- Hong Kong

- /

- Semiconductors

- /

- SEHK:3800

GCL Technology (SEHK:3800): Assessing Valuation After HK$5.4 Billion Equity Raise

Reviewed by Simply Wall St

GCL Technology Holdings (SEHK:3800) just wrapped up a major equity offering that raised more than HKD 5.4 billion by issuing a large number of new ordinary shares. Investors are weighing how this move could affect the company’s growth and capital resources.

See our latest analysis for GCL Technology Holdings.

The substantial equity raise appears to have injected renewed attention into GCL Technology Holdings, with the share price up 10.4% year-to-date and modest gains in the past week. However, with a 1-year total shareholder return still down 20.9%, momentum has yet to strongly turn the corner for long-term holders. This is despite optimism fueled by recent capital initiatives and operational moves.

If this shift in sentiment around GCL Technology has you curious about what else is gaining traction, it could be an ideal moment to broaden your perspective and discover fast growing stocks with high insider ownership

With analyst targets still far above the current price, recent capital raises, and mixed shareholder returns, is GCL Technology now trading at a steep discount, or is the market already factoring in all of its future growth potential?

Price-to-Sales of 2.8x: Is it justified?

GCL Technology trades at a price-to-sales ratio of 2.8x, which sets it modestly below its peers but above the broader semiconductor industry average. With a last close price of HK$1.17, this multiple suggests the market assigns a slight premium relative to sector norms.

The price-to-sales ratio is a relevant measure for GCL Technology, given the company’s current lack of profits and its ongoing business transformation. This ratio assesses the stock's value relative to its annual sales, making it particularly useful for unprofitable or fast-growing companies where earnings may not fully reflect operating performance.

Looking across peers, GCL Technology appears to offer relatively good value on this multiple. Its 2.8x price-to-sales is lower than the listed peer group (3.1x), though the sector’s average is lower (1.9x). However, when compared against its fair price-to-sales ratio of 1.4x, the shares look expensive, highlighting a disconnect in market expectations and the level the multiple could head towards if fundamentals do not shift.

Explore the SWS fair ratio for GCL Technology Holdings

Result: Price-to-Sales of 2.8x (ABOUT RIGHT)

However, persistent net losses and a substantial gap to analyst targets remain key risks. These factors could challenge bullish sentiment around GCL Technology shares.

Find out about the key risks to this GCL Technology Holdings narrative.

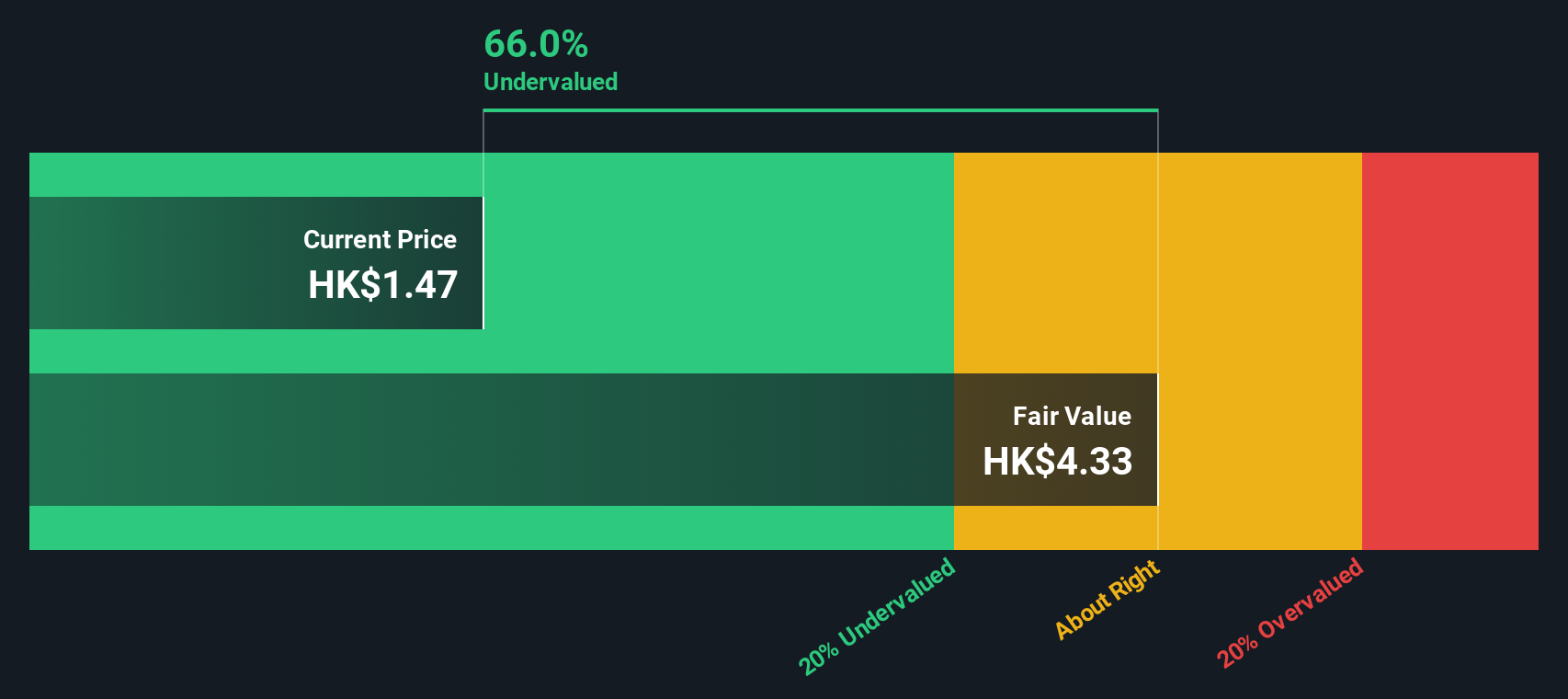

Another View: DCF Says Shares Are Deeply Discounted

Looking beyond multiples, our DCF model offers a strikingly different narrative for GCL Technology. Based on projected future cash flows, the SWS DCF model estimates the fair value at HK$4.06 per share, which is significantly higher than the recent trading price. This suggests the market may be undervaluing GCL Technology. Is the discounted cash flow model identifying opportunities others have overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GCL Technology Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GCL Technology Holdings Narrative

If you see things differently or want to investigate the numbers yourself, you can build your own view from scratch in just a few minutes. Do it your way

A great starting point for your GCL Technology Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act now to get a better edge on the market; don't let unique opportunities pass you by while others seize them first.

- Capture the advantage of strong cash flow and value by using these 923 undervalued stocks based on cash flows for high-potential stocks trading below their worth.

- Jump ahead of the curve in healthcare by checking out these 30 healthcare AI stocks, featuring companies leading breakthroughs in medical AI innovation.

- Lock in higher yields and reliable returns through these 14 dividend stocks with yields > 3% with proven, income-generating stocks offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3800

GCL Technology Holdings

Manufactures and sells polysilicon and wafers products in the People’s Republic of China and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026