Did the Phancy Group Rebrand and Board Appointment Just Shift Beijing Fourth Paradigm’s (SEHK:6682) Investment Narrative?

Reviewed by Sasha Jovanovic

- Beijing Fourth Paradigm Technology Co., Ltd. has announced a proposed change to its English name to Phancy Group Co., Ltd. and the planned appointment of Mr. Pan Jialin as an independent non-executive director, pending shareholder approval at an upcoming EGM on December 19, 2025.

- The company’s decision reflects an active effort to align its identity and leadership with evolving business priorities in computer science and artificial intelligence.

- We’ll explore how the company’s proposed name change may influence its investment case and long-term business direction.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Beijing Fourth Paradigm Technology's Investment Narrative?

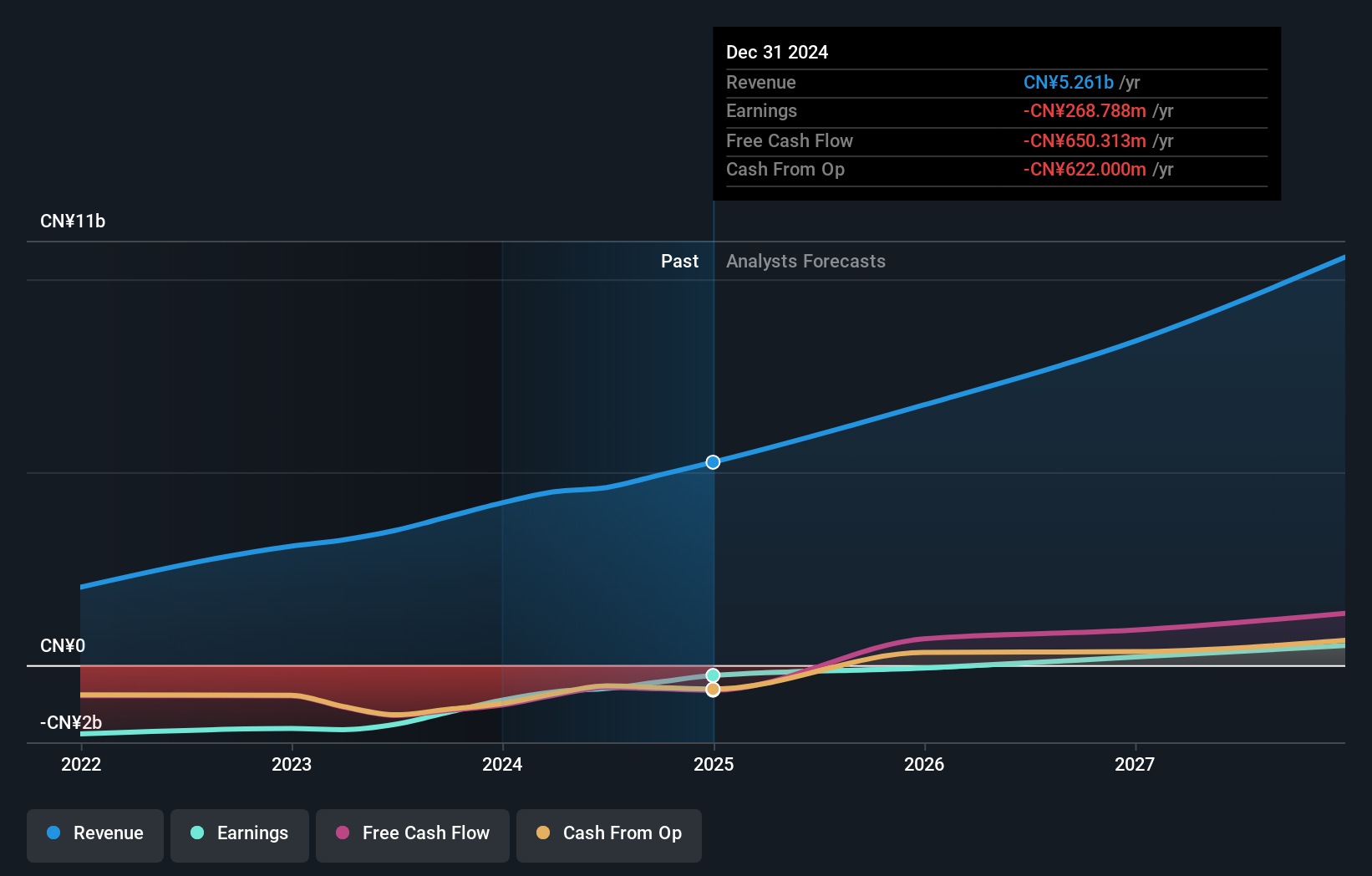

Investors considering Beijing Fourth Paradigm Technology, soon to be Phancy Group Co., Ltd. if the proposed name change is approved, are betting on the company’s ability to turn accelerating revenue growth into future profitability and stronger market positioning in AI and computer science. The planned appointment of Mr. Pan Jialin as an independent non-executive director further signals a push toward deepening expertise in its core business focus. While the news about the rebrand and board changes is unlikely to materially affect short-term financials or near-term catalysts like continued revenue expansion, cost control, and strategic partnerships, it does raise new questions about execution risk and the company’s ability to deliver results amid ongoing losses and share price underperformance relative to the broader market. As such, the name change may have implications for investor perception and longer-term strategy, but the most important risks and opportunities related to earnings momentum and cost management remain the same for now.

However, risks related to persistent losses remain an important consideration for investors.

Despite retreating, Beijing Fourth Paradigm Technology's shares might still be trading 24% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Beijing Fourth Paradigm Technology - why the stock might be worth over 2x more than the current price!

Build Your Own Beijing Fourth Paradigm Technology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beijing Fourth Paradigm Technology research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Beijing Fourth Paradigm Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beijing Fourth Paradigm Technology's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Fourth Paradigm Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6682

Beijing Fourth Paradigm Technology

An investment holding company, provides platform-centric artificial intelligence (AI) solutions in the People's Republic of China.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026