- Hong Kong

- /

- Specialty Stores

- /

- SEHK:9992

Asian Stocks Trading Below Estimated Value In November 2025

Reviewed by Simply Wall St

As global markets face mixed signals, with concerns over elevated valuations and economic uncertainties impacting investor sentiment, the Asian stock markets present intriguing opportunities for discerning investors. In this environment, identifying undervalued stocks becomes crucial as they may offer potential value amid broader market fluctuations and geopolitical developments.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.70 | CN¥25.18 | 49.6% |

| Visional (TSE:4194) | ¥9849.00 | ¥19511.72 | 49.5% |

| Tianqi Lithium (SZSE:002466) | CN¥55.32 | CN¥108.64 | 49.1% |

| TESEC (TSE:6337) | ¥2091.00 | ¥4123.87 | 49.3% |

| Takara Bio (TSE:4974) | ¥905.00 | ¥1808.35 | 50% |

| PharmaResearch (KOSDAQ:A214450) | ₩440000.00 | ₩872429.90 | 49.6% |

| Mobvista (SEHK:1860) | HK$19.23 | HK$37.72 | 49% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.11 | CN¥19.96 | 49.4% |

| Insource (TSE:6200) | ¥824.00 | ¥1645.91 | 49.9% |

| Andes Technology (TWSE:6533) | NT$257.50 | NT$506.66 | 49.2% |

Let's explore several standout options from the results in the screener.

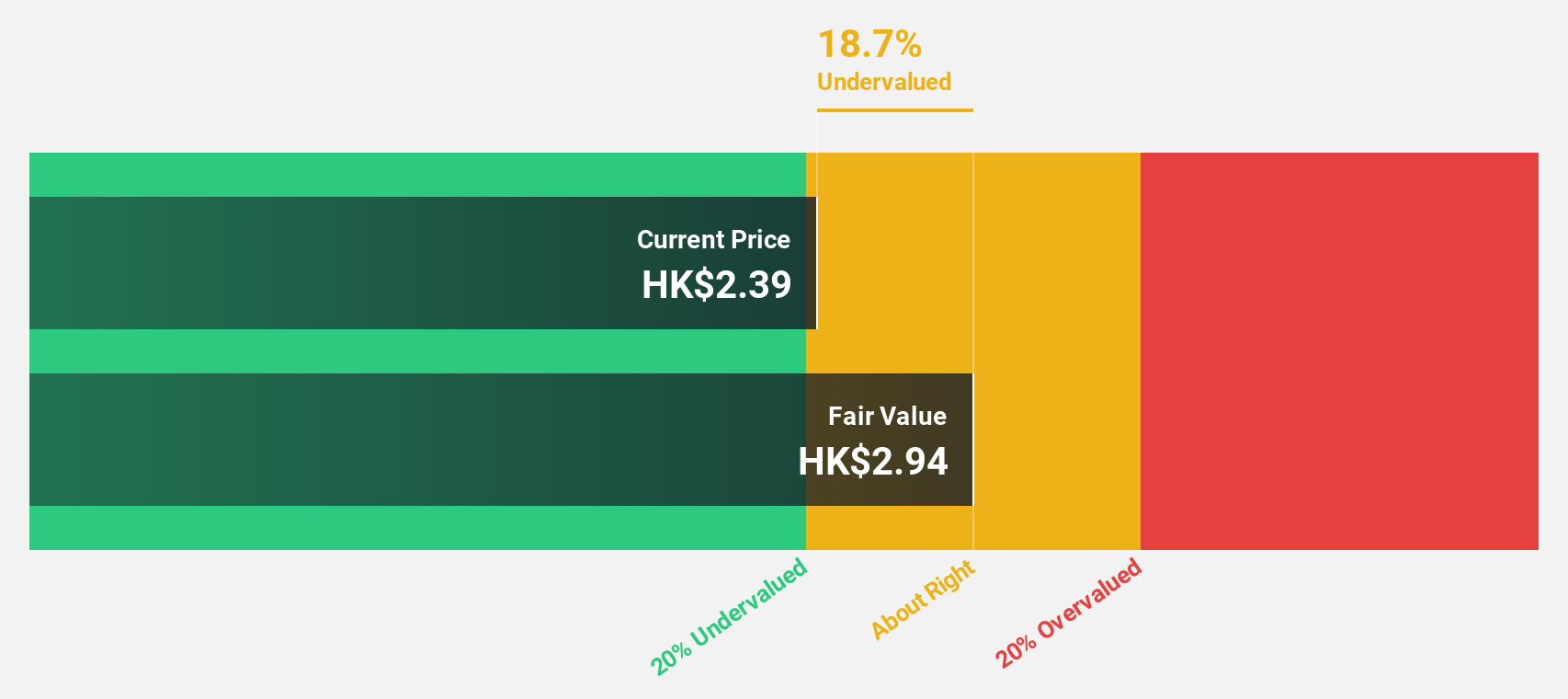

Metallurgical Corporation of China (SEHK:1618)

Overview: Metallurgical Corporation of China Ltd., along with its subsidiaries, operates in the engineering contracting sector in China and has a market capitalization of HK$75.31 billion.

Operations: Metallurgical Corporation of China Ltd. generates revenue primarily through its engineering contracting business in China, with a market capitalization of HK$75.31 billion.

Estimated Discount To Fair Value: 18.3%

Metallurgical Corporation of China is trading at HK$2.4, below its estimated fair value of HK$2.94, suggesting it may be undervalued based on cash flows. Despite a decrease in recent revenue and net income compared to last year, the company's earnings are forecast to grow significantly at 30.41% per year, outpacing the Hong Kong market's growth rate. Newly signed contracts have decreased overall but show growth in overseas markets, indicating potential future revenue streams.

- Insights from our recent growth report point to a promising forecast for Metallurgical Corporation of China's business outlook.

- Click to explore a detailed breakdown of our findings in Metallurgical Corporation of China's balance sheet health report.

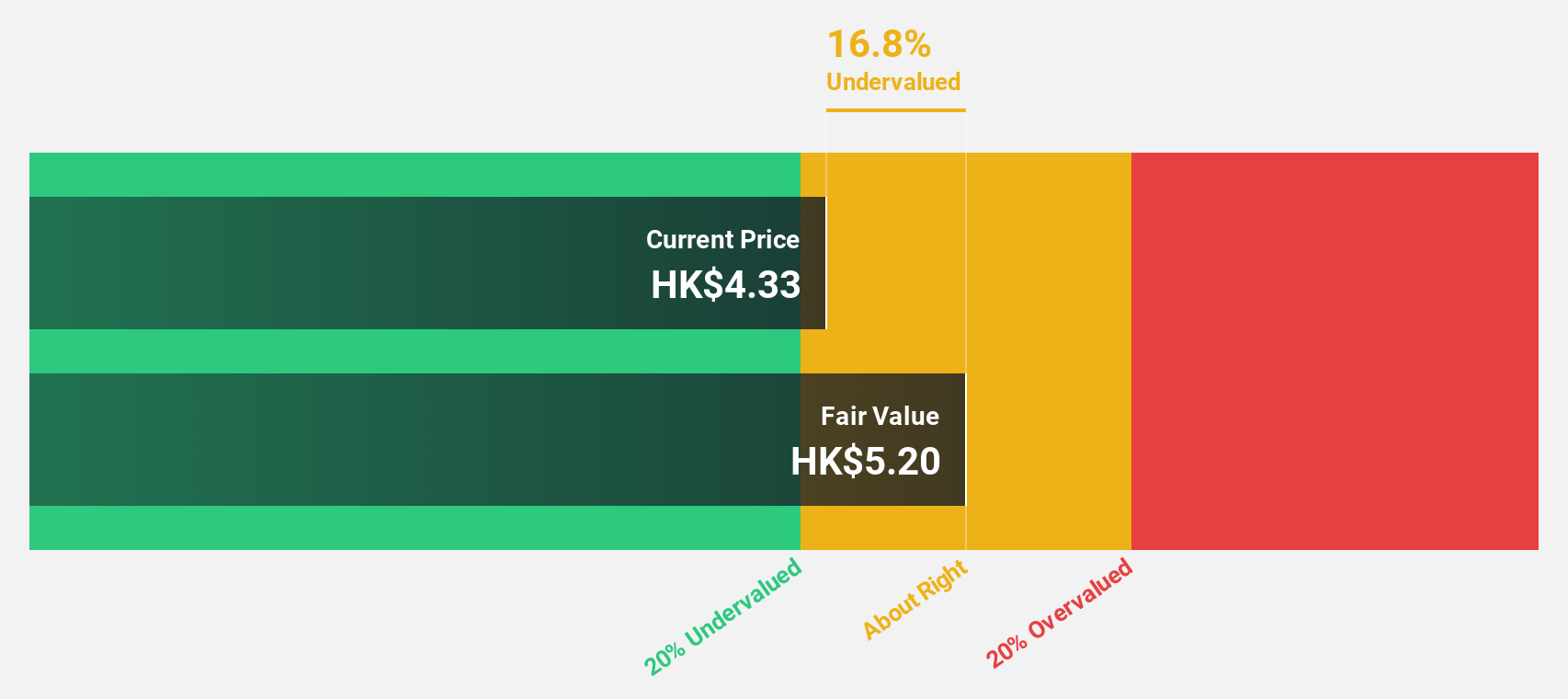

Alibaba Health Information Technology (SEHK:241)

Overview: Alibaba Health Information Technology Limited operates in pharmaceutical direct sales, pharmaceutical e-commerce platforms, and healthcare and digital services in Mainland China and Hong Kong, with a market cap of approximately HK$92.98 billion.

Operations: The company's revenue segments include CN¥30.60 billion from the distribution and development of pharmaceutical and healthcare products.

