Amidst global market volatility and economic uncertainties, Asian markets have been navigating through a landscape marked by trade tensions and fluctuating economic indicators. In such a climate, investors often look towards penny stocks as an avenue for potential growth opportunities. While the term 'penny stocks' may seem outdated, these smaller or newer companies can still offer significant value when they possess strong financial foundations.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Halcyon Technology (SET:HTECH) | THB2.66 | THB798M | ✅ 2 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.096 | SGD40.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.179 | SGD35.66M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.08 | SGD8.19B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.90 | HK$3.28B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.53 | HK$51.86B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.17 | HK$738.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.23 | HK$2.05B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.94 | HK$1.62B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,167 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Ausnutria Dairy (SEHK:1717)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ausnutria Dairy Corporation Ltd is an investment holding company involved in the research, development, production, marketing, processing, packaging, and distribution of dairy and nutrition products with a market cap of HK$3.56 billion.

Operations: The company's revenue is primarily derived from Dairy and Related Products, contributing CN¥7.10 billion, followed by Nutrition Products at CN¥304.56 million.

Market Cap: HK$3.56B

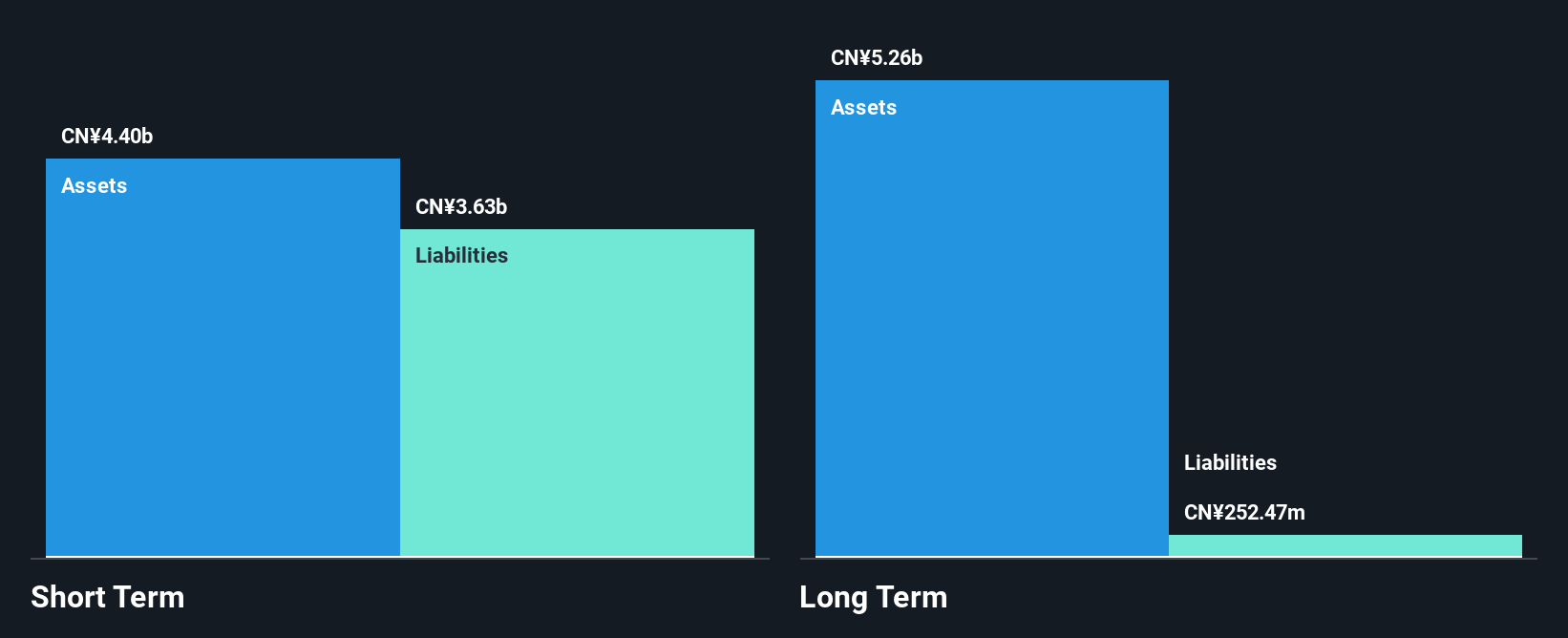

Ausnutria Dairy has shown a promising earnings growth of 35.3% over the past year, surpassing industry averages, although its five-year earnings trend reflects a decline. The company maintains strong short-term liquidity with CN¥4.4 billion in assets exceeding both short and long-term liabilities. Despite an increased debt-to-equity ratio of 37%, interest payments are well-covered by EBIT at 25.2 times coverage, though operating cash flow covers only 14% of debt, indicating potential cash flow constraints. Recent dividend increases highlight shareholder returns but raise concerns about sustainability due to limited free cash flow coverage.

- Jump into the full analysis health report here for a deeper understanding of Ausnutria Dairy.

- Learn about Ausnutria Dairy's future growth trajectory here.

Hong Kong Robotics Group Holding (SEHK:370)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Kong Robotics Group Holding Limited is an investment holding company that trades in electronic appliances across the People’s Republic of China, Singapore, and Hong Kong, with a market cap of HK$3.28 billion.

Operations: The company's revenue is primarily derived from building construction contracting (HK$72.40 million), centralised heating (HK$50.07 million), geothermal energy (HK$16.87 million), customised technical support (HK$14.87 million), property investment (HK$6.32 million), and money lending (HK$6.98 million).

