- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3638

Hunlicar Group (SEHK:3638) Posts Steep H1 Net Loss, Valuation Premium Raises Recovery Questions

Reviewed by Simply Wall St

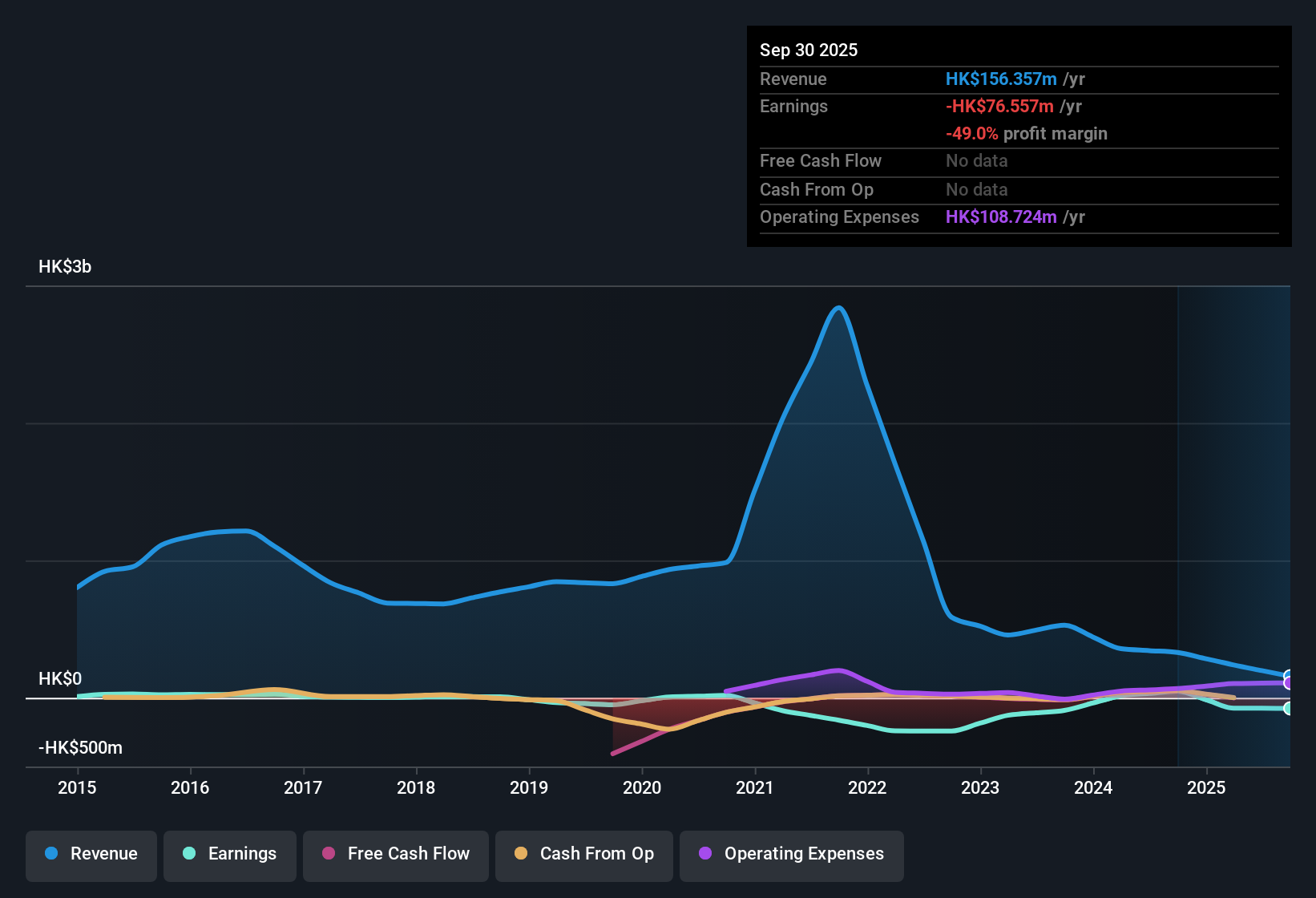

Hunlicar Group (SEHK:3638) just announced its latest results for H1 2026, posting total revenue of 69.2 million HKD and a basic EPS of -0.99 HKD. Over the previous periods, revenue figures shifted from 169.8 million HKD in H1 2025 down to 69.2 million HKD in the most recent half. EPS moved from a modest 0.01 HKD to -0.99 HKD. Margins came under persistent pressure and profitability slipped, setting the stage for investors to closely scrutinize the path forward.

See our full analysis for Hunlicar Group.Next up, we’ll see how these earnings numbers shake out when compared to the prevailing narratives and expectations around Hunlicar Group.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow, but Net Margin Remains Deep in Red

- Trailing twelve month net income (excluding extra items) came in at negative 76.6 million HKD, following a similar result of negative 77.2 million HKD in H2 2025. This means that, despite a minor reduction, the company’s losses remain significant and profitability remains elusive.

- Management's multi-year effort to close the gap is apparent, as the annual loss reduction rate averaged 19.8% over the last five years. However, there is no evidence in recent numbers of a turnaround to profitability or any improvement in net margins.

- With each period, net profit margins showed no material progress toward positive territory, challenging the hope for an imminent return to profitability.

- This ongoing pattern suggests that investors should primarily focus on loss resilience rather than profit expectations.

Price-To-Sales Multiple Stands at a Premium

- The Price-To-Sales Ratio sits at 6.9x for Hunlicar Group, which is far higher than both the Hong Kong Electronic industry average of 0.5x and the peer group average of 3.2x.

- Consensus narrative suggests the high valuation may be difficult to justify until the company shows a path to improved profitability or margin recovery.

- Investors face the tension of paying a premium for a business with persistent losses, especially when sector peers trade at lower multiples and have stronger earnings profiles.

- This puts additional pressure on management to demonstrate operational improvements or otherwise risk a rerating down to industry norms.

Recent results test the consensus view as losses persist yet the valuation premium remains in place. See how this impacts the full narrative for Hunlicar Group. 📊 Read the full Hunlicar Group Consensus Narrative.

Insider Selling Raises Further Caution Flags

- Significant insider selling was observed over the last three months, even as the company’s losses showed only nominal improvement, adding to investor wariness around the sustainability of any recovery.

- With no notable rewards or major positive catalysts visible in recent reporting, the situation highlights a key risk flagged in narrative discussions.

- This pattern may reflect reduced management or insider confidence and compounds concerns about the premium share valuation against the backdrop of ongoing net losses.

- Investors may want to closely monitor future trading activity from insiders to gauge any shifts in confidence or strategic direction.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hunlicar Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Hunlicar Group's ongoing net losses, high valuation, and continued insider selling point to challenges in both profitability and financial resilience.

If you want companies with healthier cushions and less risk from mounting losses, check out solid balance sheet and fundamentals stocks screener (1940 results) for stocks with stronger financial footing and balance sheet strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hunlicar Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3638

Hunlicar Group

An investment holding company, engages in the computer and electronic products trading business in Hong Kong and the People's Republic of China.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.