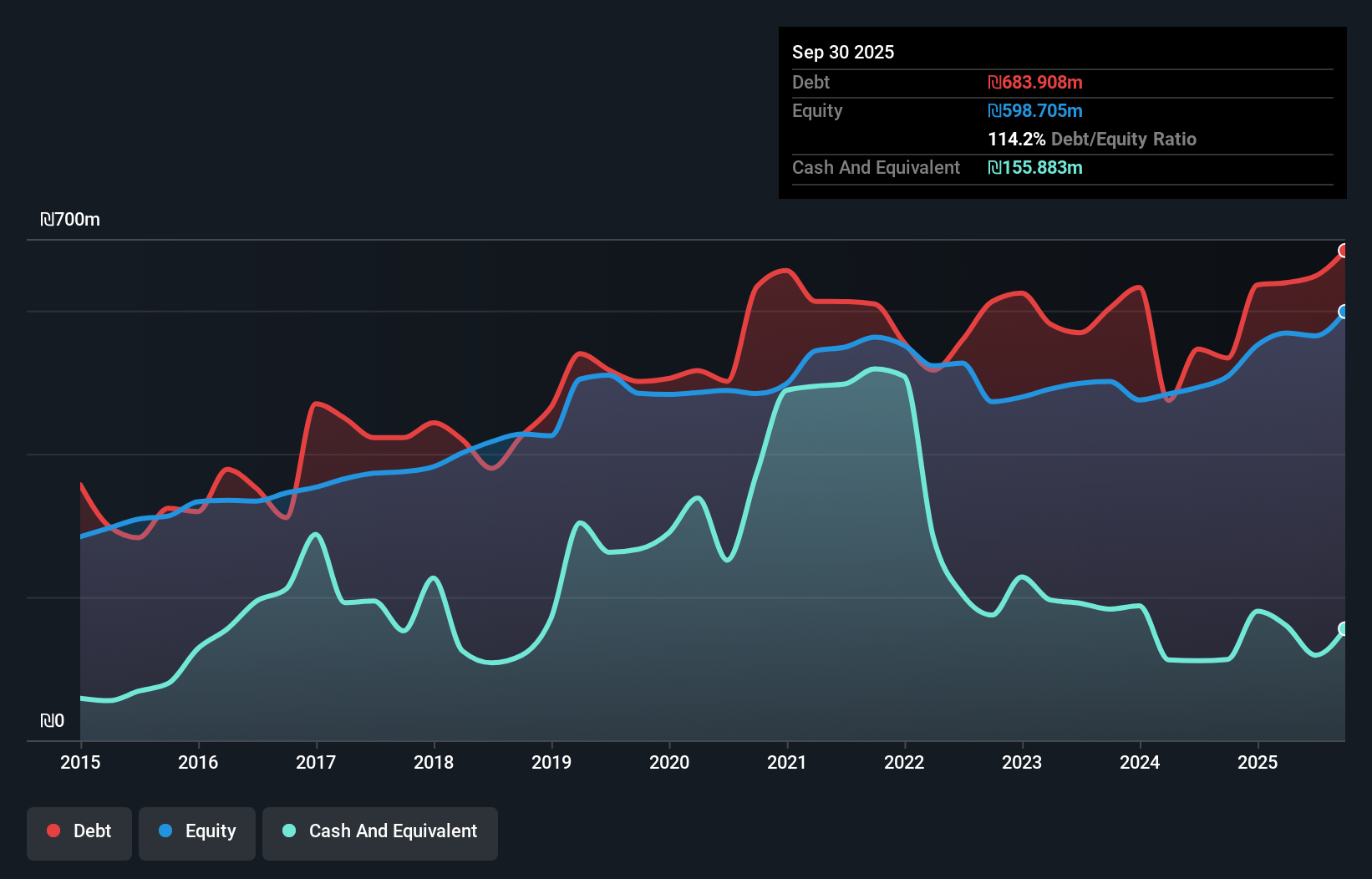

Afcon Holdings, a company with a knack for growth in the construction sector, has seen its debt to equity ratio shrink from 130.9% to 114.2% over five years, though its net debt to equity at 88.2% remains high. The firm enjoys robust earnings quality and impressive growth; last year's earnings surged by 345.5%, outpacing the industry average of 2.2%. Recent financials show third-quarter sales at ILS 448.63 million and net income climbing to ILS 23.29 million from ILS 14.14 million year-on-year, indicating operational improvements despite a slight dip in sales compared to the previous year.

- Click here and access our complete health analysis report to understand the dynamics of Afcon Holdings.

Gain insights into Afcon Holdings' past trends and performance with our Past report.

Aryt Industries (TASE:ARYT)

Simply Wall St Value Rating: ★★★★★★

Overview: Aryt Industries Ltd. focuses on developing, producing, and marketing electronic fuses for the defense market in Israel, with a market cap of ₪4.92 billion.

Operations: Aryt Industries generates revenue primarily from its detonators segment, which contributed ₪252.36 million. The company's market cap is approximately ₪4.92 billion.

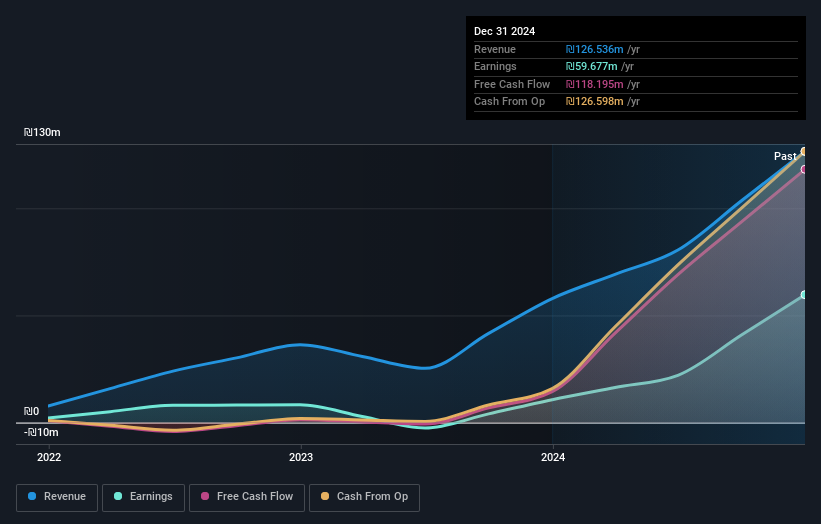

Aryt Industries, a nimble player in the Aerospace & Defense sector, has seen its earnings soar by 579% over the past year, outpacing industry growth of 57%. Despite being debt-free for five years, Aryt's shares trade at a significant discount of nearly 56% below estimated fair value. The company boasts high-quality earnings and positive free cash flow. However, its share price has been highly volatile recently. Aryt was recently added to the S&P Global BMI Index on September 21st, which may enhance visibility and investor interest moving forward.

I.E.S Holdings (TASE:IES)

Simply Wall St Value Rating: ★★★★★★

Overview: I.E.S Holdings Ltd focuses on real estate investment operations in Israel and has a market capitalization of ₪1.91 billion.

Operations: The company's revenue from investment real estate amounts to ₪61.68 million.

