- Hong Kong

- /

- Communications

- /

- SEHK:285

3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 30%

Reviewed by Simply Wall St

As global markets face fluctuations, with concerns about elevated valuations and economic uncertainties in major regions like the U.S. and Europe, Asia presents intriguing opportunities for investors seeking value. In this environment, identifying undervalued stocks—those trading below their intrinsic worth—can be a strategic approach to potentially benefit from market inefficiencies and capture future growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.70 | CN¥25.18 | 49.6% |

| Visional (TSE:4194) | ¥9849.00 | ¥19511.72 | 49.5% |

| Tianqi Lithium (SZSE:002466) | CN¥55.32 | CN¥108.64 | 49.1% |

| TESEC (TSE:6337) | ¥2091.00 | ¥4123.87 | 49.3% |

| Takara Bio (TSE:4974) | ¥905.00 | ¥1808.35 | 50% |

| PharmaResearch (KOSDAQ:A214450) | ₩440000.00 | ₩872429.90 | 49.6% |

| Mobvista (SEHK:1860) | HK$19.23 | HK$37.72 | 49% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.11 | CN¥19.96 | 49.4% |

| Insource (TSE:6200) | ¥824.00 | ¥1645.91 | 49.9% |

| Andes Technology (TWSE:6533) | NT$257.50 | NT$506.66 | 49.2% |

Here's a peek at a few of the choices from the screener.

BYD Electronic (International) (SEHK:285)

Overview: BYD Electronic (International) Company Limited is an investment holding company that focuses on designing, manufacturing, assembling, and selling mobile handset components and modules in China and globally, with a market cap of approximately HK$79.81 billion.

Operations: The company's revenue primarily comes from the manufacture, assembly, and sale of mobile handset components and modules, generating CN¥179.33 billion.

Estimated Discount To Fair Value: 25.3%

BYD Electronic (International) is trading at a good value, 25.3% below its estimated fair value of HK$47.43, indicating it may be undervalued based on cash flows. Earnings are expected to grow significantly at 22.6% annually, outpacing the Hong Kong market's growth rate of 11.7%. However, revenue growth is projected at a slower pace of 9.5% per year compared to the industry benchmark for high growth rates. Recent earnings show improved net income and sales figures year-over-year.

- Our earnings growth report unveils the potential for significant increases in BYD Electronic (International)'s future results.

- Get an in-depth perspective on BYD Electronic (International)'s balance sheet by reading our health report here.

Xinjiang Qingsong Building Materials and Chemicals(Group)CoLtd (SHSE:600425)

Overview: Xinjiang Qingsong Building Materials and Chemicals (Group) Co., Ltd. operates in the building materials and chemicals industry, with a market capitalization of approximately CN¥8.01 billion.

Operations: Xinjiang Qingsong Building Materials and Chemicals (Group) Co., Ltd. generates revenue through its operations in the building materials and chemicals sectors.