Market Cap: HK$3.28B

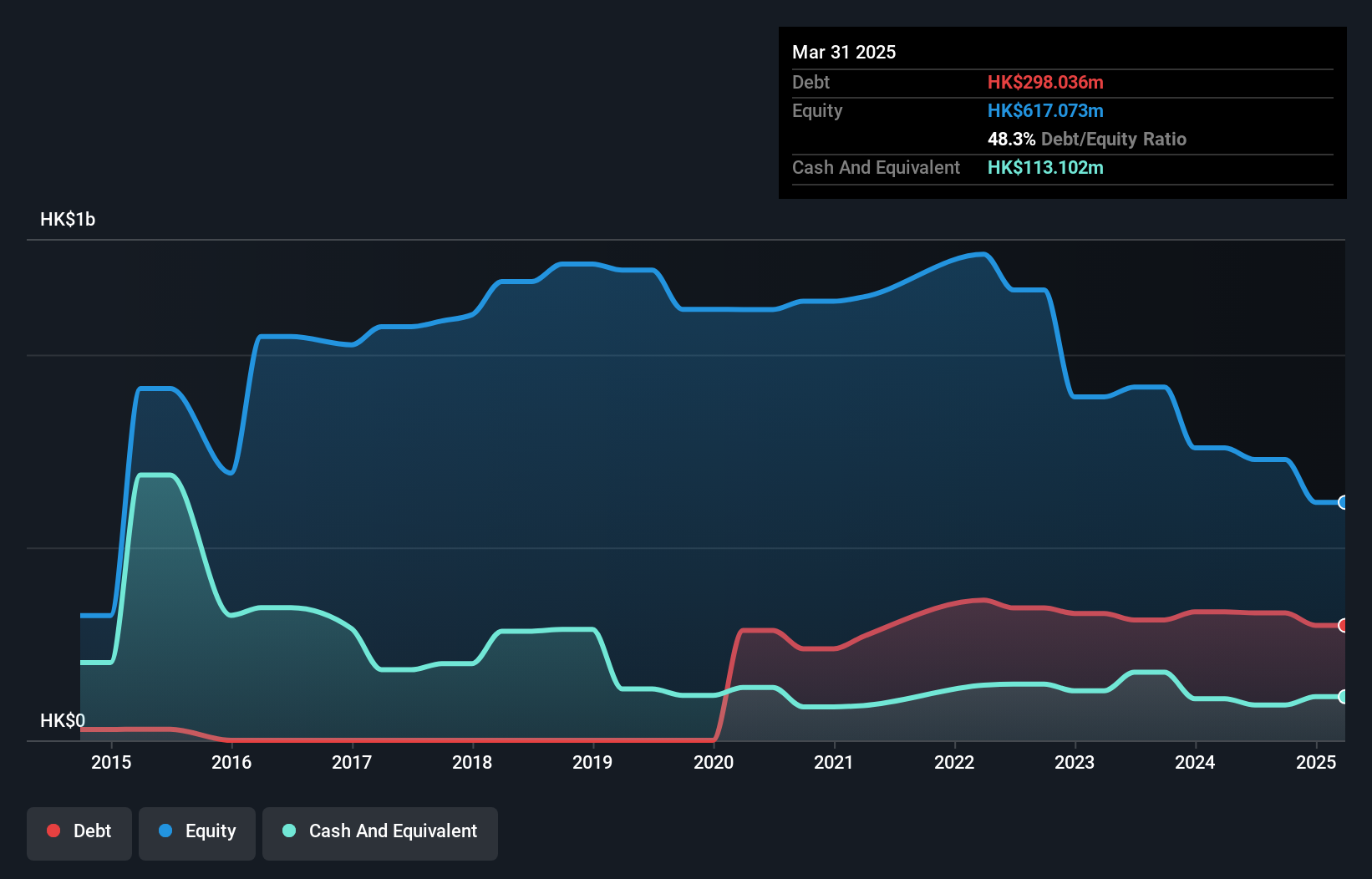

Hong Kong Robotics Group Holding Limited, with a market cap of HK$3.28 billion, remains unprofitable despite diverse revenue streams from building construction contracting and centralised heating. The company's short-term assets of HK$1.0 billion comfortably cover both short and long-term liabilities, reflecting solid liquidity management. While the company has a satisfactory net debt to equity ratio of 32.8%, the increased debt levels over five years warrant caution. Recent developments include a name change and collaboration on a healthcare project in Jiangsu Province, which could enhance its strategic positioning but also introduces execution risks amidst ongoing volatility in its share price.

- Click to explore a detailed breakdown of our findings in Hong Kong Robotics Group Holding's financial health report.

- Gain insights into Hong Kong Robotics Group Holding's past trends and performance with our report on the company's historical track record.

China Oriental Group (SEHK:581)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Oriental Group Company Limited manufactures and sells iron and steel products for downstream steel manufacturers in the People’s Republic of China, with a market cap of HK$4.91 billion.

