Famous Tech International Holdings Limited's (HKG:8100) Share Price Boosted 33% But Its Business Prospects Need A Lift Too

Famous Tech International Holdings Limited (HKG:8100) shares have continued their recent momentum with a 33% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

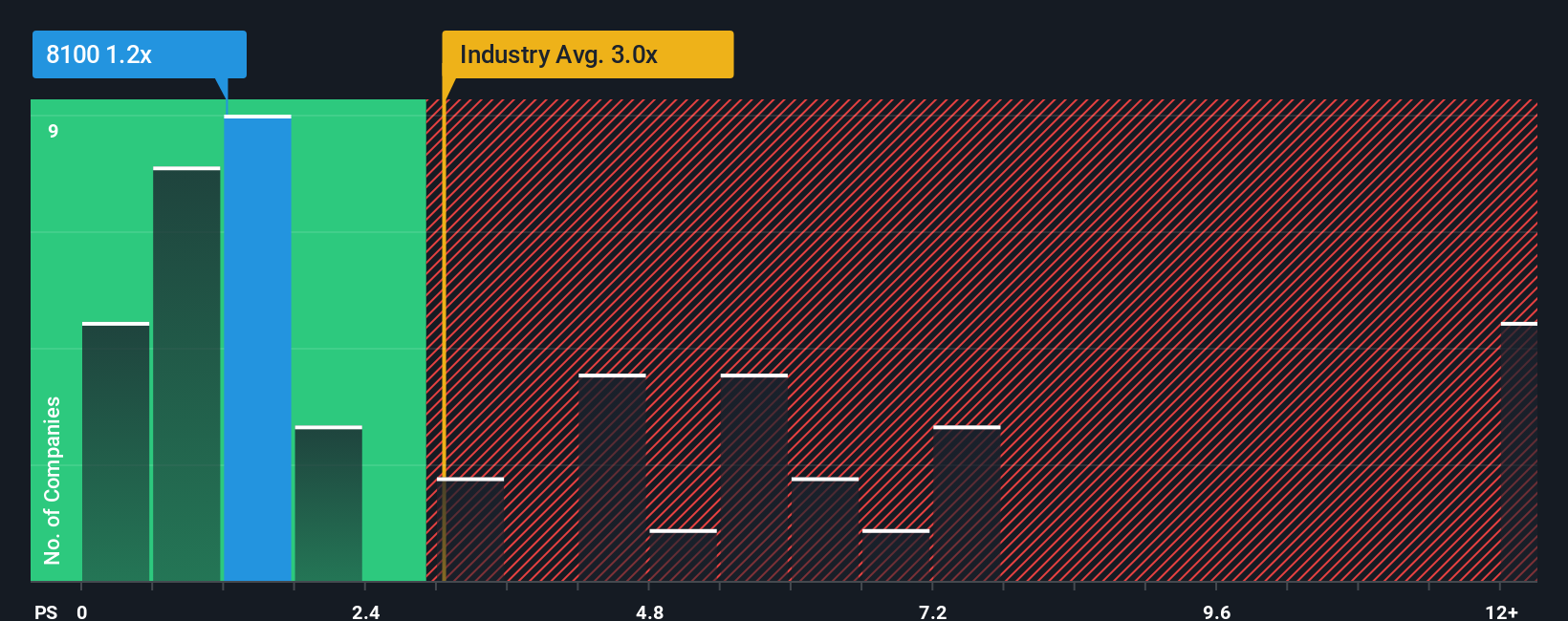

Even after such a large jump in price, Famous Tech International Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.2x, since almost half of all companies in the Software industry in Hong Kong have P/S ratios greater than 3x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Famous Tech International Holdings

What Does Famous Tech International Holdings' Recent Performance Look Like?

It looks like revenue growth has deserted Famous Tech International Holdings recently, which is not something to boast about. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Famous Tech International Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Famous Tech International Holdings would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 19% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 36% shows it's an unpleasant look.

With this in mind, we understand why Famous Tech International Holdings' P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On Famous Tech International Holdings' P/S

The latest share price surge wasn't enough to lift Famous Tech International Holdings' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Famous Tech International Holdings revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Famous Tech International Holdings is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8100

Famous Tech International Holdings

An investment holding company, engages in the research, development, and distribution of personal computer performance software, anti-virus software, mobile phone applications, and toolbar advertisements.

Flawless balance sheet and good value.

Market Insights

Community Narratives