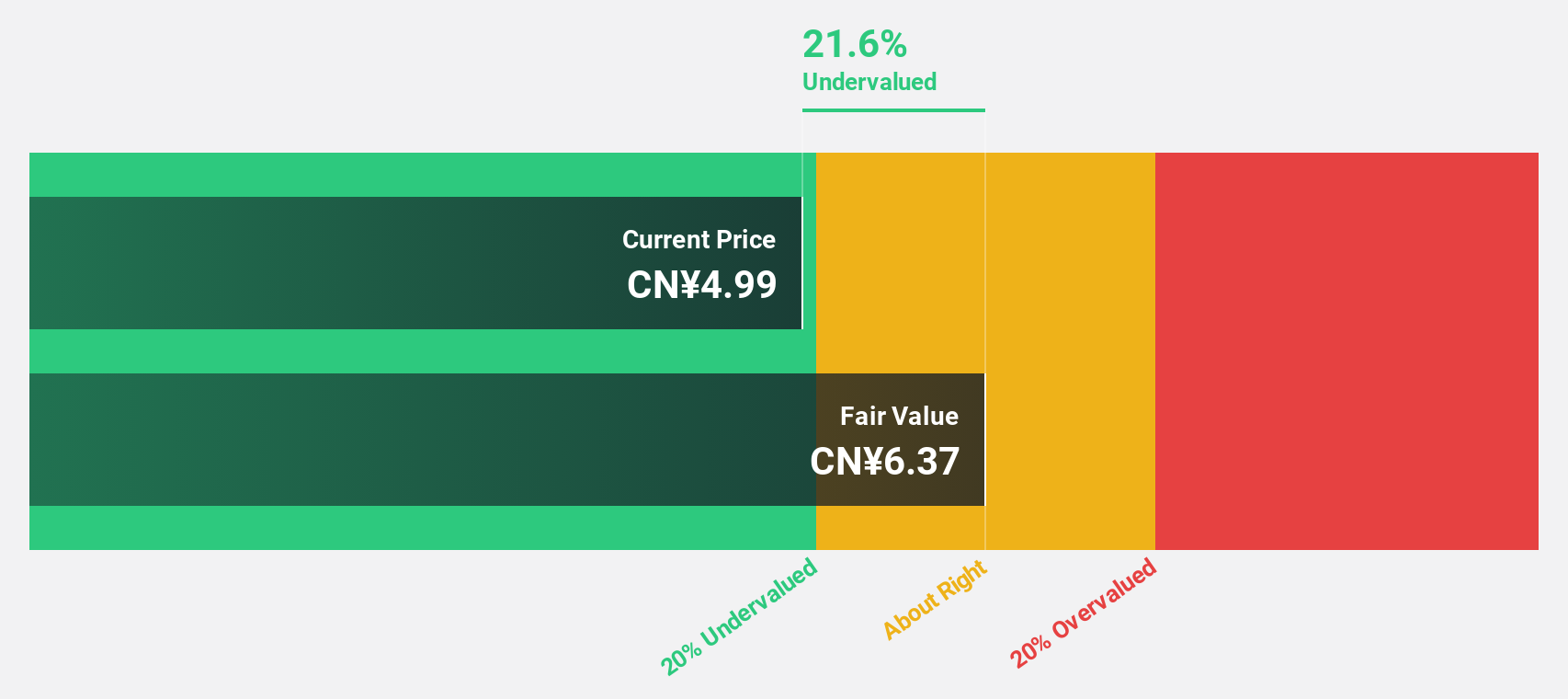

Estimated Discount To Fair Value: 21.6%

Xinjiang Qingsong Building Materials and Chemicals is trading 21.6% below its estimated fair value of CNY 6.37, highlighting potential undervaluation based on cash flows. Despite a decline in recent sales and net income, earnings are forecast to grow significantly at 39.58% annually, surpassing the broader Chinese market's growth rate of 27%. However, revenue growth is expected to be slower than ideal at 18.1%, though still above the market average of 14.4%.

- In light of our recent growth report, it seems possible that Xinjiang Qingsong Building Materials and Chemicals(Group)CoLtd's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Xinjiang Qingsong Building Materials and Chemicals(Group)CoLtd.

Asia Vital Components (TWSE:3017)

Overview: Asia Vital Components Co., Ltd., along with its subsidiaries, offers thermal solutions globally and has a market capitalization of NT$597.78 billion.

Operations: The company generates revenue from its Overseas Operating Department, contributing NT$106.77 billion, and its Integrated Management Division, which accounts for NT$74.12 billion.