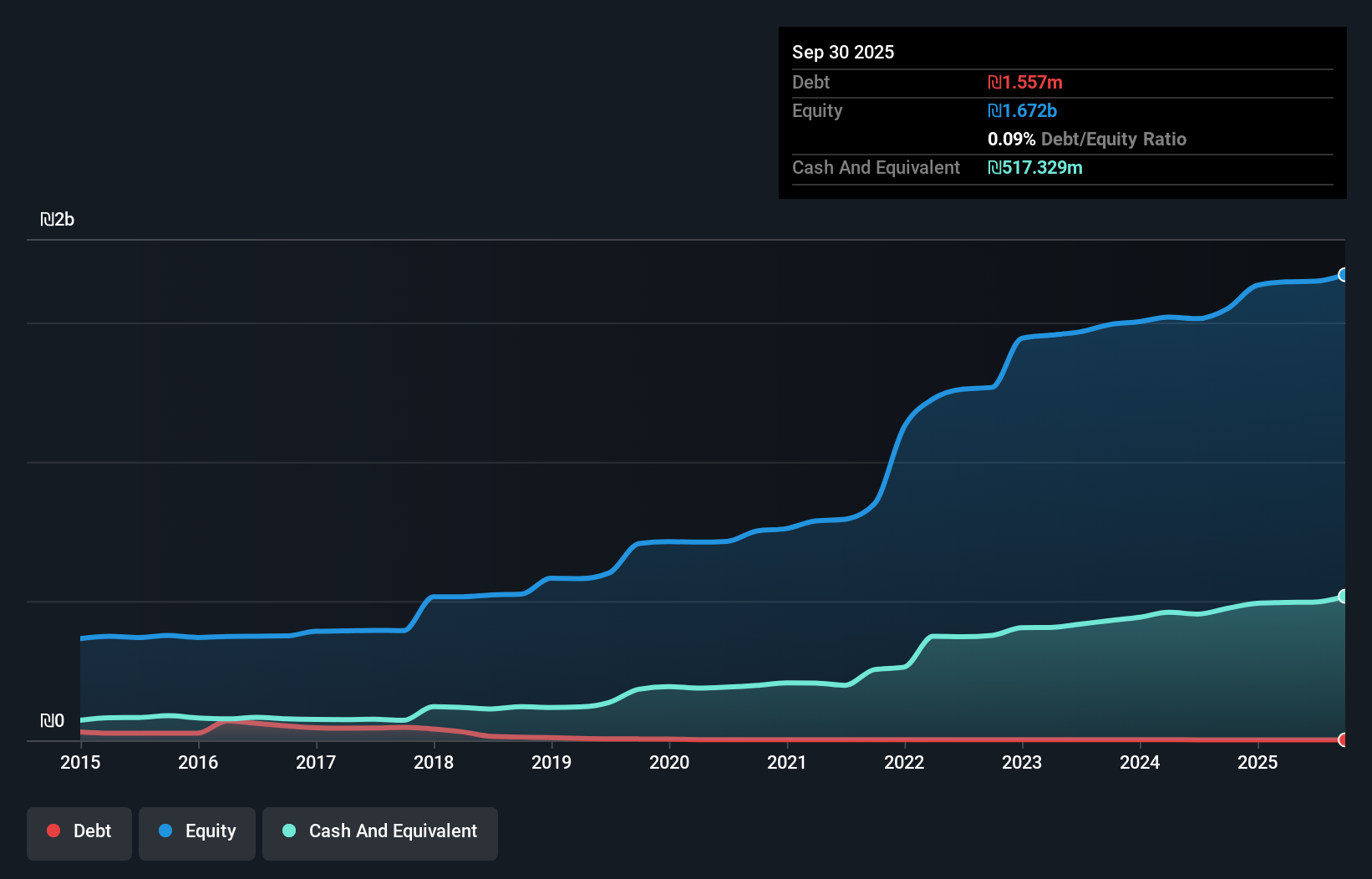

IES Holdings is carving its niche with impressive earnings growth of 117.9% over the past year, outpacing the Real Estate industry's 10.4%. Despite a significant one-off gain of ₪124.7M impacting recent results, its underlying performance remains robust. The company boasts a reduced debt-to-equity ratio from 0.3% to 0.09% in five years, indicating prudent financial management and more cash than total debt suggests stability in operations. With a price-to-earnings ratio of 11.5x below the IL market's average, IES appears attractively valued while maintaining positive free cash flow and strong interest coverage capabilities for future endeavors.

- Take a closer look at I.E.S Holdings' potential here in our health report.

Assess I.E.S Holdings' past performance with our detailed historical performance reports.

Where To Now?

- Access the full spectrum of 182 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:AFHL

Afcon Holdings

Develops and executes construction projects in Israel and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026