- Hong Kong

- /

- Water Utilities

- /

- SEHK:855

Exploring China Water Affairs Group (SEHK:855) Valuation Following Earnings Drop and Interim Dividend Announcement

Reviewed by Simply Wall St

China Water Affairs Group (SEHK:855) just posted its half-year earnings, with both sales and net income coming in lower than the previous period. Alongside the results, the board declared an interim dividend for shareholders.

See our latest analysis for China Water Affairs Group.

Following the earnings drop and confirmation of its interim dividend, China Water Affairs Group’s share price has remained resilient. While the share price return has dipped 5.7% over the past month, it is still up 17.5% year-to-date and, thanks to dividends, boasts a 1-year total shareholder return of over 41%. This suggests that, despite some near-term softness, longer-term momentum and investor confidence are still present. This can be a useful signal for those weighing growth against growing risks.

If you’re looking to expand your watchlist beyond utilities, now is the perfect moment to explore fast growing stocks with high insider ownership.

With recent results showing both setbacks and signs of resilience, the key question for investors now is whether China Water Affairs Group shares are attractively undervalued, or if the current price already reflects future growth expectations.

Price-to-Earnings of 10.8x: Is it justified?

China Water Affairs Group’s shares are trading at a price-to-earnings (P/E) ratio of 10.8x, which appears high relative to the peer average (9.1x) but below the regional industry average.

The price-to-earnings ratio measures how much investors are willing to pay today for a dollar of the company’s earnings. It is a widely used benchmark in utilities and reflects market expectations of future profit growth and stability.

At present levels, the stock commands a premium compared to its direct peers, suggesting the market may be pricing in stronger future earnings or a more resilient business model. However, compared to the broader Asian Water Utilities industry’s average P/E of 14.6x, the company trades at a relative discount, and is also near its own estimated fair P/E ratio of 11.5x. This could indicate a level to which the market might eventually converge.

Explore the SWS fair ratio for China Water Affairs Group

Result: Price-to-Earnings of 10.8x (OVERVALUED)

However, still, slower revenue growth or worsening industry sentiment could quickly challenge the current valuation and investor optimism surrounding China Water Affairs Group.

Find out about the key risks to this China Water Affairs Group narrative.

Another View: Discounted Cash Flow Model Perspective

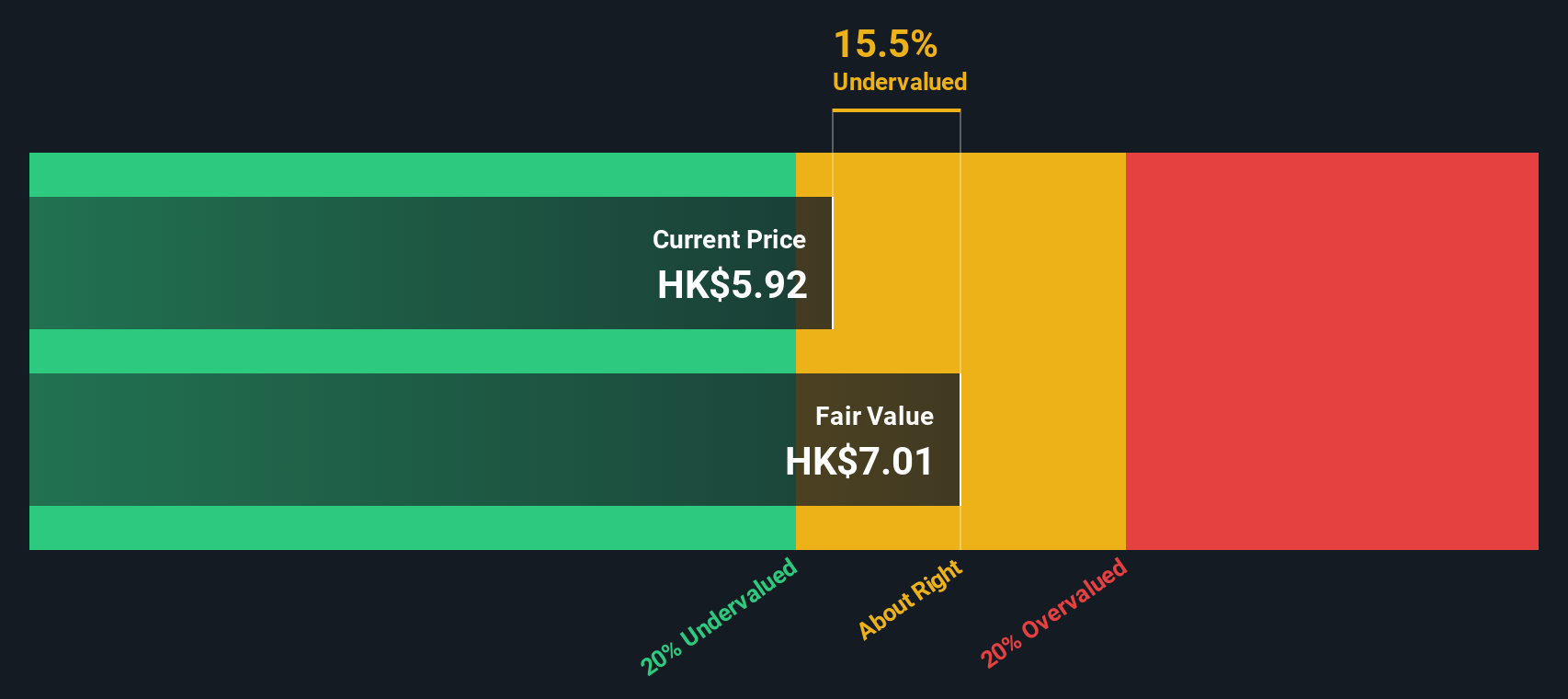

While multiples suggest that China Water Affairs Group is priced at a premium relative to peers, the SWS DCF model points to a different story. According to this approach, the shares are trading about 15.5% below their estimated fair value. This could imply hidden upside the market may be overlooking. Are investors being too cautious, or is there real risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Water Affairs Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Water Affairs Group Narrative

If you want a different perspective or believe in doing your own analysis, you can easily craft your own narrative in just a few minutes with Do it your way.

A great starting point for your China Water Affairs Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve by checking out these hand-picked opportunities tailored for savvy investors. Explore new prospects to help you discover your next potential winner.

- Uncover promising companies with solid payouts by using these 15 dividend stocks with yields > 3% and target investment income that may offer yields above the average.

- Tap into breakthroughs in medicine and technology with these 30 healthcare AI stocks to spot high-impact healthcare trends before they become widely recognized.

- Set your sights on tomorrow's tech leaders by browsing these 25 AI penny stocks for artificial intelligence companies making significant advancements in the sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:855

China Water Affairs Group

An investment holding company, engages in the water supply, environmental protection, and property businesses in the People’s Republic of China.

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026