Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:301280

Exploring High Growth Tech Stocks Including Digital China Holdings And Two More

Reviewed by Simply Wall St

The global markets have recently experienced a tumultuous period, with major indices like the Nasdaq Composite and S&P MidCap 400 hitting record highs before retreating sharply, while small-cap stocks demonstrated resilience amid a busy earnings season. In this context of fluctuating market conditions and mixed economic signals, identifying high-growth tech stocks requires careful consideration of their potential for innovation and adaptability to changing economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| TG Therapeutics | 34.69% | 57.41% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Digital China Holdings (SEHK:861)

Simply Wall St Growth Rating: ★★★★☆☆

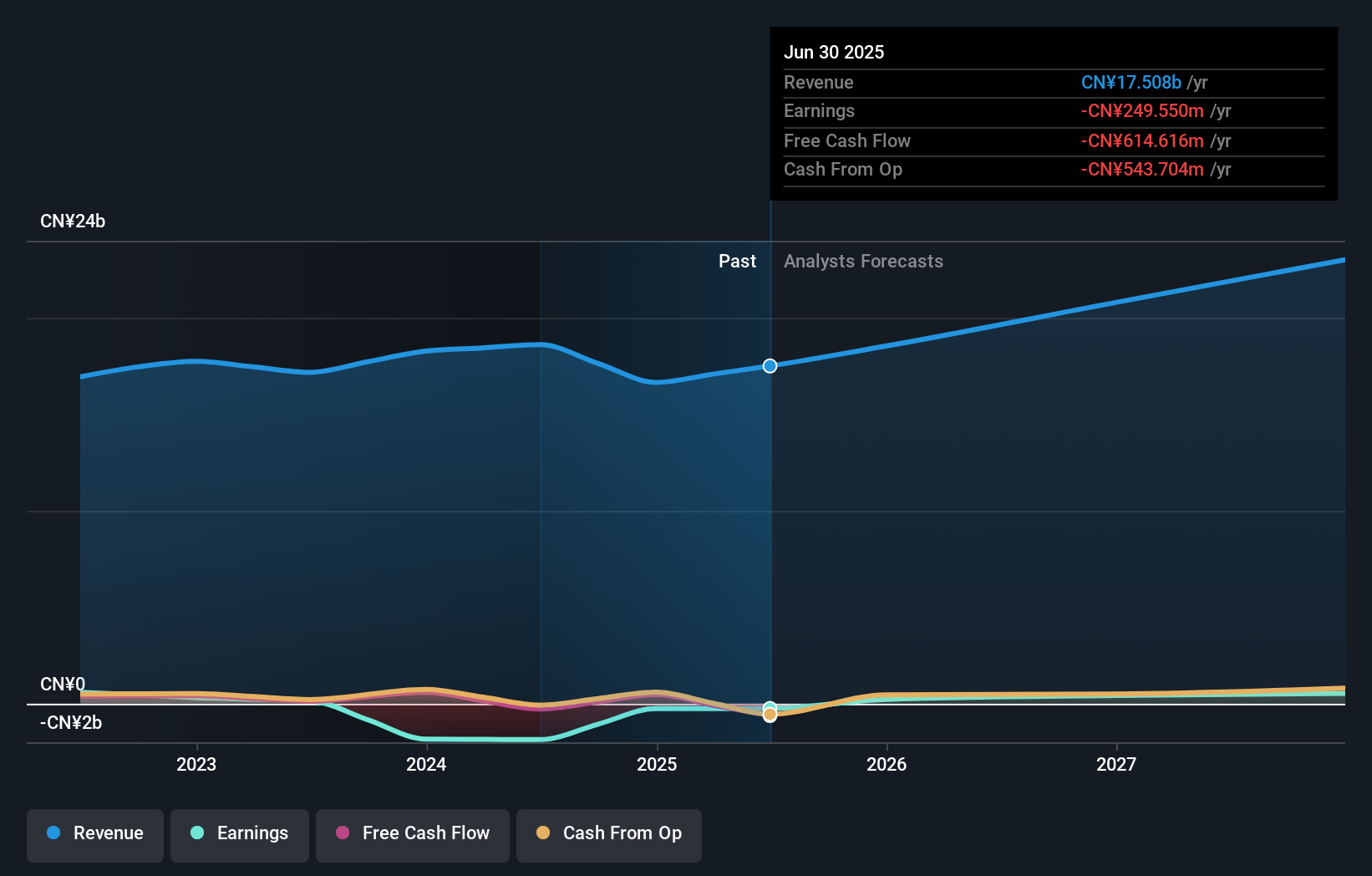

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise clients mainly in Mainland China, with a market capitalization of HK$4.70 billion.

Operations: The company generates revenue primarily from three segments: Big Data Products and Solutions (CN¥3.39 billion), Software and Operating Services (CN¥5.31 billion), and Traditional and Localization Services (CN¥10.03 billion).

Digital China Holdings, navigating a competitive landscape, anticipates a notable shift with its recent earnings guidance projecting a sharp decrease in profits due to increased competition and rising expenses at its subsidiary DCITS. Despite these challenges, the company's commitment to innovation remains robust with R&D expenses aligning closely with industry demands. Interestingly, while overall profitability is under pressure, Digital China maintains a strategic focus on expanding new product lines which could catalyze future growth. This approach underscores an adaptive strategy in the face of evolving market dynamics and heightened competition within the tech sector.

- Delve into the full analysis health report here for a deeper understanding of Digital China Holdings.

Evaluate Digital China Holdings' historical performance by accessing our past performance report.

Beijing InHand Networks Technology (SHSE:688080)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing InHand Networks Technology Co., Ltd. is a company that specializes in computer network solutions and has a market capitalization of CN¥2.52 billion.

Operations: InHand Networks generates revenue primarily from its computer networks segment, with reported earnings of CN¥549.56 million.

Beijing InHand Networks Technology has demonstrated robust financial performance with a 16% increase in revenue and a 21% rise in net income for the nine months ending September 2024. This growth is underpinned by significant R&D investment, aligning with its strategic focus on innovative tech solutions. The company also initiated a CNY 40 million share repurchase program, signaling confidence in its operational stability and future prospects. With projected annual earnings growth of 27.5% and revenue increases expected at 24.4%, Beijing InHand is positioning itself strongly within the competitive tech landscape, leveraging both market trends and internal capabilities to enhance shareholder value.

- Unlock comprehensive insights into our analysis of Beijing InHand Networks Technology stock in this health report.

Understand Beijing InHand Networks Technology's track record by examining our Past report.

Zhejiang ZUCH Technology (SZSE:301280)

