- Hong Kong

- /

- Transportation

- /

- SEHK:66

Could New Leadership at MTR (SEHK:66) Shift Its Competitive Edge in Hong Kong Transport?

Reviewed by Sasha Jovanovic

- MTR Corporation Limited has announced the appointment of Wilson Kwong Wing-tsuen as Hong Kong Transport Services Director and Executive Directorate Member, effective January 28, 2026, bringing extensive transportation and logistics industry experience to oversee key operational and commercial functions in Hong Kong.

- Kwong’s prominent roles in major organizations and receipt of a Medal of Honour highlight both his sector expertise and significant professional recognition, making this leadership change particularly impactful for MTR’s future direction.

- We'll explore how the appointment of an experienced transport leader could influence MTR’s investment narrative and operational outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

MTR Investment Narrative Recap

To own MTR stock today, you need to believe in its ability to balance long-term infrastructure investment and property-driven growth against evolving transport demand in Hong Kong and abroad. The appointment of Wilson Kwong as Hong Kong Transport Services Director introduces operational expertise, but this leadership change is not expected to materially alter near-term catalysts such as ridership recovery or the major risk around capital-intensive expansion, execution delays, or weakness in property profits.

Among the recent developments, the HK$30 billion syndicated green loan from October 2025 stands out, as it underpins MTR’s ongoing investment spree and signals confidence in the company's ability to fund expansion and asset upgrades, closely tied to risk around escalating project costs versus delivery of higher recurring revenues.

On the other hand, investors should be mindful that if passenger demand doesn’t rebound as expected following leadership changes and planned upgrades...

Read the full narrative on MTR (it's free!)

MTR's narrative projects HK$64.0 billion in revenue and HK$12.0 billion in earnings by 2028. This requires 3.3% yearly revenue growth and a HK$5.5 billion earnings decrease from the current HK$17.5 billion.

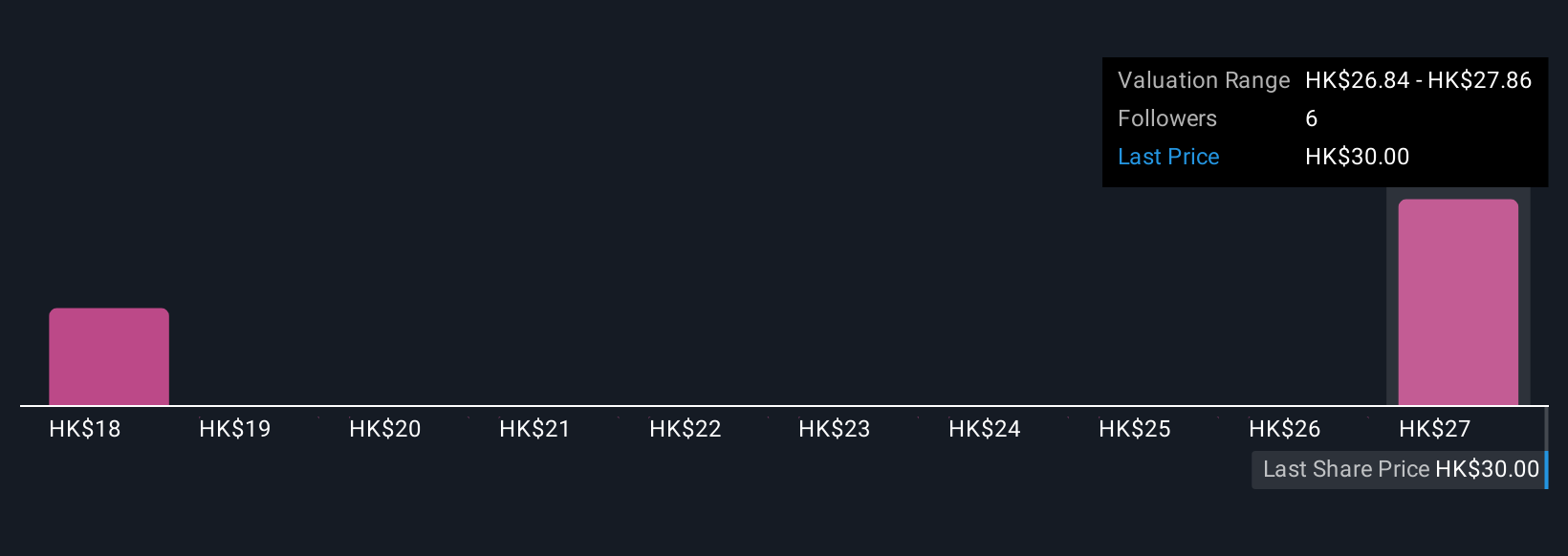

Uncover how MTR's forecasts yield a HK$27.86 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimate MTR’s fair value between HK$17.71 and HK$27.86. This wide span reflects different expectations about growth but also reinforces how major investment cycles and execution risks are on everyone’s radar.

Explore 2 other fair value estimates on MTR - why the stock might be worth as much as HK$27.86!

Build Your Own MTR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MTR research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MTR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MTR's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:66

MTR

Engages in railway design, construction, operation, maintenance, and investment in Hong Kong, Australia, Mainland China, Macao, Sweden, and the United Kingdom.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives