- Hong Kong

- /

- Retail REITs

- /

- SEHK:823

How Does Link Real Estate Investment Trust's (HKG:823) CEO Salary Compare to Peers?

George Hongchoy became the CEO of Link Real Estate Investment Trust (HKG:823) in 2010, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Link Real Estate Investment Trust.

Note: The company does not report funds from operations, and as a result, we have used earnings per share in our analysis.

Check out our latest analysis for Link Real Estate Investment Trust

How Does Total Compensation For George Hongchoy Compare With Other Companies In The Industry?

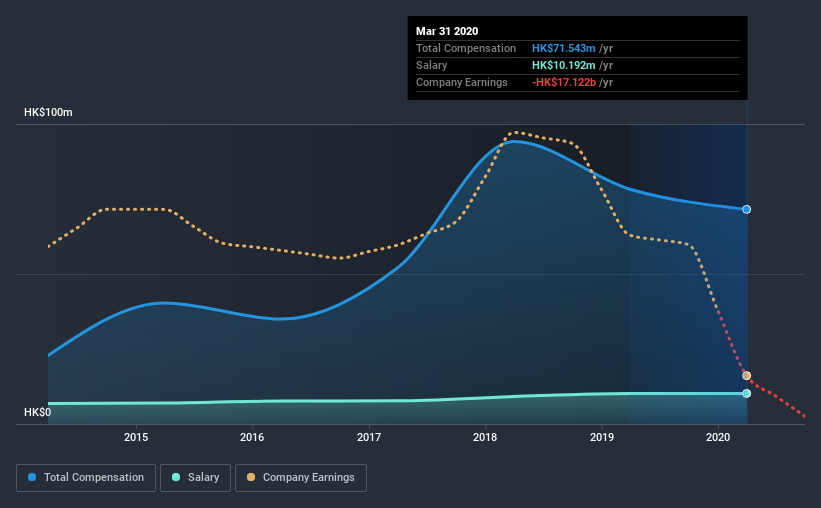

Our data indicates that Link Real Estate Investment Trust has a market capitalization of HK$147b, and total annual CEO compensation was reported as HK$72m for the year to March 2020. That's a notable decrease of 8.6% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at HK$10m.

On comparing similar companies in the industry with market capitalizations above HK$62b, we found that the median total CEO compensation was HK$54m. Hence, we can conclude that George Hongchoy is remunerated higher than the industry median. Moreover, George Hongchoy also holds HK$29m worth of Link Real Estate Investment Trust stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$10m | HK$10m | 14% |

| Other | HK$61m | HK$68m | 86% |

| Total Compensation | HK$72m | HK$78m | 100% |

On an industry level, roughly 25% of total compensation represents salary and 75% is other remuneration. Link Real Estate Investment Trust pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Link Real Estate Investment Trust's Growth

Over the last three years, Link Real Estate Investment Trust has shrunk its earnings per share by 85% per year. In the last year, its revenue is up 1.7%.

Few shareholders would be pleased to read that EPS have declined. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Link Real Estate Investment Trust Been A Good Investment?

Link Real Estate Investment Trust has not done too badly by shareholders, with a total return of 6.5%, over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

As previously discussed, George is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. Meanwhile, EPS has not been growing sufficiently to impress us, over the last three years. And shareholder returns are decent but not great. So you may want to delve deeper, because we don't think the amount George makes is justifiable.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Link Real Estate Investment Trust that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Link Real Estate Investment Trust or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:823

Link Real Estate Investment Trust

Link Real Estate Investment Trust, managed by Link Asset Management Limited, is the largest REIT in Asia, and a leading real estate investor and asset manager in the world.

Very undervalued average dividend payer.