- Hong Kong

- /

- Energy Services

- /

- SEHK:3303

3 Top Dividend Stocks Offering Up To 8.5% Yield

Reviewed by Simply Wall St

As global markets continue to experience gains, with major indices like the Dow Jones Industrial Average and S&P 500 Index reaching record highs, investors are increasingly looking for stability amid geopolitical uncertainties and domestic policy shifts. In such a dynamic environment, dividend stocks can offer an attractive option for those seeking steady income streams alongside potential capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.57% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.60% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.18% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.49% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.45% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.85% | ★★★★★★ |

Click here to see the full list of 1943 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

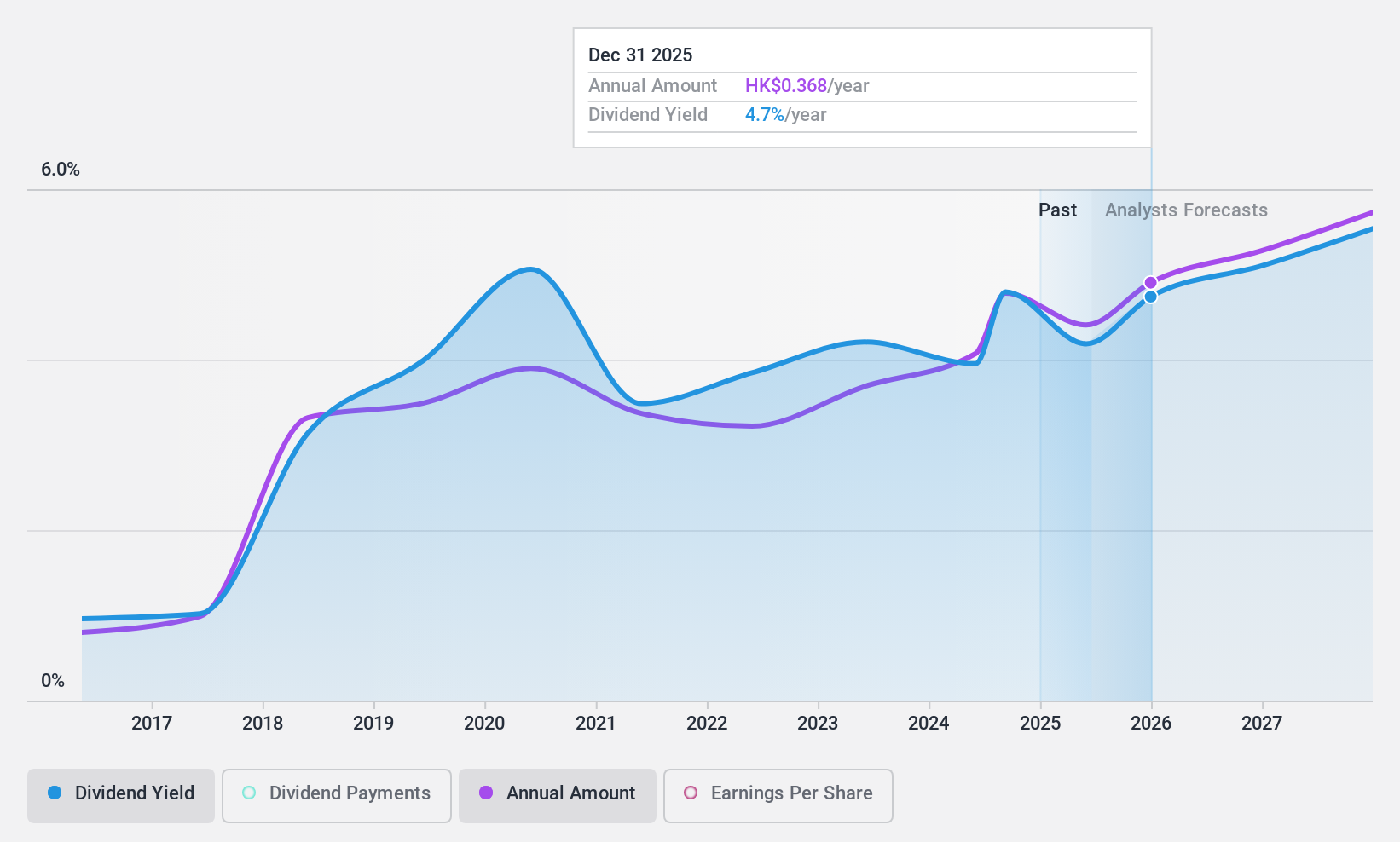

Kunlun Energy (SEHK:135)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kunlun Energy Company Limited is an investment holding company involved in the exploration, development, production, and sale of crude oil and natural gas, with a market cap of approximately HK$65.29 billion.

Operations: Kunlun Energy's revenue primarily comes from the sales of natural gas excluding LPG (CN¥149.69 billion), followed by sales of LPG (CN¥25.97 billion), and LNG processing and terminal operations (CN¥12.64 billion), with additional contributions from exploration and production activities (CN¥391 million).

Dividend Yield: 4.4%

Kunlun Energy's dividend payments have grown over the past decade, supported by a reasonable cash payout ratio of 37.8% and earnings coverage at 67.3%. However, the dividends have been volatile and are considered unreliable due to historical inconsistencies. Despite trading at a significant discount to its estimated fair value, its yield of 4.43% is below top-tier levels in Hong Kong. Recent auditor changes may not directly impact dividend stability but reflect ongoing corporate governance adjustments.

- Click to explore a detailed breakdown of our findings in Kunlun Energy's dividend report.

- Our valuation report here indicates Kunlun Energy may be undervalued.

