- Hong Kong

- /

- Infrastructure

- /

- SEHK:6198

Qingdao Port International (SEHK:6198): Valuation Insights After Strong Results and New Dividend Announcement

Reviewed by Simply Wall St

Qingdao Port International (SEHK:6198) caught investor attention as it announced steady gains in both cargo throughput and earnings for the nine months ended September 2025, along with news of an interim dividend for shareholders.

See our latest analysis for Qingdao Port International.

It has been a strong year for Qingdao Port International, with its solid operating results and fresh dividend announcement helping to keep momentum on the upswing. Following recent board changes and sustained throughput growth, shares are now trading at HK$7.59. The company has delivered a 22% year-to-date share price return and a notable 49% total shareholder return over the past twelve months, which points to renewed investor confidence in both the short and long term.

If this kind of momentum has you curious about other opportunities, now’s a smart time to expand your radar and discover fast growing stocks with high insider ownership

So after such a rally and solid financials, is Qingdao Port International still undervalued and primed for further gains, or has the market already priced in the company’s growth prospects and dividend appeal?

Price-to-Earnings of 8.2x: Is it justified?

Qingdao Port International’s price-to-earnings ratio stands at just 8.2x, placing its valuation below both its peer average and the wider Infrastructure industry. With a last close price of HK$7.59, this metric suggests shares remain attractively priced compared to local competitors.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of company earnings. For a mature infrastructure firm such as Qingdao Port International, the P/E offers insight into market expectations around its stable cash flows and future growth.

At 8.2x, the company’s P/E ratio is lower than the industry average of 9.2x and the peer group’s 9.9x. This could suggest the market may be underestimating its earnings potential. Notably, this is also below its estimated “fair” P/E multiple of 10.3x, a level the market could move toward given recent profitability and steady growth trends.

Explore the SWS fair ratio for Qingdao Port International

Result: Price-to-Earnings of 8.2x (UNDERVALUED)

However, persistent low revenue and net income growth could challenge further upside, particularly if broader market sentiment changes or analyst expectations shift.

Find out about the key risks to this Qingdao Port International narrative.

Another View: SWS DCF Model Points to Deeper Undervaluation

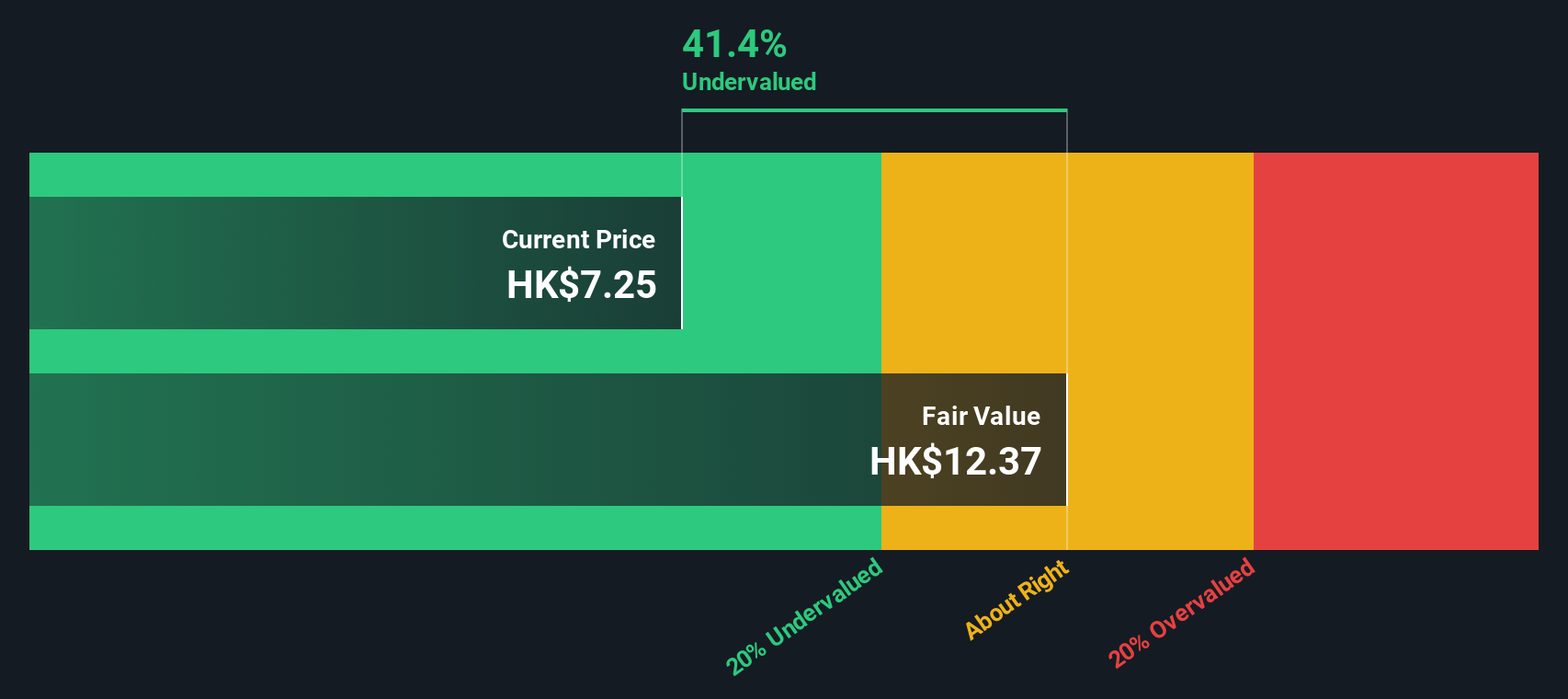

While the price-to-earnings ratio hints at an undervalued stock compared to peers, our SWS DCF model draws an even starker picture. It puts Qingdao Port International’s fair value at HK$12.36, which is 38.6% above its current share price. Could this unique disconnect offer investors a rare opportunity, or is there more behind the discount?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Qingdao Port International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Qingdao Port International Narrative

If you think there’s another angle or want to dig deeper on your own terms, crafting your own view takes just a few minutes. Do it your way

A great starting point for your Qingdao Port International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Your next big winner could be waiting in plain sight, but only if you step beyond the obvious. Open the door to fresh opportunities right now and don’t let another portfolio-changing stock pass you by.

- Unlock the potential for rapid growth with these 24 AI penny stocks, shaping tomorrow's industries and transforming how the world does business.

- Secure reliable income streams as you evaluate these 16 dividend stocks with yields > 3%, offering attractive yields and consistent returns for long-term stability.

- Tap into emerging technology frontiers by checking out these 28 quantum computing stocks, where pioneers are racing to redefine what's possible in computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Port International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6198

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives