- Hong Kong

- /

- Tech Hardware

- /

- SEHK:992

Lenovo Group (SEHK:992) Revenue Growth Reinforces Bullish AI and PC Demand Narratives

Reviewed by Simply Wall St

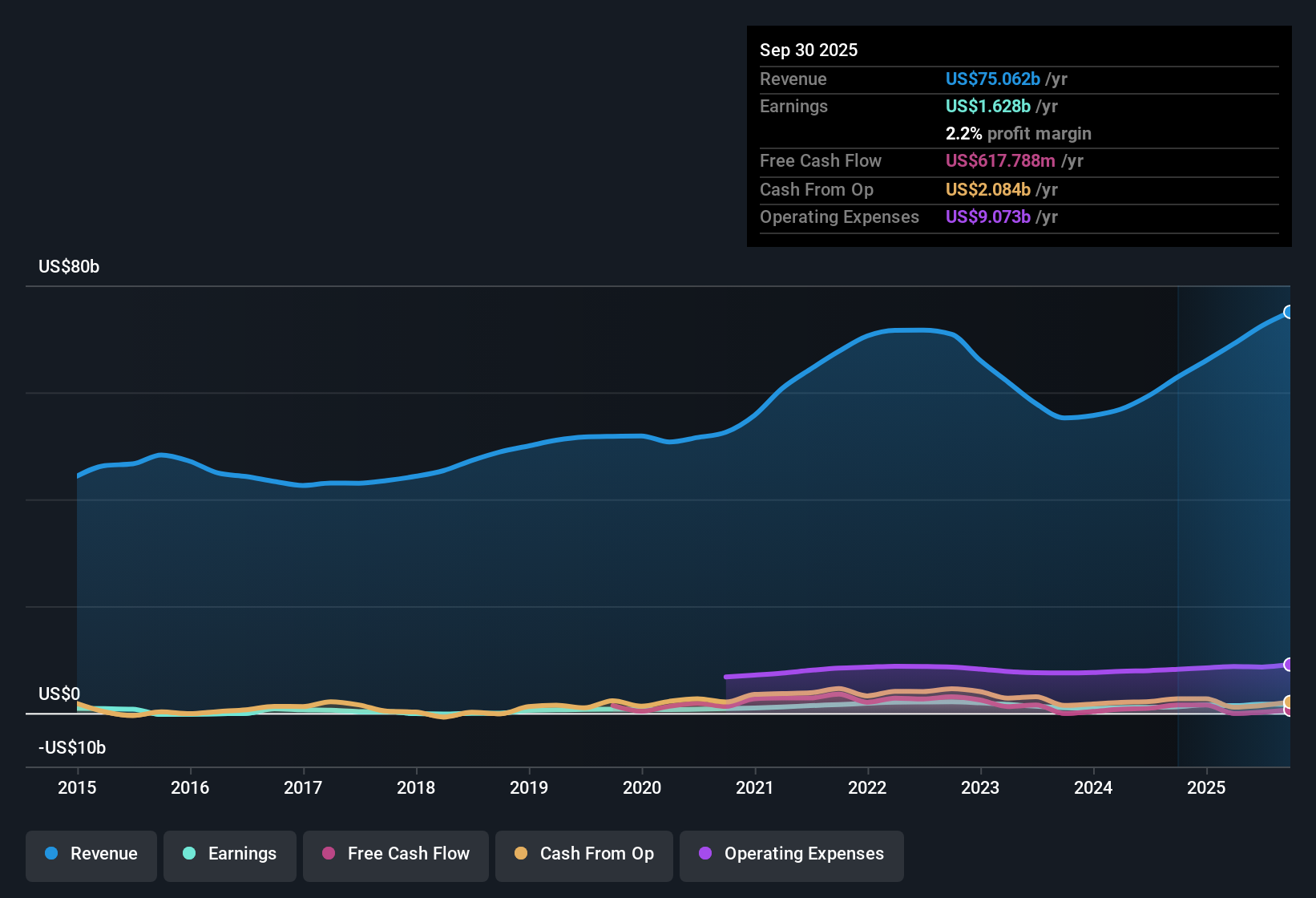

Lenovo Group (SEHK:992) has posted Q2 2026 results with revenue of about $20.5 billion and net income of roughly $340 million, translating to EPS of $0.03 for the quarter as the company extends the earnings momentum seen over the past year. The company has seen quarterly revenue move from $17.9 billion in Q2 2025 to $20.5 billion in Q2 2026, while trailing twelve month EPS has climbed from $0.10 in Q2 2025 to $0.13 in Q2 2026, setting the stage for investors to weigh healthier profitability against how sustainable these trends look.

See our full analysis for Lenovo Group.With the latest numbers on the table, the next step is to compare this earnings profile with the dominant narratives around Lenovo to see which storylines hold up and which might need a rethink.

See what the community is saying about Lenovo Group

TTM earnings growth runs at 37.2%

- Over the last twelve months, net income reached about $1.6 billion on $75.1 billion of revenue, lifting net margin to 2.2% from 1.9% year over year.

- Consensus narrative highlights surging demand for PCs, AI infrastructure, and services as growth drivers, and these TTM figures

- align with the story of Lenovo gaining from AI servers and data center demand because revenue has climbed from $59.4 billion to $75.1 billion over the last five TTM snapshots

- but also show margins are still low at 2.2%, so profitability remains sensitive if those higher growth segments do not scale as quickly as expected.

Valuation sits well below DCF fair value

- With the share price at HK$10.03 versus a DCF fair value of HK$27.21 and a P/E of 9.8 times against industry at 22.8 times, the stock screens as notably discounted.

- Consensus narrative argues that expanding services and AI driven infrastructure should support higher margins and long term competitiveness, and the current discount

- heavily supports the bullish case that investors are not paying full price for the forecast 7.8% annual earnings growth, especially given the TTM earnings jump of 37.2%

- yet also leaves room for bears to say the low multiple reflects caution around how far margins can rise from today’s 2.2% level.

Bulls point to Lenovo’s margin improvements and AI driven growth, while the current P/E discount raises the question of how long the value gap can last before expectations reset or results disappoint. 🐂 Lenovo Group Bull Case

Dividend cash coverage and insider selling

- The dividend yield sits at 3.86%, but the payout is flagged as not well covered by free cash flow and there has been notable insider selling over the past three months.

- Bears focus on this weaker cash coverage and recent selling activity as signals to be cautious, and the operating backdrop gives them some support

- because even with net income of about $1.6 billion on $75.1 billion of revenue, the 2.2% margin leaves less room to comfortably fund both R&D and dividends

- and the reliance on cost advantages and cyclical PC demand in the consensus narrative means any pressure on hardware pricing could make that cash coverage issue more visible.

Skeptics warn that a 3.86% yield paired with weak free cash flow coverage and insider selling could matter more if revenue growth slows from the forecast 6.6% pace. 🐻 Lenovo Group Bear Case

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Lenovo Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle? Use that insight to shape a clear Lenovo story in just a few minutes, then Do it your way.

A great starting point for your Lenovo Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Lenovo’s thin margins, cautious dividend coverage, and recent insider selling highlight vulnerabilities in its cash generation and overall financial resilience if growth stalls.

If you want businesses with sturdier finances and fewer payout worries, use our solid balance sheet and fundamentals stocks screener (1940 results) today to quickly focus on companies built to handle tougher conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:992

Lenovo Group

An investment holding company, develops, manufactures, and markets technology products and services.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026