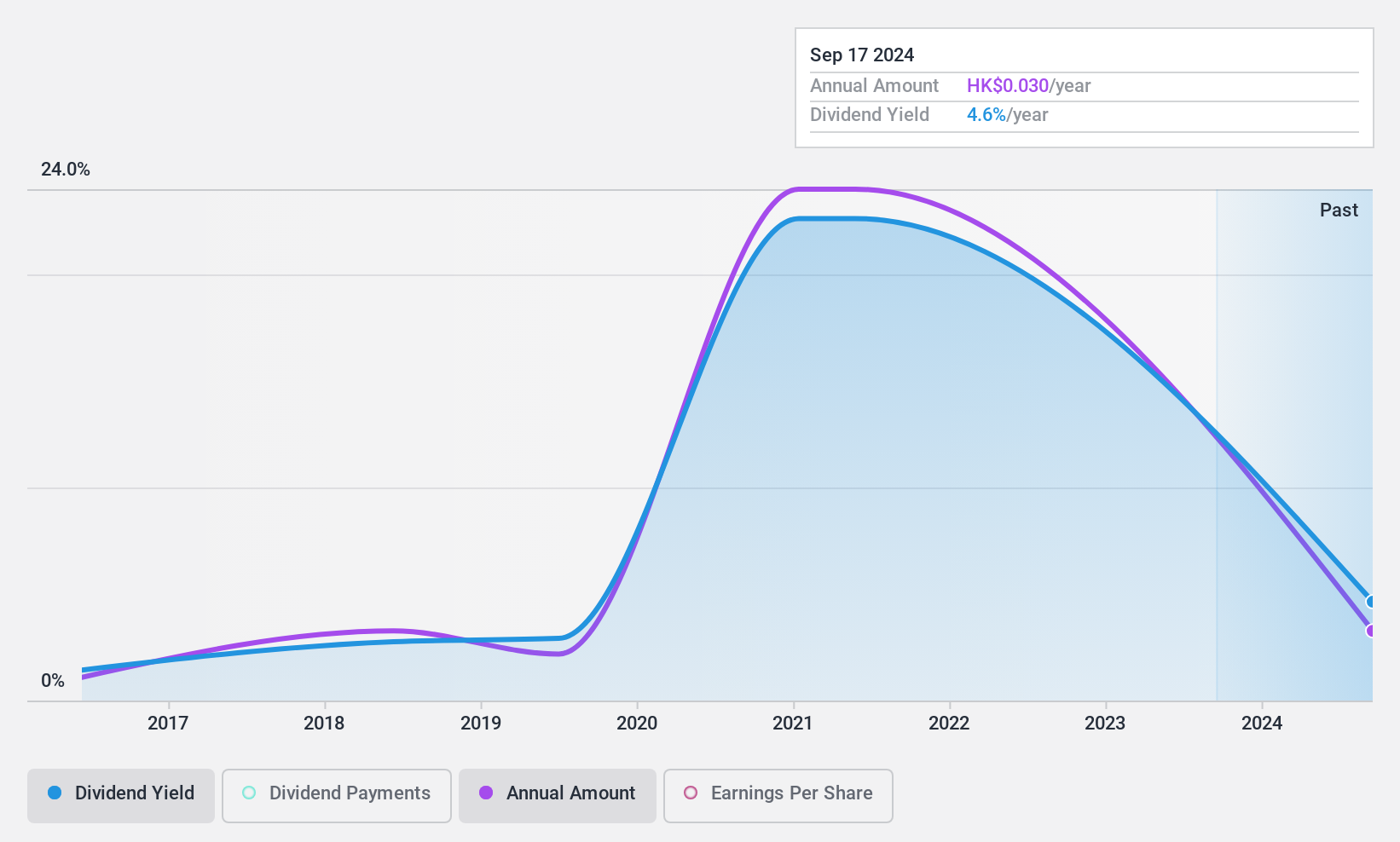

Jutal Offshore Oil Services (SEHK:3303)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jutal Offshore Oil Services Limited is an investment holding company involved in the fabrication of facilities and provision of integrated services for the oil and gas, new energy, and refining and chemical industries, with a market cap of HK$1.45 billion.

Operations: Jutal Offshore Oil Services Limited generates revenue primarily from its oil and gas segment, which accounts for CN¥2.98 billion, with additional contributions from the new energy and refinery and chemical segment totaling CN¥64.13 million.

Dividend Yield: 8.5%

Jutal Offshore Oil Services offers an attractive dividend yield of 8.53%, ranking in the top 25% among Hong Kong payers, supported by low payout ratios—15.5% from earnings and 24.1% from cash flows—indicating strong coverage. However, dividends have been volatile over the past decade, with significant annual drops exceeding 20%, highlighting unreliability. Despite recent address changes in Hong Kong and substantial earnings growth, shareholder dilution last year poses potential concerns for investors seeking stability.

- Dive into the specifics of Jutal Offshore Oil Services here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Jutal Offshore Oil Services is priced lower than what may be justified by its financials.

