F.I.B.I. Holdings (TASE:FIBIH) Margin Compression Challenges Durable Earnings Narrative in Q3 2025

Reviewed by Simply Wall St

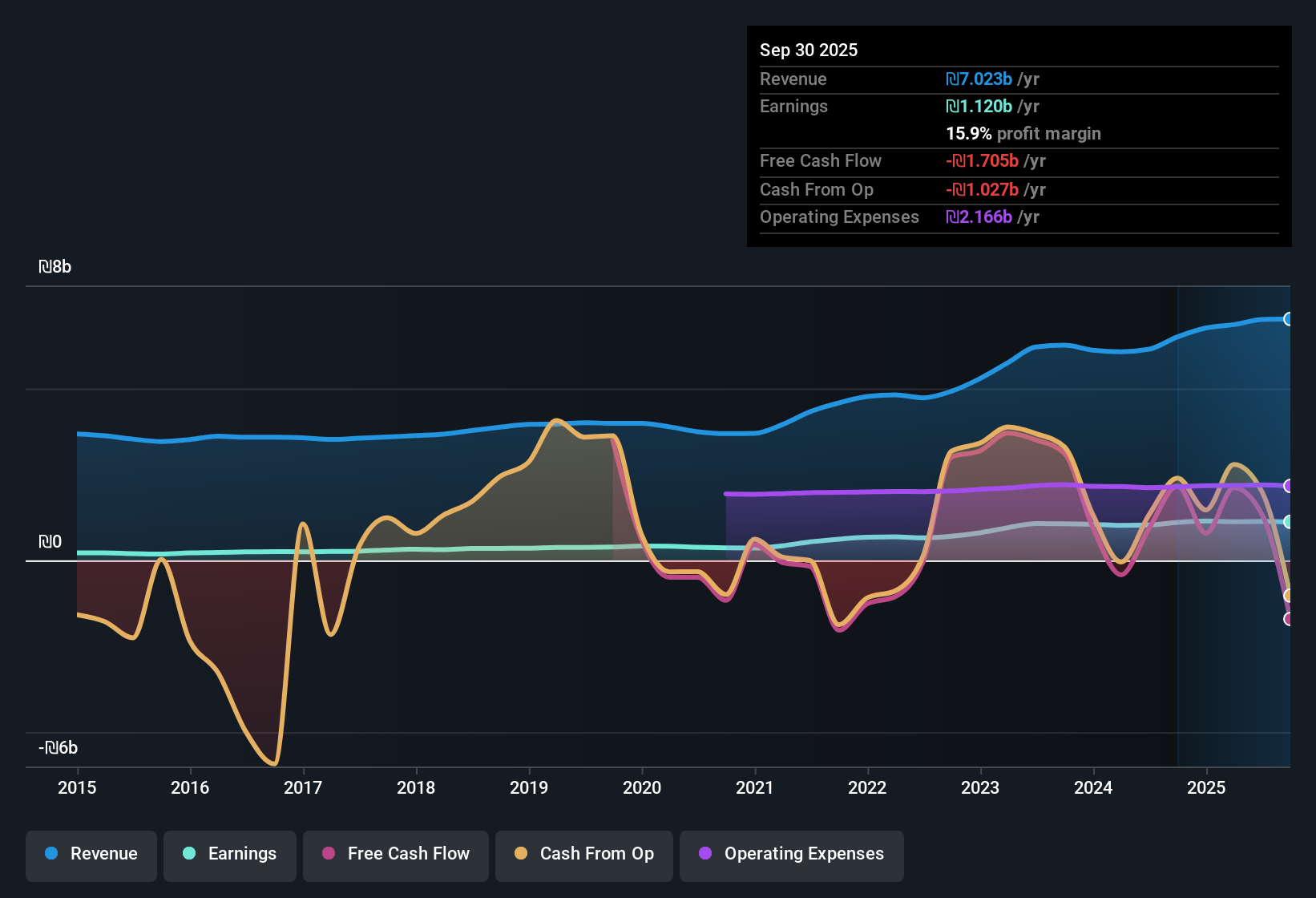

F.I.B.I. Holdings (TASE:FIBIH) has just posted its Q3 2025 financial results, reporting revenue of ₪1.8 billion and net income of ₪281 million, with EPS coming in at ₪7.93. Over the past year, the company has seen revenue rise from ₪6.5 billion to ₪7.0 billion, while basic EPS tracked from ₪31.2 to ₪31.6. Investors watching the latest results will note that margins compressed, which points to some profit headwinds amid ongoing topline momentum.

See our full analysis for F.I.B.I. Holdings.Next, let's put these numbers in context by comparing them to the current market narratives around F.I.B.I. Holdings and see which views hold up under the latest results.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Growth Slows to 1.3% This Year

- Trailing twelve month earnings growth came in at just 1.3%, a notable deceleration compared to F.I.B.I. Holdings’ strong 20.2% average over the last five years.

- Market analysis points to the company’s reputation for durable, high-quality earnings. However, the slowed pace this year contrasts with its former momentum.

- Consensus narrative highlights how the current margin compression and moderate top-line growth signal a transition from the rapid expansion phase, even as long-term trends look solid.

- While quality is recognized, the dip in earnings growth makes investors reconsider how much historical performance should anchor their outlook.

DCF Valuation Implies 23% Upside

- With shares trading at ₪266.90 and a DCF fair value estimate of ₪348.05, F.I.B.I. Holdings is priced around 23% below its modeled intrinsic value, based on the latest inputs.

- The prevailing investment narrative suggests this discount is drawing in valuation-focused investors.

- Analysts see the company’s price-to-earnings ratio of 8.4x as a clear advantage over the Asian Banks industry average of 9.5x and peer average of 9.7x.

- Back-to-back years of high quality net income create a foundation for the current “value” sentiment. Some investors may weigh this against the flattening profits.

Net Margins Down to 15.9%

- Net profit margin has compressed from 17% to 15.9% year-on-year, putting pressure on the bottom line even as revenue rose.

- This trend brings attention to risks flagged in recent reports, especially regarding profit durability.

- Market commentary points to unstable dividend history and the risk that narrowing margins could further impact future distributions.

- Profit quality remains strong, reminding cautious investors that the core business still delivers consistent results, even if less profit is dropping to the bottom line.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on F.I.B.I. Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

F.I.B.I. Holdings' slowing profit growth and margin compression indicate earnings may become less reliable than investors have come to expect.

If steady performance matters most to you, use stable growth stocks screener (2074 results) to quickly spot companies that have delivered consistent growth even when conditions become less favorable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FIBIH

F.I.B.I. Holdings

Operates as the holding company for The First International Bank of Israel Ltd.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success