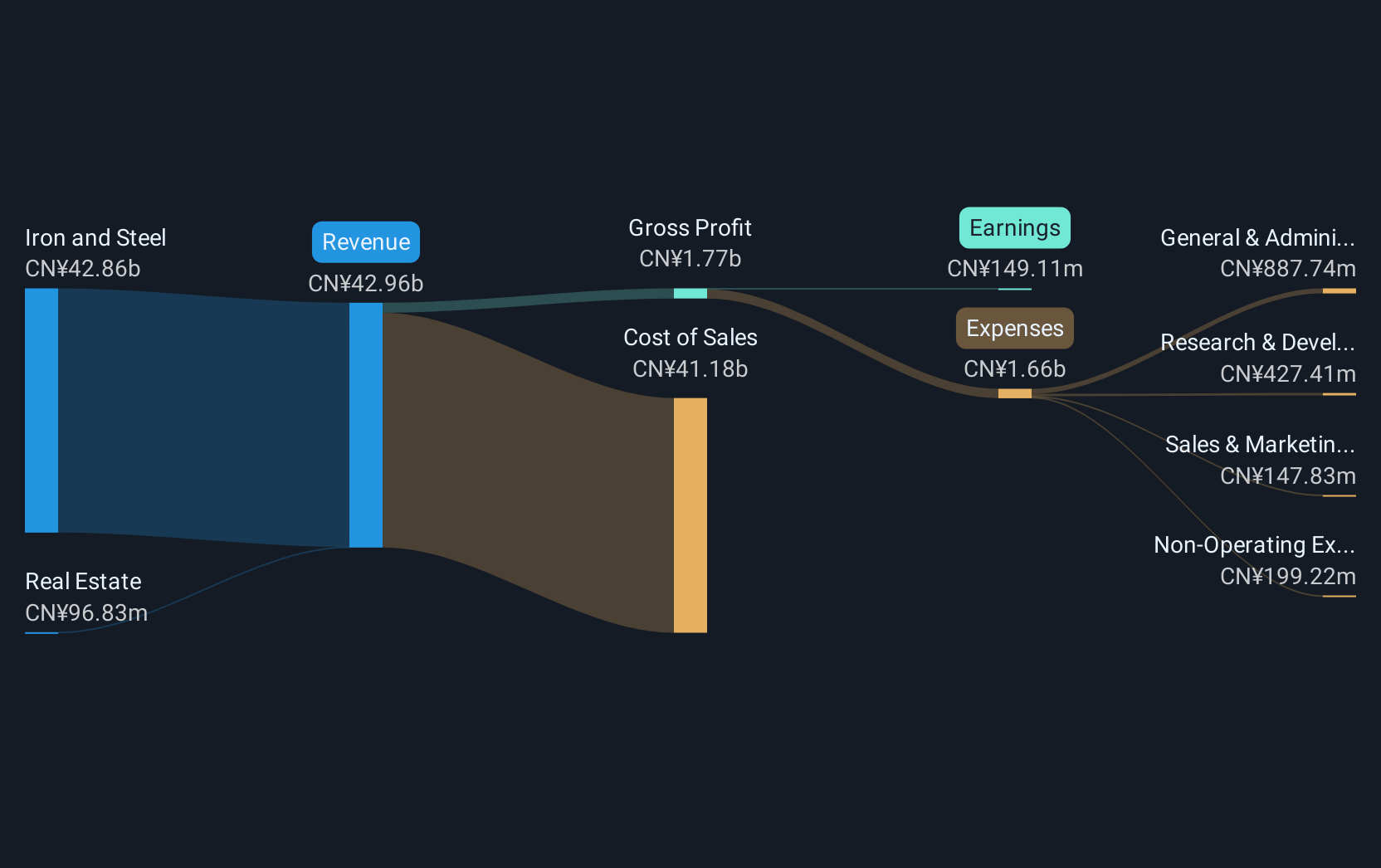

Operations: The company generates revenue primarily from its Iron and Steel segment, which accounts for CN¥42.86 billion, alongside a smaller contribution of CN¥96.83 million from Real Estate activities.

Market Cap: HK$4.91B

China Oriental Group, with a market cap of HK$4.91 billion, recently reported a turnaround from a CN¥159.69 million net loss to a CN¥149.11 million net profit for 2024, aided by improved earnings and stable revenue of CN¥42.96 billion primarily from its iron and steel segment. The company announced dividends totaling HKD 0.06 per share for the year ended December 2024, reflecting shareholder returns despite an unstable dividend history. While the management team is experienced and interest coverage is adequate, concerns remain over increased debt levels and low return on equity at 0.9%.

- Take a closer look at China Oriental Group's potential here in our financial health report.

- Assess China Oriental Group's previous results with our detailed historical performance reports.

Taking Advantage

- Take a closer look at our Asian Penny Stocks list of 1,167 companies by clicking here.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1717

Ausnutria Dairy

An investment holding company, primarily engages in the research and development, production, marketing, processing, packaging, and distribution of dairy and related products, and nutrition products.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives