- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:1732

Revenues Tell The Story For Xiangxing International Holding Limited (HKG:1732) As Its Stock Soars 30%

Despite an already strong run, Xiangxing International Holding Limited (HKG:1732) shares have been powering on, with a gain of 30% in the last thirty days. The annual gain comes to 253% following the latest surge, making investors sit up and take notice.

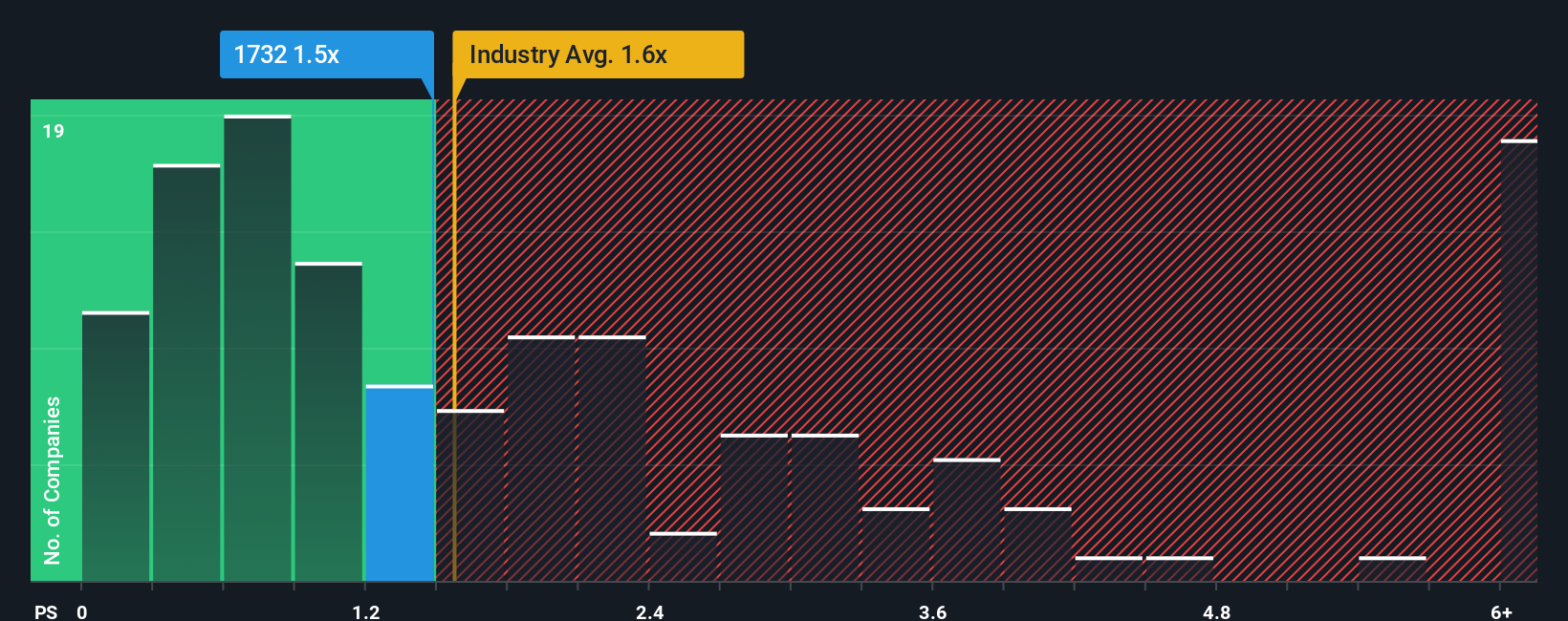

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Xiangxing International Holding's P/S ratio of 1.5x, since the median price-to-sales (or "P/S") ratio for the Shipping industry in Hong Kong is also close to 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Xiangxing International Holding

What Does Xiangxing International Holding's Recent Performance Look Like?

For example, consider that Xiangxing International Holding's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Xiangxing International Holding will help you shine a light on its historical performance.How Is Xiangxing International Holding's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Xiangxing International Holding's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 1.2% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 24% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

For that matter, there's little to separate that medium-term revenue trajectory on an annualised basis against the broader industry's one-year forecast for a contraction of 7.5% either.

In light of this, it's understandable that Xiangxing International Holding's P/S sits in line with the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S long-term, which could set up shareholders for future disappointment regardless. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Key Takeaway

Xiangxing International Holding appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Xiangxing International Holding confirms that the company's contraction in revenue over the past three-year years is a major contributor to its industry-matching P/S, given the industry is set to decline in a similar fashion. At this stage investors feel the company's revenue potential is similar enough to its peers that it doesn't warrant a higher or lower P/S. However, we're slightly cautious about the company's ability to stay its recent medium-term course and resist further pain to its business from the broader industry turmoil. If the company's performance remains relatively stable, it's likely that the current share price will continue to find support.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Xiangxing International Holding (at least 2 which make us uncomfortable), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1732

Xiangxing International Holding

An investment holding company, provides intra-port services, logistics services, and supply chain operations in the People’s Republic of China.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026