Simply Wall St Growth Rating: ★★★★★☆

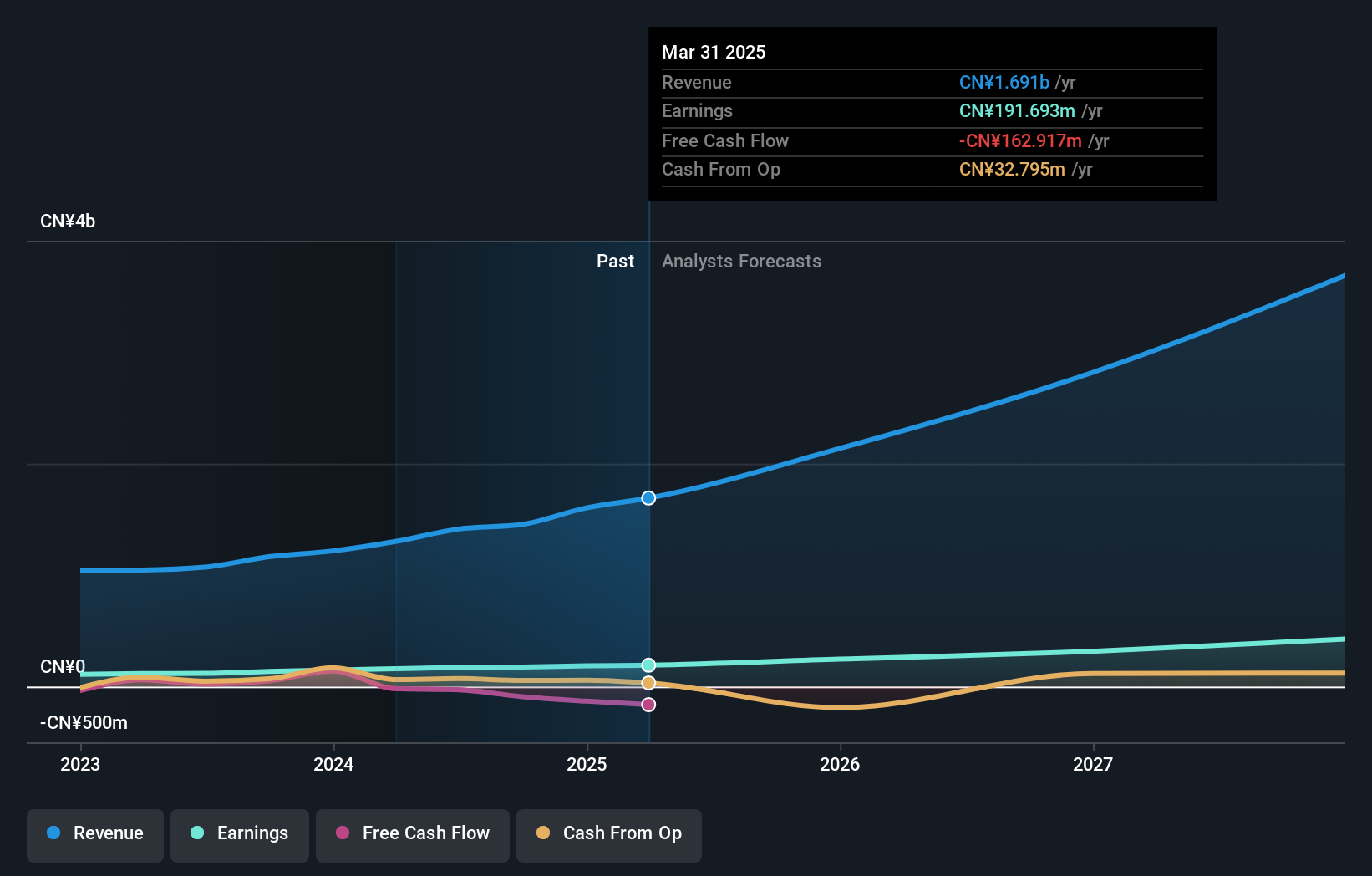

Overview: Zhejiang ZUCH Technology Co., Ltd. specializes in providing electric connectors in China, with a market cap of CN¥4.08 billion.

Operations: Zhejiang ZUCH Technology Co., Ltd. generates revenue through the sale of electric connectors in China. The company's market capitalization stands at approximately CN¥4.08 billion, indicating its significant presence in the industry.

Zhejiang ZUCH Technology's recent performance underscores its upward trajectory in the tech sector, with a notable 26.6% increase in revenue to CNY 1.14 billion and a 25.7% rise in net income to CNY 135 million for the nine months ending September 2024. This growth is bolstered by strategic R&D investments, which are pivotal as evidenced by their forecasted annual earnings growth of 31.2%, outpacing the Chinese market's expectation of 25.8%. The firm's commitment to innovation is further highlighted by its projected revenue growth rate of 28.4% annually, signaling robust future prospects amidst competitive industry dynamics.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1288 High Growth Tech and AI Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang ZUCH Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301280

Zhejiang ZUCH Technology

Offers electric connectors in China.