Lifestyle China Group Limited's (HKG:2136) most bullish insider, CEO Luen Hung Lau must be pleased with the recent 11% gain

Key Insights

- Insiders appear to have a vested interest in Lifestyle China Group's growth, as seen by their sizeable ownership

- The largest shareholder of the company is Luen Hung Lau with a 75% stake

- Past performance of a company along with ownership data serve to give a strong idea about prospects for a business

Every investor in Lifestyle China Group Limited (HKG:2136) should be aware of the most powerful shareholder groups. And the group that holds the biggest piece of the pie are individual insiders with 75% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

As a result, insiders scored the highest last week as the company hit HK$1.0b market cap following a 11% gain in the stock.

Let's delve deeper into each type of owner of Lifestyle China Group, beginning with the chart below.

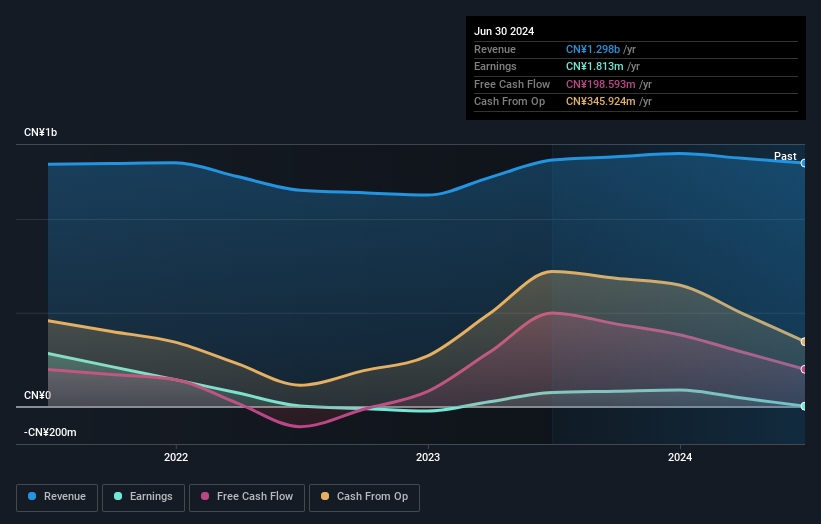

See our latest analysis for Lifestyle China Group

What Does The Lack Of Institutional Ownership Tell Us About Lifestyle China Group?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. Lifestyle China Group might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

Lifestyle China Group is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is the CEO Luen Hung Lau with 75% of shares outstanding. This implies that they possess majority interests and have significant control over the company. Investors usually consider it a good sign when the company leadership has such a significant stake, as this is widely perceived to increase the chance that the management will act in the best interests of the company. In comparison, the second and third largest shareholders hold about 0.2% and 0.02% of the stock. Interestingly, the third-largest shareholder, Chor Ling Chan is also a Member of the Board of Directors, again, indicating strong insider ownership amongst the company's top shareholders.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Lifestyle China Group

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders own more than half of Lifestyle China Group Limited. This gives them effective control of the company. Given it has a market cap of HK$1.0b, that means they have HK$779m worth of shares. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public-- including retail investors -- own 25% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Take risks for example - Lifestyle China Group has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2136

Lifestyle China Group

An investment holding company, operates department stores in the People’s Republic of China.

Imperfect balance sheet very low.