- China

- /

- Electronic Equipment and Components

- /

- SZSE:300296

Exploring High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 reach record highs before experiencing sharp declines, while small-cap stocks demonstrated resilience compared to their larger counterparts. Amid this backdrop of cautious market sentiment, investors may find potential portfolio enhancement opportunities by exploring high growth tech stocks that exhibit strong fundamentals and adaptability to evolving economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| TG Therapeutics | 34.69% | 57.41% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.17% | 70.49% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 71.73% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingdee International Software Group Company Limited is an investment holding company that operates in the enterprise resource planning sector, with a market capitalization of approximately HK$28.48 billion.

Operations: Kingdee focuses on enterprise resource planning, primarily generating revenue through its Cloud Service Business (CN¥4.86 billion) and ERP Business (CN¥1.13 billion). The Cloud Service segment is a significant contributor to the company's overall revenue stream.

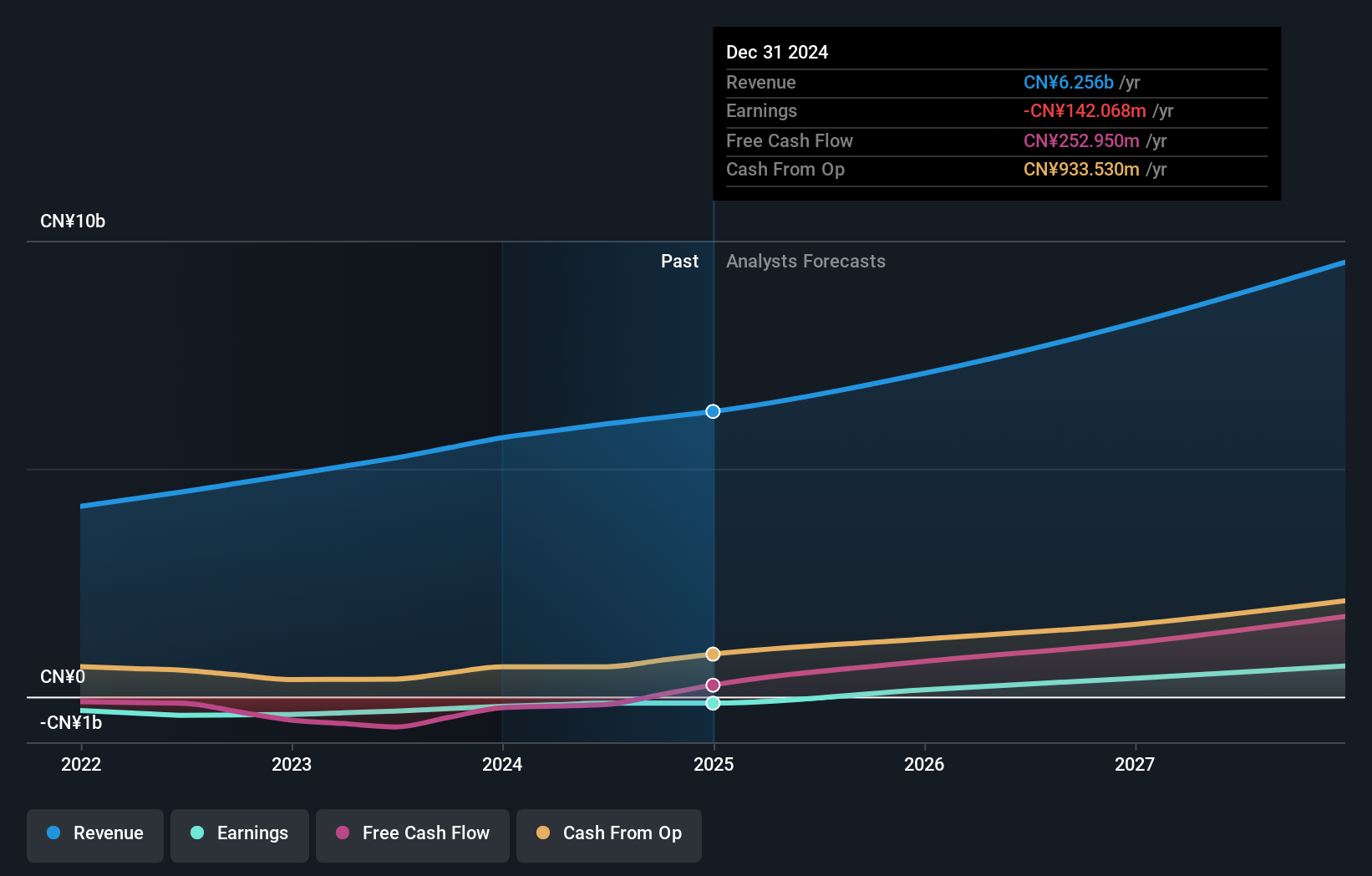

Kingdee International Software Group has demonstrated resilience with a significant reduction in net loss to CNY 217.85 million from CNY 283.54 million year-over-year, alongside an uplift in sales to CNY 2.87 billion. This performance is underpinned by a robust R&D commitment, crucial for maintaining competitive edge in the fast-evolving software sector, where innovation translates directly into market relevance and potential revenue streams. Despite current unprofitability, the company's revenue is expected to grow at an annual rate of 14.1%, outpacing the Hong Kong market's average of 7.8%. Looking ahead, Kingdee is poised for a promising turnaround with anticipated profitability within three years, reflecting not only a recovery trajectory but also potential for substantial growth in the tech landscape driven by strategic expansions and product innovations.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Raytron Technology Co., Ltd. focuses on the research and development, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China, with a market capitalization of CN¥21.60 billion.

Operations: Raytron Technology Co., Ltd. generates revenue primarily through the development and sale of uncooled infrared imaging and MEMS sensor technologies. The company operates within China, leveraging its expertise in these advanced technologies to capture market opportunities.

