- Hong Kong

- /

- Communications

- /

- SEHK:6869

Is Yangtze Optical Fibre And Cable (SEHK:6869) Using Governance Reforms To Redefine Its Long-Term Strategy?

Reviewed by Sasha Jovanovic

- At its extraordinary general meeting on December 5, 2025, Yangtze Optical Fibre and Cable Joint Stock Limited Company approved abolishing its supervisory board, amending its articles of association, and appointing Qiu Xiangping and Guan Jingzhi as non-executive directors.

- This overhaul of the company’s governance framework, including a reshaped board and committee structure, signals a meaningful shift in how oversight and leadership responsibilities are organized.

- We’ll examine how the abolishment of the supervisory board and refreshed non-executive lineup could reshape Yangtze Optical Fibre and Cable’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Yangtze Optical Fibre And Cable Limited's Investment Narrative?

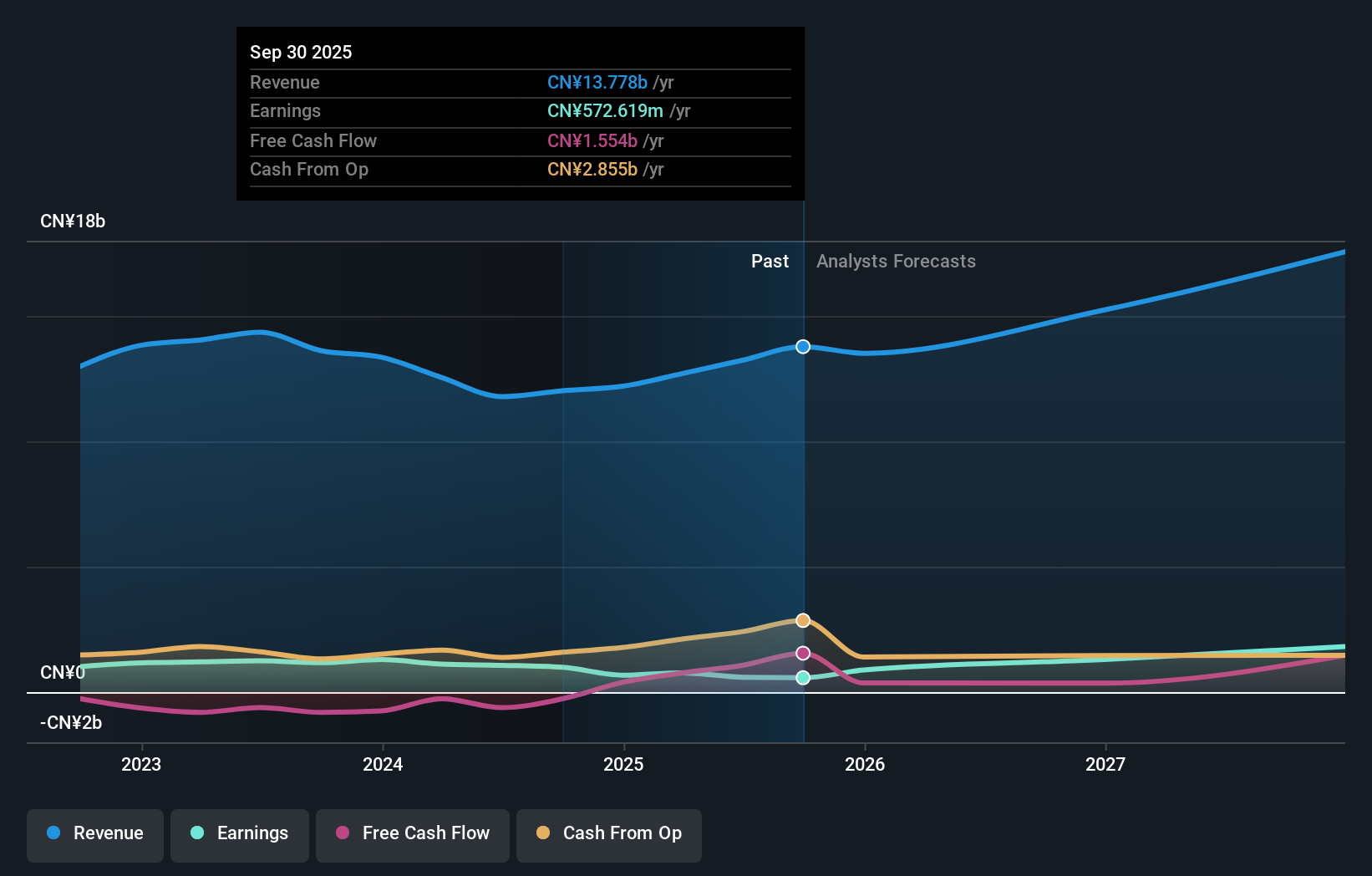

To own Yangtze Optical Fibre and Cable, you need to believe in its role as a key player in optical fibre demand while accepting near term earnings volatility, relatively rich valuation multiples and a history of margin pressure. The stock has had a very large one year total return, supported by strong consensus growth forecasts, yet profit margins are currently well below last year and return on equity is still low. Against that backdrop, the December 5 decision to abolish the supervisory board and refresh the non executive bench looks more like a governance clean up than a clear short term catalyst for earnings or cash flow. Unless this new structure leads to sharper capital allocation or tighter risk oversight, its immediate impact on the key drivers for the share price may be limited.

However, there is a governance risk here that investors should not ignore. Despite retreating, Yangtze Optical Fibre And Cable Limited's shares might still be trading 20% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Yangtze Optical Fibre And Cable Limited - why the stock might be worth as much as 35% more than the current price!

Build Your Own Yangtze Optical Fibre And Cable Limited Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yangtze Optical Fibre And Cable Limited research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Yangtze Optical Fibre And Cable Limited research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yangtze Optical Fibre And Cable Limited's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6869

Yangtze Optical Fibre And Cable Limited

Engages in the production and sale of optical fiber preforms rods, optical fiber, and optical fiber cables in China and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026