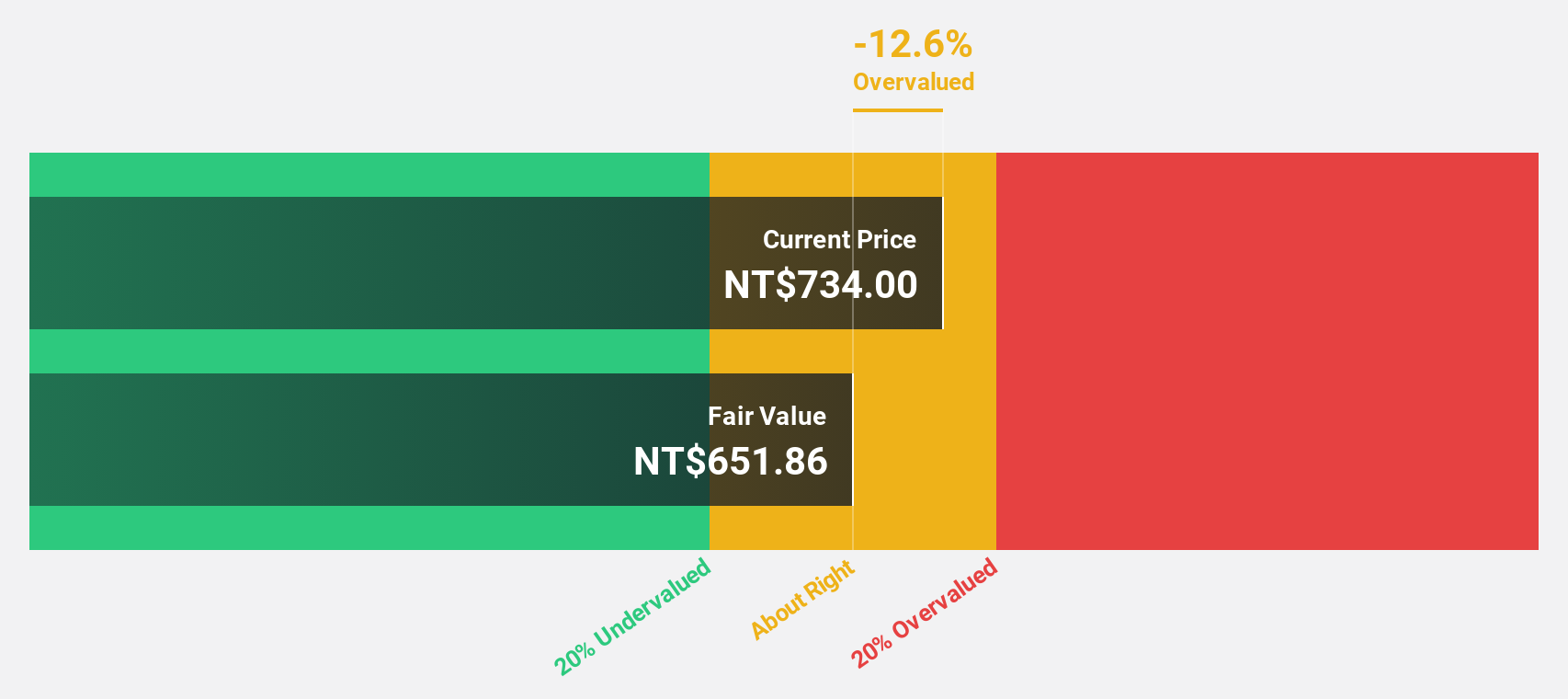

Estimated Discount To Fair Value: 30%

Asia Vital Components is trading at NT$1,540, significantly below its estimated fair value of NT$2,198.54, suggesting potential undervaluation based on cash flows. The company reported robust earnings growth with net income for the second quarter reaching NT$3.99 billion from NT$1.95 billion a year ago. Despite recent share price volatility, its earnings and revenue are expected to grow faster than the Taiwan market over the next three years at 32.5% and 30% annually respectively.

- Our comprehensive growth report raises the possibility that Asia Vital Components is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Asia Vital Components.

Make It Happen

- Click here to access our complete index of 292 Undervalued Asian Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD Electronic (International) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:285

BYD Electronic (International)

An investment holding company, primarily engages in the design, manufacture, assembly, and sale of mobile handset components, modules, and other products in the People’s Republic of China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives