- Hong Kong

- /

- Infrastructure

- /

- SEHK:694

Beijing Capital International Airport (HKG:694) shareholders are up 6.8% this past week, but still in the red over the last five years

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. Zooming in on an example, the Beijing Capital International Airport Company Limited (HKG:694) share price dropped 65% in the last half decade. That's an unpleasant experience for long term holders. And it's not just long term holders hurting, because the stock is down 36% in the last year. On the other hand the share price has bounced 6.8% over the last week. The buoyant market could have helped drive the share price pop, since stocks are up 3.9% in the same period.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Beijing Capital International Airport

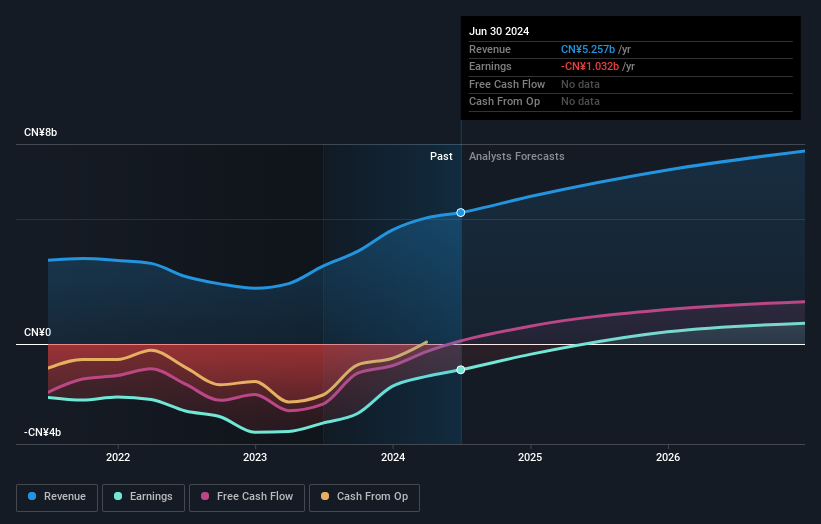

Because Beijing Capital International Airport made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Beijing Capital International Airport reduced its trailing twelve month revenue by 26% for each year. That puts it in an unattractive cohort, to put it mildly. Arguably, the market has responded appropriately to this business performance by sending the share price down 11% (annualized) in the same time period. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Beijing Capital International Airport will earn in the future (free profit forecasts).

A Different Perspective

Beijing Capital International Airport shareholders are down 36% for the year, but the market itself is up 6.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Beijing Capital International Airport is showing 1 warning sign in our investment analysis , you should know about...

Of course Beijing Capital International Airport may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Capital International Airport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:694

Beijing Capital International Airport

Engages in the aeronautical and non-aeronautical businesses at the Beijing Capital Airport in the People’s Republic of China.

Reasonable growth potential and slightly overvalued.