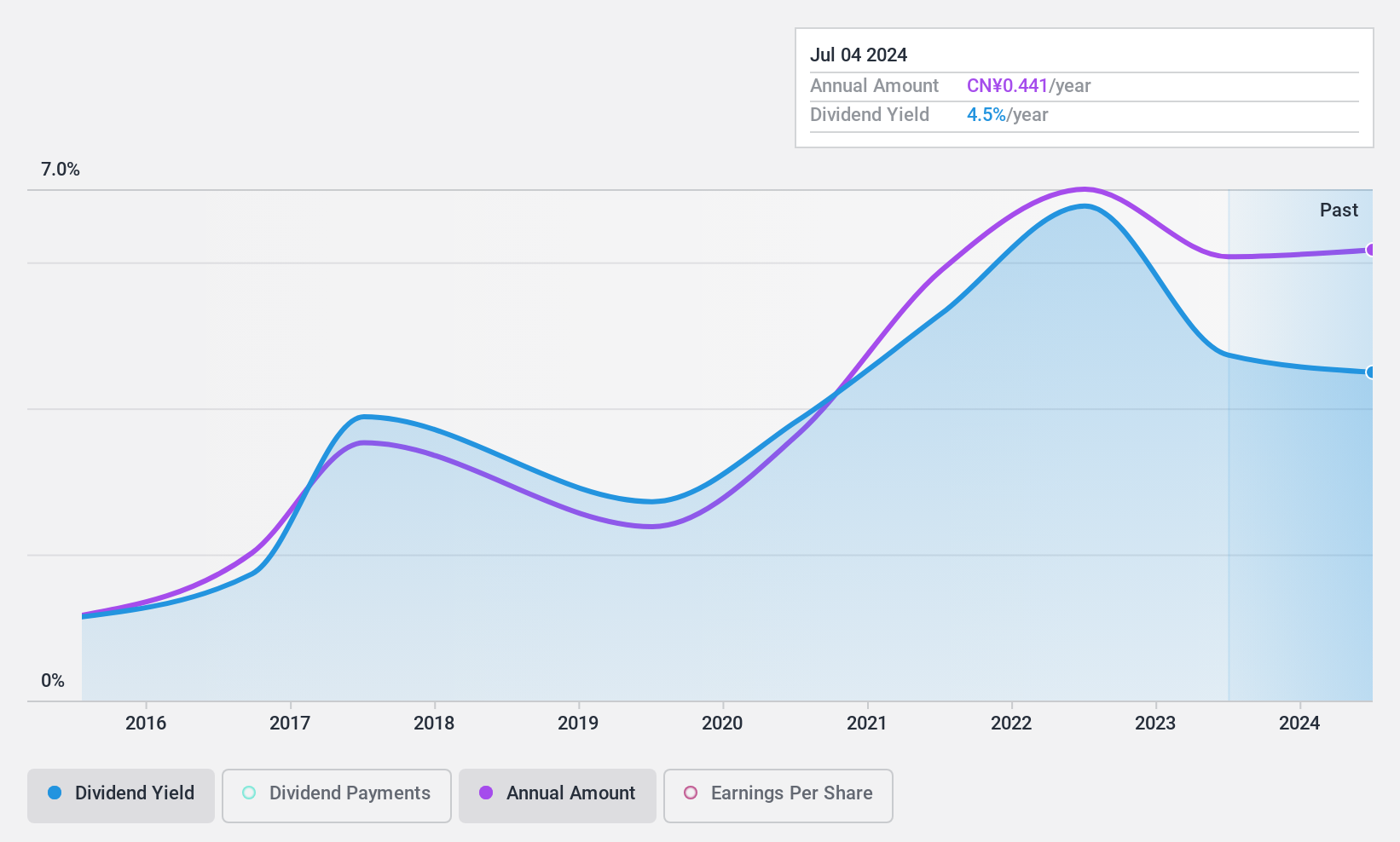

Jiangxi Hongcheng EnvironmentLtd (SHSE:600461)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangxi Hongcheng Environment Co., Ltd. operates in the production and supply of tap water in China, with a market capitalization of CN¥11.92 billion.

Operations: Jiangxi Hongcheng Environment Co., Ltd. generates its revenue from the production and supply of tap water in China.

Dividend Yield: 4.6%

Jiangxi Hongcheng Environment Ltd. offers a dividend yield of 4.56%, placing it in the top 25% of Chinese dividend payers, yet its high cash payout ratio (179.5%) suggests dividends are not well covered by cash flows, raising sustainability concerns. Despite trading at a good value and recent earnings growth of 3.7%, dividends have been volatile over the past decade with significant drops, and shareholder dilution last year further complicates its reliability for income-focused investors.

- Unlock comprehensive insights into our analysis of Jiangxi Hongcheng EnvironmentLtd stock in this dividend report.

- Upon reviewing our latest valuation report, Jiangxi Hongcheng EnvironmentLtd's share price might be too pessimistic.

Summing It All Up

- Delve into our full catalog of 1943 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3303

Jutal Offshore Oil Services

An investment holding company, engages in the fabrication of facilities and provision of integrated services for oil and gas, new energy, and refining and chemical industries.

Flawless balance sheet with solid track record and pays a dividend.