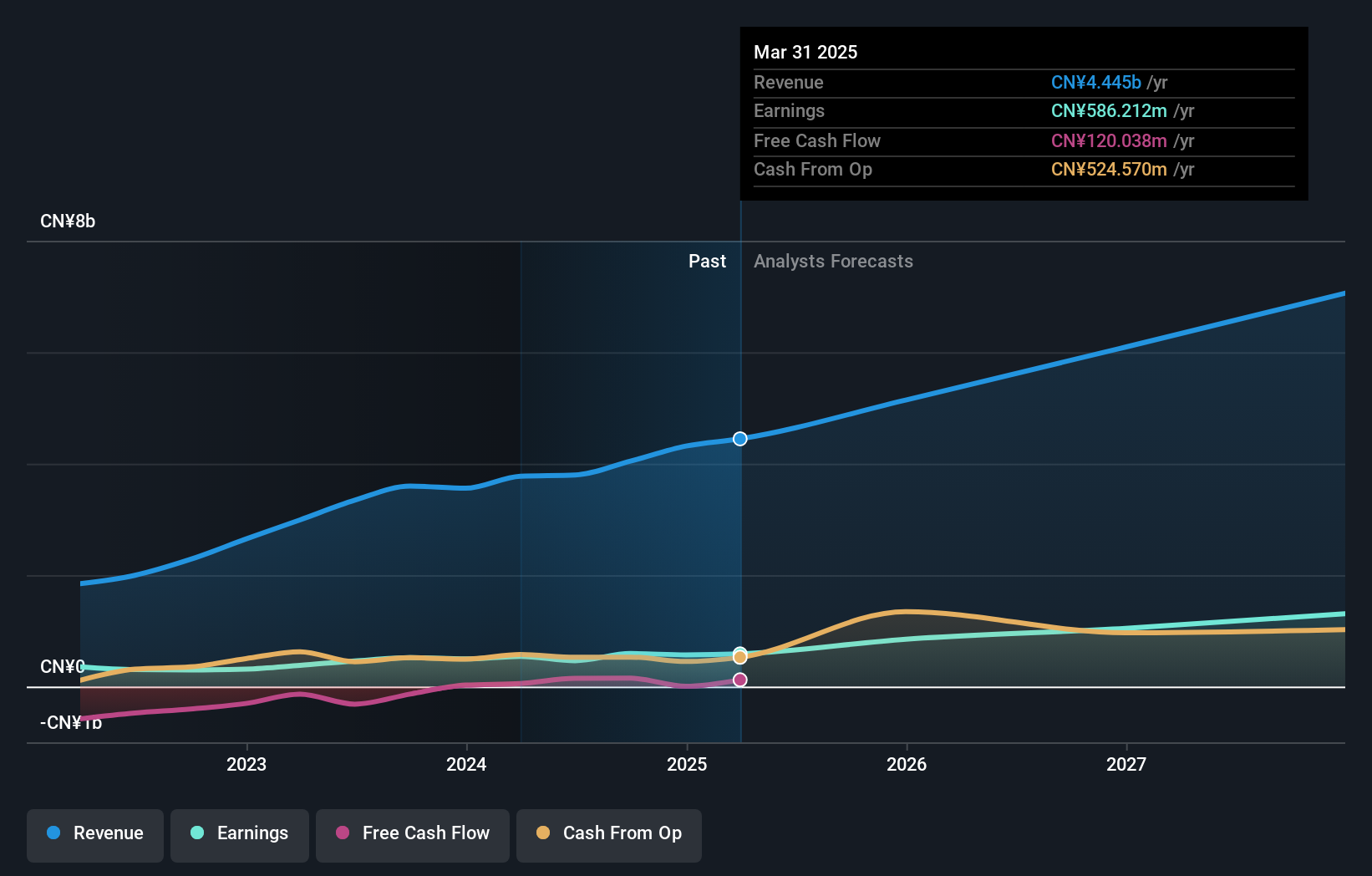

Raytron Technology Co.,Ltd. has demonstrated robust financial performance with a 22.4% annual revenue growth, outstripping the Chinese market's average of 14%. This growth is complemented by a notable increase in net income from CNY 386.89 million to CNY 483.4 million within nine months, reflecting a solid upward trajectory in profitability. The company also strategically repurchased shares worth CNY 49.43 million, underscoring confidence in its financial health and commitment to shareholder value. With R&D expenses aligned closely with these advancements, Raytron is not only enhancing its product offerings but also securing a competitive stance in the tech industry’s rapidly evolving landscape.

- Get an in-depth perspective on Raytron TechnologyLtd's performance by reading our health report here.

Understand Raytron TechnologyLtd's track record by examining our Past report.

Leyard Optoelectronic (SZSE:300296)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leyard Optoelectronic Co., Ltd. is an audio-visual technology company with operations in China and internationally, and it has a market cap of CN¥13.04 billion.

Operations: Leyard Optoelectronic focuses on audio-visual technology, offering products and services across various international markets. The company's revenue model is primarily driven by its diverse range of display solutions, including LED displays, which cater to both domestic and global clients.

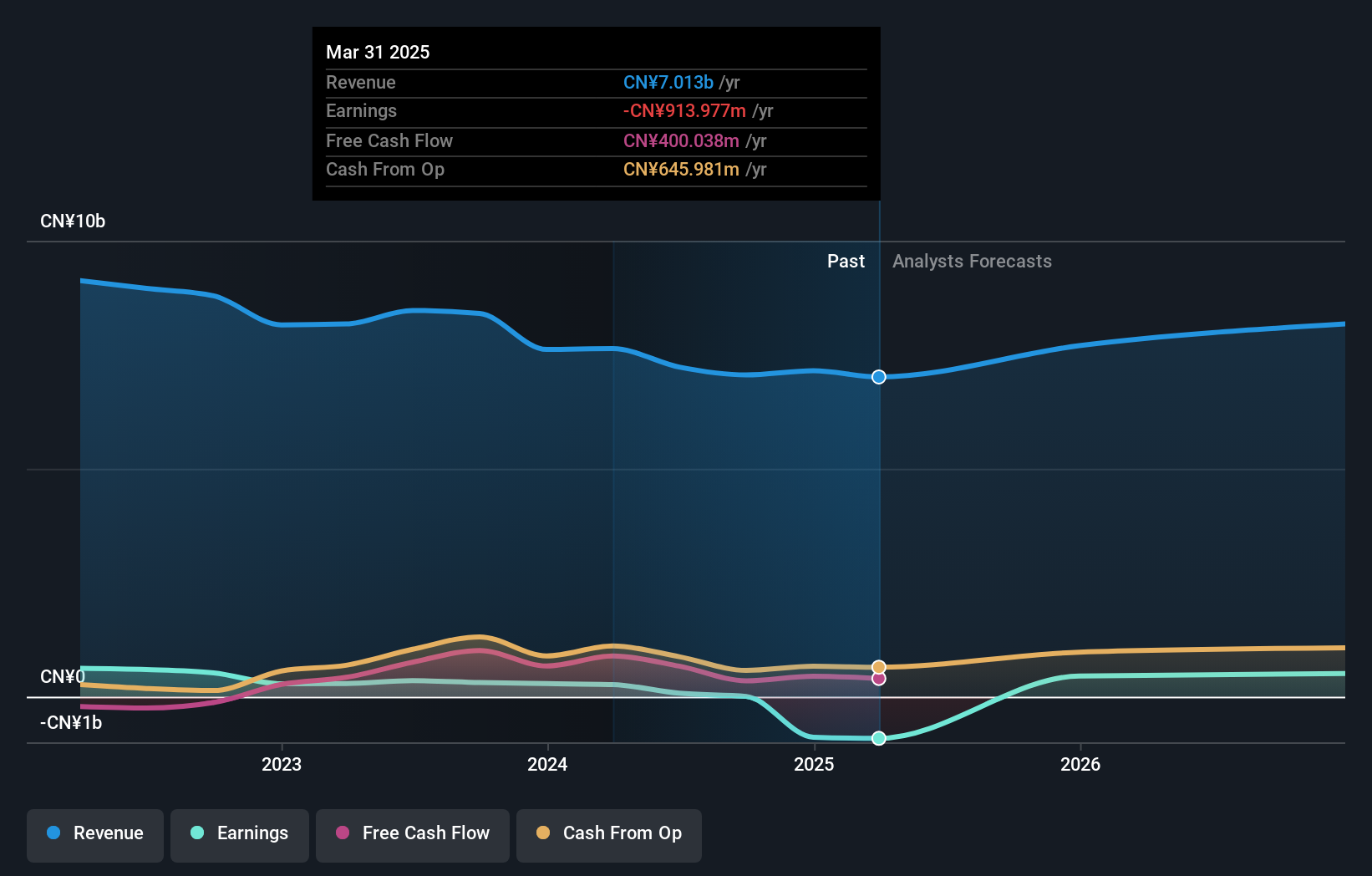

Leyard Optoelectronic, amidst a challenging year with a revenue drop to CNY 5.46 billion from CNY 6.02 billion, still demonstrates resilience with strategic maneuvers like repurchasing shares for CNY 22.4 million, signaling confidence in its stability and future prospects. Despite a significant net income reduction to CNY 181.38 million from last year's CNY 460.9 million, the company is poised for recovery with expected earnings growth of an impressive 90.5% annually, outpacing the broader Chinese market forecast of 25.9%. This financial agility coupled with an aggressive R&D focus positions Leyard Optoelectronic well within the tech sector’s dynamic landscape for potential rebound and innovation-driven growth.

Make It Happen

- Take a closer look at our High Growth Tech and AI Stocks list of 1291 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300296

Leyard Optoelectronic

Operates as an audio-visual technology company in China and internationally.

Flawless balance sheet with reasonable growth potential.