- Hong Kong

- /

- Gas Utilities

- /

- SEHK:384

China Gas Holdings (SEHK:384): Assessing Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

China Gas Holdings (SEHK:384) has been catching the attention of investors lately, and it is not from a single headline-grabbing event. Instead, a series of subtle shifts may be raising questions about what is driving its price action. With its presence spanning city gas distribution, LPG sales, and a growing renewables angle, the company already sits in a complicated spot for anyone weighing the next move. When stocks move without a clear catalyst, it often signals a tug-of-war between investor expectations and the underlying value of the business.

Looking back over the past year, China Gas Holdings has delivered a total return of 43%, a sharp turnaround after lackluster multi-year performance. Shares have climbed 21% so far this year and are up 6% in the last three months, even accounting for some correction in the previous month. Recent momentum suggests market sentiment has improved, but this follows several years of declining returns, which might have reset expectations for future growth. Small but steady improvements in top- and bottom-line numbers seem to be encouraging a reassessment of the company’s outlook.

So, with this year’s lift after some tough longer-term results, is China Gas Holdings being undervalued right now, or is the market simply catching up and pricing in its next chapter?

Price-to-Earnings of 13.3x: Is it justified?

Based on its price-to-earnings ratio, China Gas Holdings currently trades at 13.3 times its earnings, which is slightly below the Asian Gas Utilities industry average of 13.8x but above the peer group average of 11.2x. This suggests its valuation is in line with its sector or just above it, but a bit stretched compared to close competitors.

The price-to-earnings (P/E) ratio is a widely used metric that helps investors compare how much they are paying for each dollar of earnings. In the utility sector, where stable income and earnings predictability are common, P/E ratios often serve as a quick gauge of relative value and growth expectations.

While China Gas Holdings appears fairly valued by the broader industry standard, its premium compared to peers may reflect improved short-term performance and renewed optimism about future earnings growth. However, the higher P/E could prompt questions about whether the current momentum can be sustained or if future results will keep pace with the elevated expectations now factored into the share price.

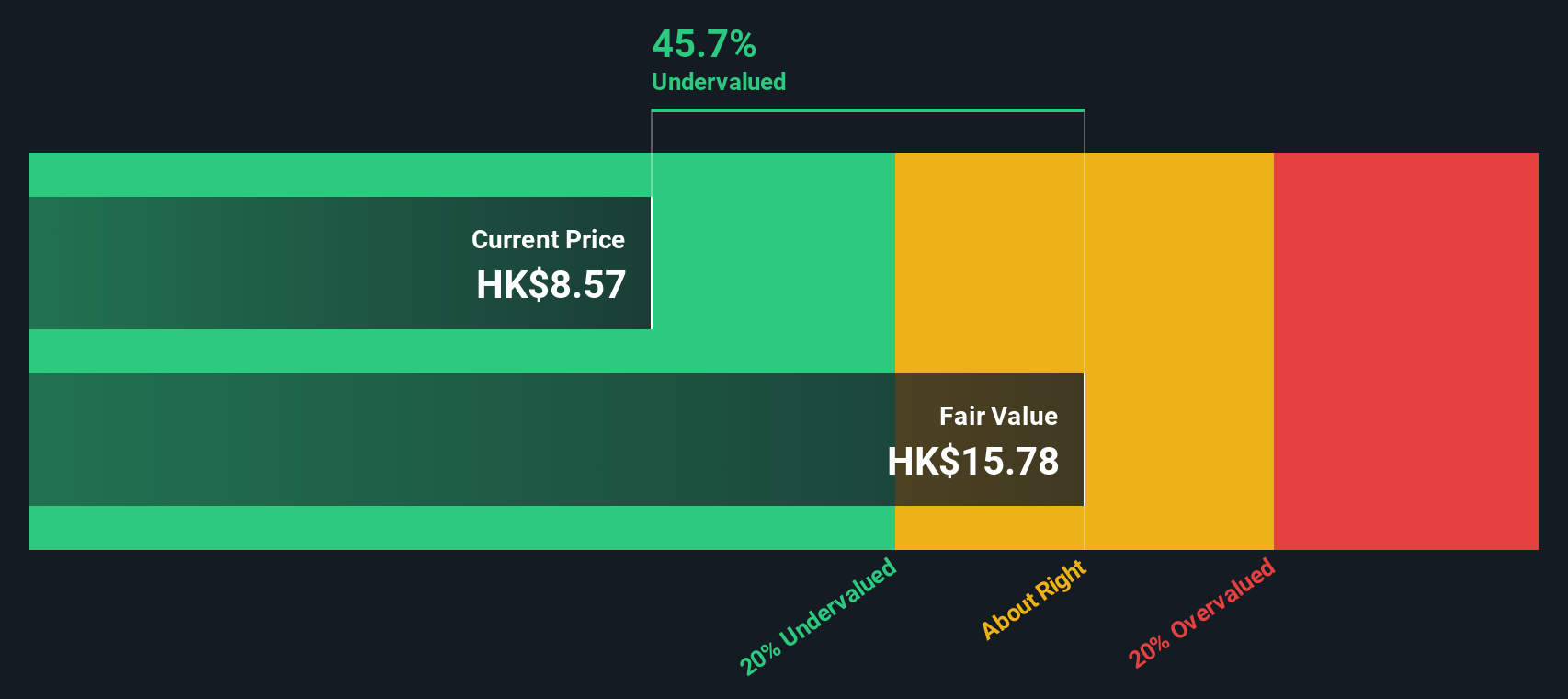

Result: Fair Value of $15.61 (UNDERVALUED)

See our latest analysis for China Gas Holdings.However, slow revenue growth or another drop in net income could reverse sentiment and raise doubts about the sustainability of the recent rally.

Find out about the key risks to this China Gas Holdings narrative.Another View: What Does Our DCF Model Suggest?

While the current valuation based on earnings places China Gas Holdings near the sector average, the SWS DCF model offers another perspective. This approach suggests that the shares may be undervalued, raising the question of which method best captures reality.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own China Gas Holdings Narrative

If the current analysis does not fit your view or you prefer diving into the numbers yourself, consider building your personal narrative in just a few minutes. Do it your way

A great starting point for your China Gas Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now and supercharge your portfolio. Groundbreaking opportunities are waiting for you right now. Don’t let these smart moves slip by when you can get ahead.

- Uncover rising stars among smaller companies that show robust financial strength with the help of penny stocks with strong financials.

- Catch the momentum behind technology’s next leap by scouting the trailblazers developing quantum computing breakthroughs through quantum computing stocks.

- Secure your future income stream by checking out companies offering attractive yields above 3% with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:384

China Gas Holdings

An investment holding company, operates as an energy supplier and service provider in the People’s Republic of China.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives