- Hong Kong

- /

- Electric Utilities

- /

- SEHK:1038

CK Infrastructure Holdings (SEHK:1038): What Barclays' Coverage Means for Valuation and Future Upside

Reviewed by Simply Wall St

Barclays has just begun coverage on CK Infrastructure Holdings (SEHK:1038), highlighting its established foothold in crucial markets such as the UK and Australia. The firm points to sector-wide investment and cash flow strength as reasons for investor optimism.

See our latest analysis for CK Infrastructure Holdings.

After a tough start to the year, investor sentiment toward CK Infrastructure Holdings has improved in recent weeks, helped by Barclays’ upbeat view and growing confidence in the firm's utility assets. While the stock is still down year-to-date, it posted a 4.75% gain over the last week and delivered a strong 3.5% total shareholder return over the past year. In addition, a 61% total return in three years suggests momentum could be building again.

If you're interested in what else is catching investors' attention, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading almost 18% below analyst targets despite stable growth, is the current price a window for value, or is the market simply reflecting CK Infrastructure Holdings’ steady outlook and future prospects?

Price-to-Earnings of 16.4x: Is it justified?

CK Infrastructure Holdings currently trades at a price-to-earnings (P/E) ratio of 16.4x, above both its peer group average of 15.6x and the estimated fair P/E ratio of 10.4x. With the last close price at HK$52.95, the market appears to be awarding a premium compared to regional peers.

The P/E ratio reveals how much investors are willing to pay for each dollar of earnings. For companies in the utilities sector, this metric is key since stable cash flows and steady profit make earnings-based comparisons particularly meaningful.

This premium multiple may reflect investor expectations for future earnings growth or a perceived lower risk profile. However, compared to the estimated fair P/E and sector averages, the market may be overpricing current earnings or underestimating challenges in delivering accelerated growth.

Looking at the broader Asian Electric Utilities industry, CK Infrastructure’s P/E is actually slightly lower than the industry average of 17.1x. Yet, relative to its calculated “fair” multiple, the shares trade at a notable premium. This suggests the market could adjust toward the fair ratio level over time.

Explore the SWS fair ratio for CK Infrastructure Holdings

Result: Price-to-Earnings of 16.4x (OVERVALUED)

However, risks such as slowing revenue growth and persistent market discount could prompt a reassessment of CK Infrastructure Holdings’ valuation and near-term outlook.

Find out about the key risks to this CK Infrastructure Holdings narrative.

Another View: SWS DCF Model Suggests Shares Are Overvalued

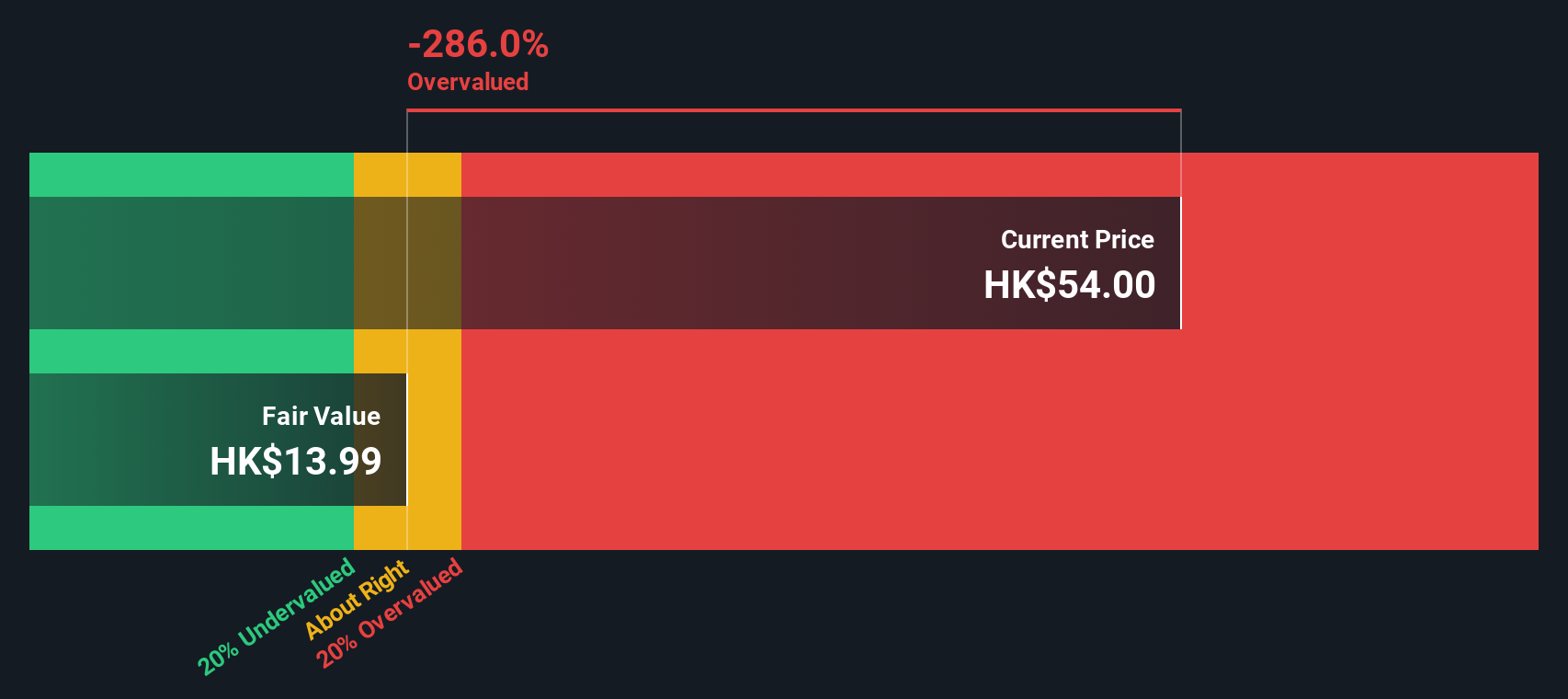

While the earnings-based analysis implies CK Infrastructure Holdings is priced at a premium, our DCF model tells a more cautious story. According to the SWS DCF model, shares are trading significantly above the estimated fair value of HK$13.99, which indicates the stock is overvalued by this measure. This raises the question of whether the market's optimism is misplaced, or if the premium could be justified by future growth not captured in current models.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CK Infrastructure Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CK Infrastructure Holdings Narrative

If you see things differently or want to dig into the numbers yourself, it takes just a few minutes to build your own perspective and share your findings. Do it your way.

A great starting point for your CK Infrastructure Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye out for the next opportunity. Make your research count by checking out these compelling stock ideas you might regret missing:

- Supercharge your returns with these 876 undervalued stocks based on cash flows, featuring companies trading below intrinsic value and offering hidden upside potential.

- Collect reliable passive income through these 16 dividend stocks with yields > 3%, where you’ll uncover stocks offering solid yields and strong fundamentals to support portfolio stability.

- Stay ahead of emerging trends by exploring these 25 AI penny stocks, which highlights promising companies using artificial intelligence to drive future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1038

CK Infrastructure Holdings

An infrastructure company, invests in, develops, and operates infrastructure businesses in Hong Kong, Mainland China, the United Kingdom, Continental Europe, Australia, New Zealand, Canada, and the United States.

Average dividend payer with acceptable track record.

Market Insights

Community Narratives