Estimated Discount To Fair Value: 48.6%

Alibaba Health Information Technology is currently trading at HK$5.77, well below its estimated fair value of HK$11.23, highlighting its potential undervaluation based on cash flows. The company is expected to see significant earnings growth of over 20% annually, surpassing the Hong Kong market's average. However, large one-off items have impacted recent financial results and its forecasted return on equity remains modest at 14% in three years.

- Our expertly prepared growth report on Alibaba Health Information Technology implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Alibaba Health Information Technology.

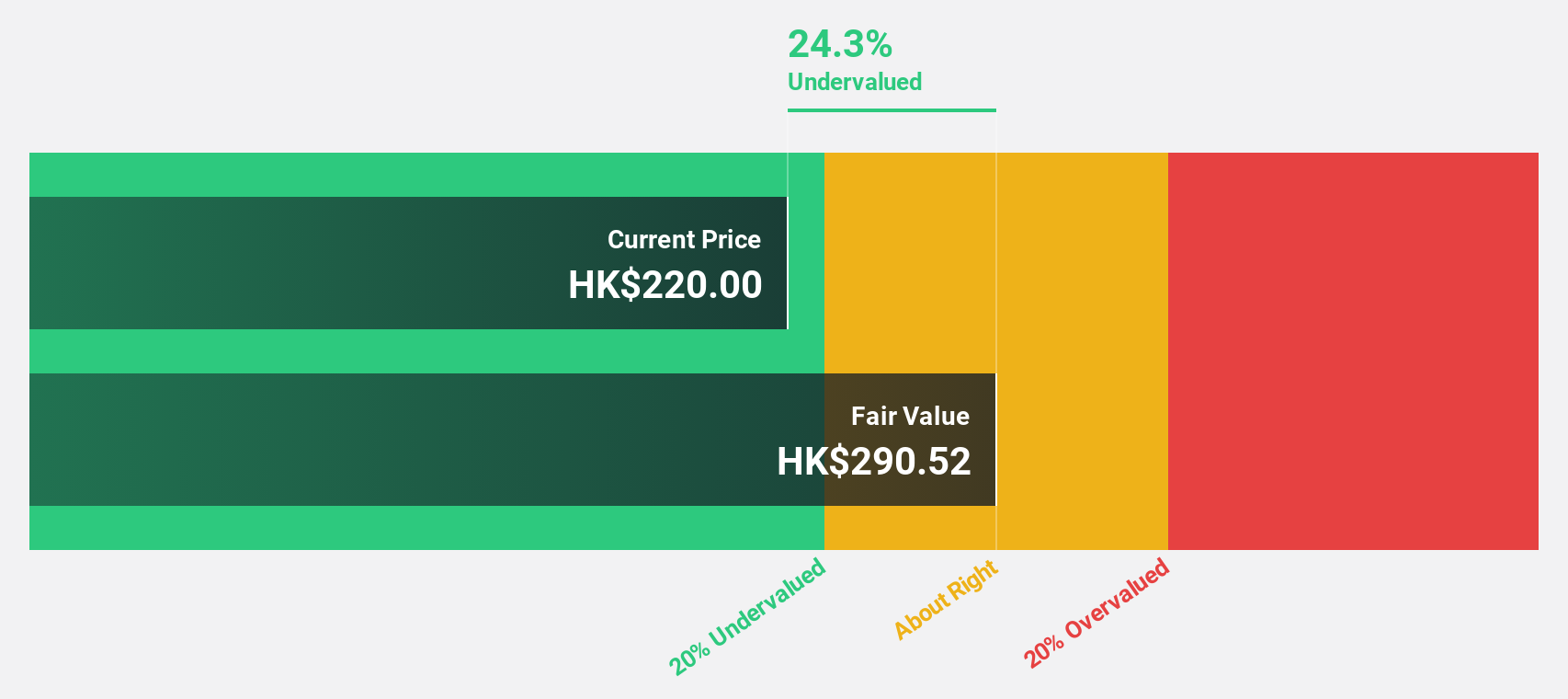

Pop Mart International Group (SEHK:9992)

Overview: Pop Mart International Group Limited is an investment holding company focused on the design, development, and sale of pop toys across the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally with a market cap of HK$296.45 billion.

Operations: The company generates revenue of CN¥22.36 billion from its brand development, design, and sales of toys.

Estimated Discount To Fair Value: 23.3%

Pop Mart International Group is trading at HK$223.2, significantly below its estimated fair value of HK$290.99, suggesting potential undervaluation based on cash flows. The company reported substantial revenue growth with a 245%-250% increase for Q3 2025 compared to the previous year and forecasts indicate earnings growth of over 25% annually, outpacing the Hong Kong market average. Its return on equity is projected to reach a high level of 42.8% in three years.

- Our comprehensive growth report raises the possibility that Pop Mart International Group is poised for substantial financial growth.

- Take a closer look at Pop Mart International Group's balance sheet health here in our report.

Where To Now?

- Access the full spectrum of 292 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9992

Pop Mart International Group

An investment holding company, engages in the design, development, and sale of pop toys in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives