- Hong Kong

- /

- Tech Hardware

- /

- SEHK:2369

Some Coolpad Group Limited (HKG:2369) Shareholders Look For Exit As Shares Take 25% Pounding

Coolpad Group Limited (HKG:2369) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

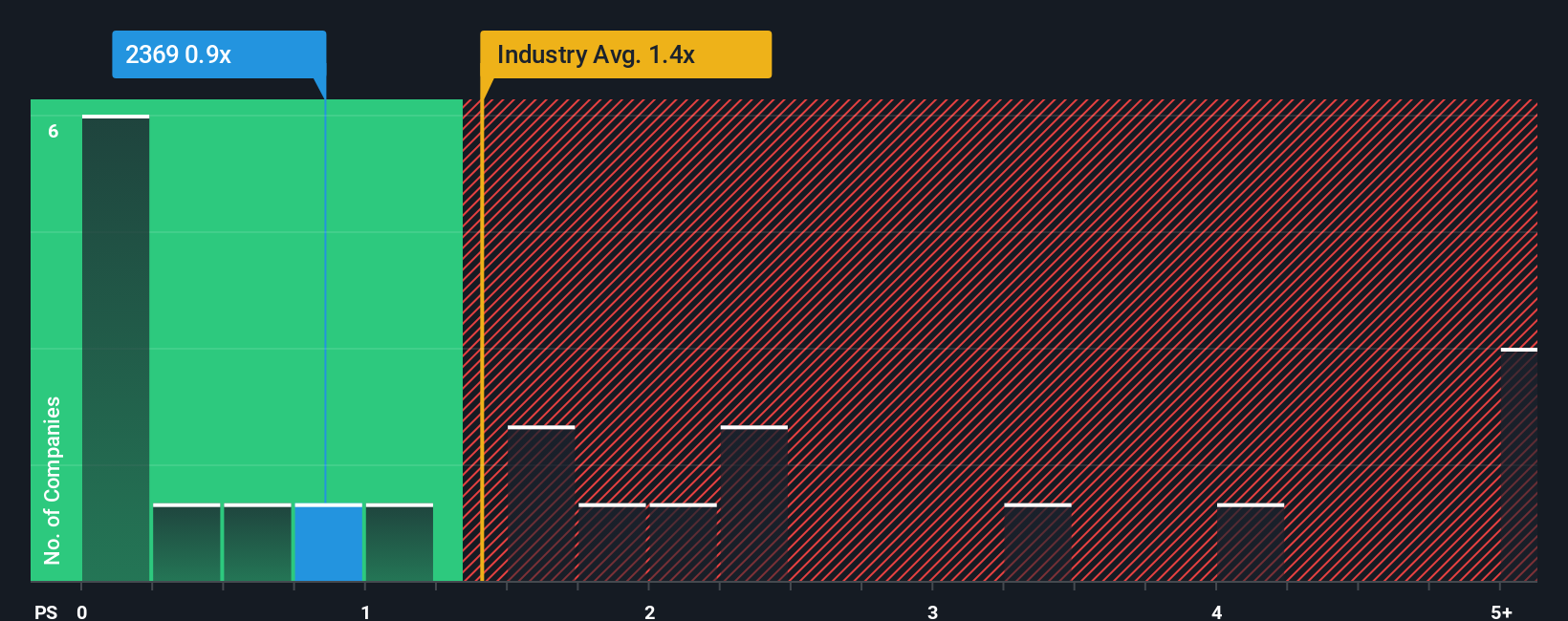

Even after such a large drop in price, it's still not a stretch to say that Coolpad Group's price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" compared to the Tech industry in Hong Kong, where the median P/S ratio is around 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Coolpad Group

What Does Coolpad Group's Recent Performance Look Like?

Coolpad Group has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Coolpad Group's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Coolpad Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 8.6%. Still, lamentably revenue has fallen 13% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 21% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Coolpad Group's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Bottom Line On Coolpad Group's P/S

Following Coolpad Group's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Coolpad Group currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you settle on your opinion, we've discovered 3 warning signs for Coolpad Group (1 is a bit concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on Coolpad Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2369

Coolpad Group

An investment holding company, engages in the production and sale of mobile phone and accessories in Mainland China and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives