- China

- /

- Real Estate

- /

- SHSE:600208

Spotlight On 3 Penny Stocks With Market Caps Over US$600M

Reviewed by Simply Wall St

As global markets experience broad-based gains, with U.S. indexes approaching record highs and smaller-cap indexes outperforming large-caps, investor sentiment remains buoyant despite geopolitical uncertainties. For those looking to invest in smaller or newer companies, penny stocks — despite the name's vintage feel — can still offer surprising value. In this article, we explore three penny stocks that demonstrate financial strength and potential for long-term growth amidst current market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.22 | £836.42M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$46.36B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$66.23M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.20 | £417.71M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.92 | £74.76M | ★★★★☆☆ |

Click here to see the full list of 5,745 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

SenseTime Group (SEHK:20)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SenseTime Group Inc. is an investment holding company that develops and sells artificial intelligence software platforms across China, Northeast Asia, Southeast Asia, and internationally, with a market cap of approximately HK$50.61 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, totaling CN¥3.71 billion.

Market Cap: HK$50.61B

SenseTime Group Inc., with a market cap of approximately HK$50.61 billion, derives its CN¥3.71 billion revenue primarily from the Software & Programming segment. Despite being unprofitable, the company has reduced losses by 14.4% annually over five years and maintains a cash runway exceeding three years if current free cash flow trends persist. Its short-term assets significantly cover both short and long-term liabilities, indicating financial stability despite recent shareholder dilution and removal from the Hang Seng China Enterprises Index. The management team is experienced, though share price volatility remains high compared to most Hong Kong stocks.

- Click to explore a detailed breakdown of our findings in SenseTime Group's financial health report.

- Evaluate SenseTime Group's prospects by accessing our earnings growth report.

Quzhou Xin'an Development (SHSE:600208)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quzhou Xin'an Development Co., Ltd. operates in real estate development, technology manufacturing, and financial services in China with a market cap of CN¥25.02 billion.

Operations: The company generates revenue of CN¥27.61 billion from its operations in China.

Market Cap: CN¥25.02B

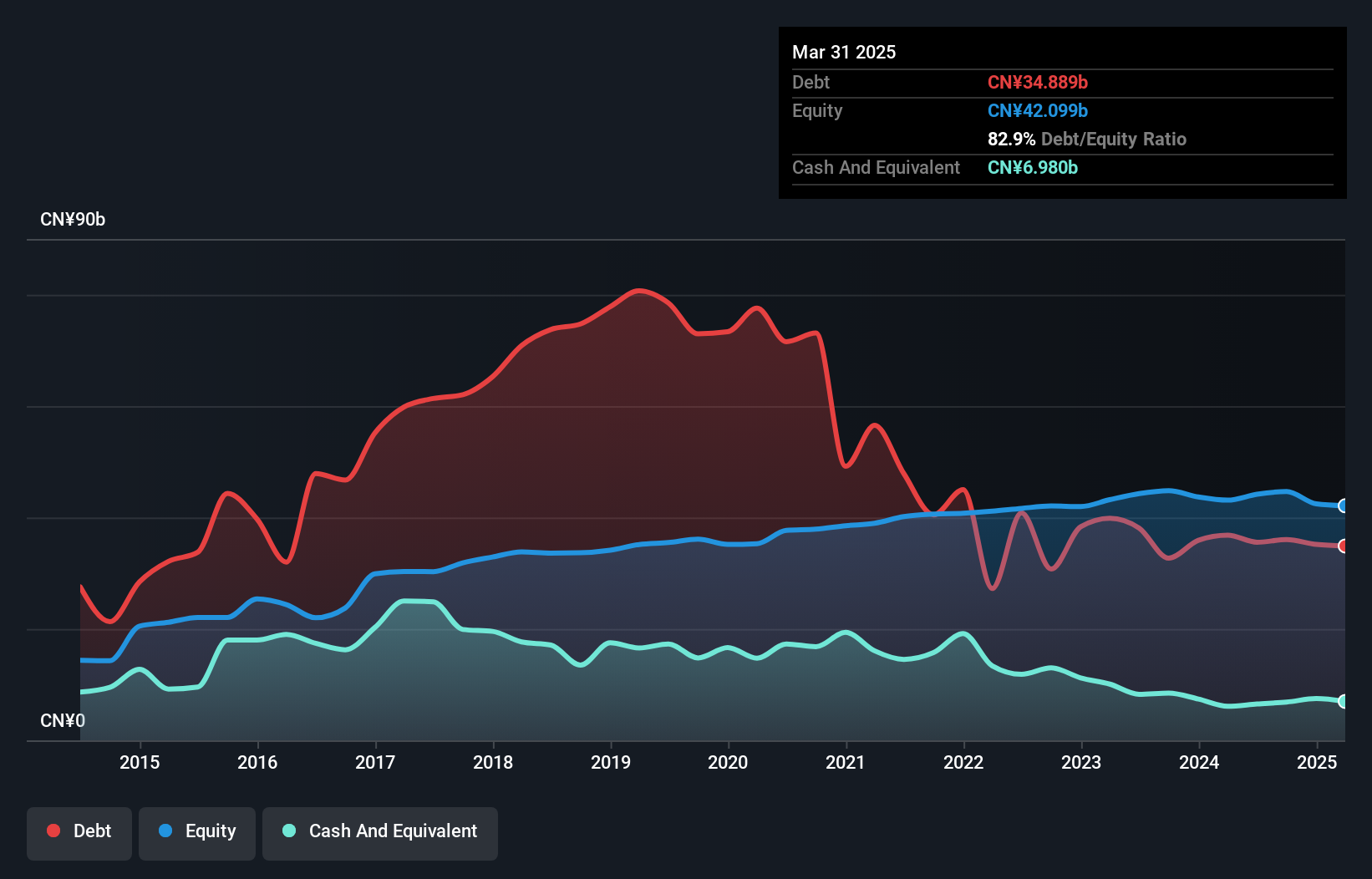

Quzhou Xin'an Development Co., Ltd., with a market cap of CN¥25.02 billion, reported substantial revenue growth to CN¥14.12 billion for the first nine months of 2024, up from CN¥3.72 billion a year earlier. Despite high net debt to equity at 65.3%, its short-term assets cover both short and long-term liabilities, suggesting manageable financial health. The company has completed a share buyback program worth CN¥150.53 million but faces challenges with low return on equity at 7.7% and declining profit margins from last year's figures, indicating potential volatility in earnings performance amidst industry pressures.

- Click here to discover the nuances of Quzhou Xin'an Development with our detailed analytical financial health report.

- Examine Quzhou Xin'an Development's earnings growth report to understand how analysts expect it to perform.

Sichuan Etrol Technologies (SZSE:300370)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sichuan Etrol Technologies Co., Ltd. is a Chinese company that manufactures and sells smart industry, automation, and oil and gas products and solutions, with a market cap of CN¥4.76 billion.

Operations: The company's revenue primarily comes from its operations in China, totaling CN¥466.33 million.

Market Cap: CN¥4.76B

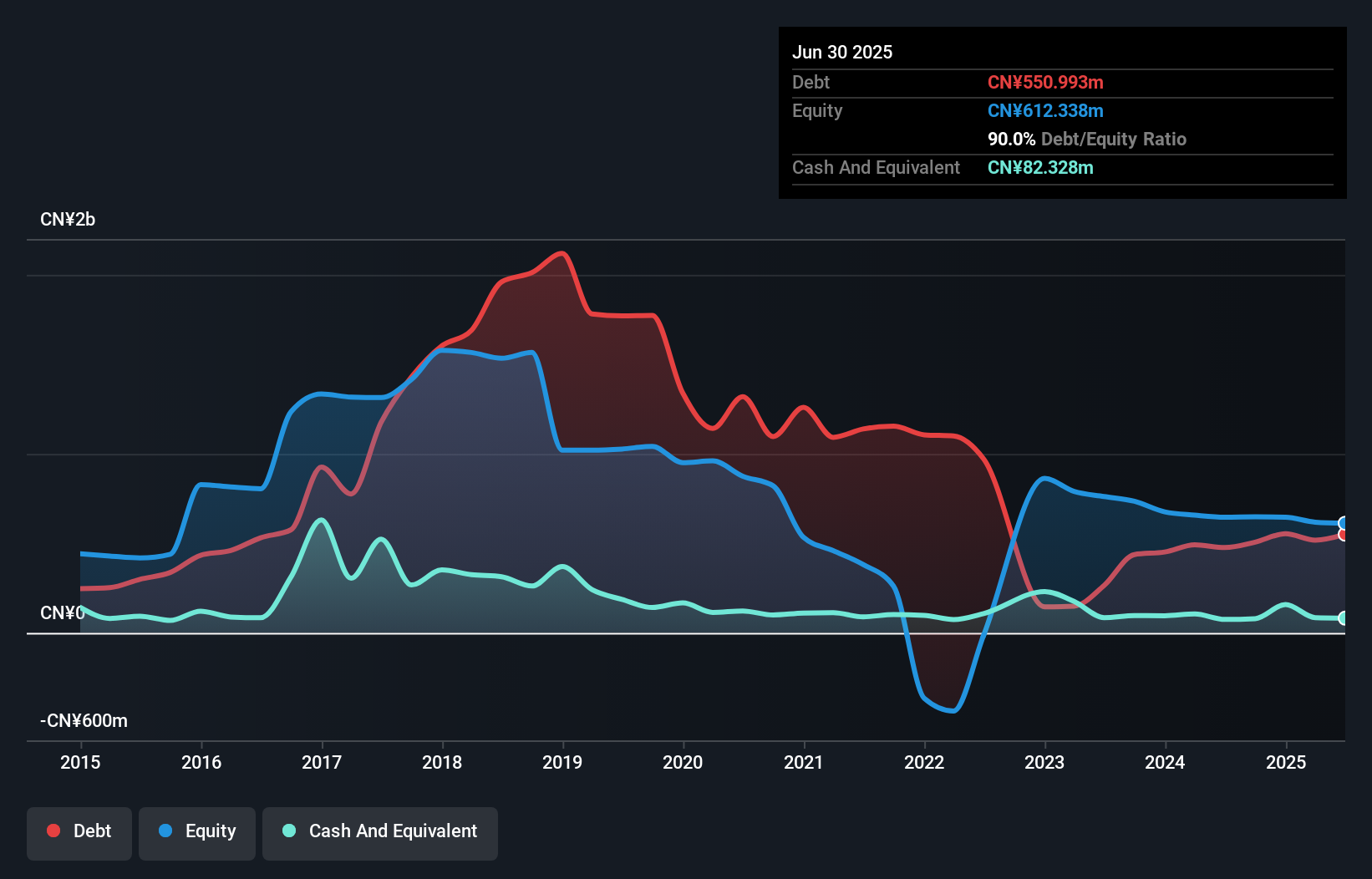

Sichuan Etrol Technologies, with a market cap of CN¥4.76 billion, has shown resilience despite its unprofitable status by reducing net losses to CN¥34.57 million for the first nine months of 2024 from CN¥119.91 million a year ago. The company's short-term assets (CN¥501.1M) exceed both short and long-term liabilities, suggesting manageable liquidity in the near term. However, its high net debt to equity ratio of 65.9% indicates financial leverage concerns. While volatility remains high and return on equity is negative at -17.09%, no significant shareholder dilution occurred over the past year, reflecting stability in ownership structure amidst ongoing challenges.

- Jump into the full analysis health report here for a deeper understanding of Sichuan Etrol Technologies.

- Understand Sichuan Etrol Technologies' track record by examining our performance history report.

Seize The Opportunity

- Reveal the 5,745 hidden gems among our Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quzhou Xin'an Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600208

Quzhou Xin'an Development

Engages in the real estate development, technology manufacturing, and financial service businesses in China.

Adequate balance sheet and fair value.