- Hong Kong

- /

- Real Estate

- /

- SEHK:688

China Overseas Land & Investment (HKG:688) Will Pay A Larger Dividend Than Last Year At HK$0.73

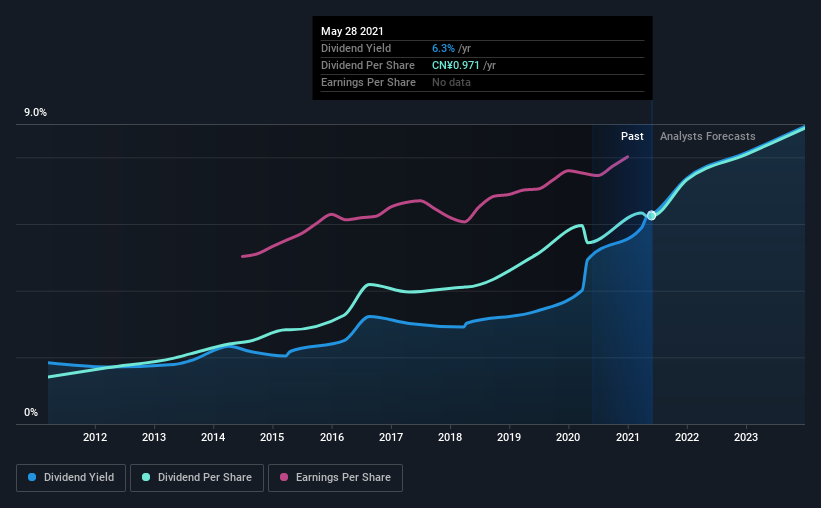

China Overseas Land & Investment Limited (HKG:688) will increase its dividend on the 12th of July to HK$0.73. This will take the dividend yield from 6.3% to 6.3%, providing a nice boost to shareholder returns.

View our latest analysis for China Overseas Land & Investment

China Overseas Land & Investment's Dividend Is Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before making this announcement, China Overseas Land & Investment was paying a whopping 113% as a dividend, but this only made up 25% of its overall earnings. A cash payout ratio this high could put the dividend under pressure and force the company to reduce it in the future if it were to run into tough times.

EPS is set to fall by 4.9% over the next 12 months. If the dividend continues along recent trends, we estimate the payout ratio could be 35%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

China Overseas Land & Investment Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2011, the dividend has gone from CN¥0.22 to CN¥0.97. This works out to be a compound annual growth rate (CAGR) of approximately 16% a year over that time. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

We Could See China Overseas Land & Investment's Dividend Growing

The company's investors will be pleased to have been receiving dividend income for some time. However, China Overseas Land & Investment has only grown its earnings per share at 5.0% per annum over the past five years. If China Overseas Land & Investment is struggling to find viable investments, it always has the option to increase its payout ratio to pay more to shareholders.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think China Overseas Land & Investment's payments are rock solid. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments China Overseas Land & Investment has been making. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for China Overseas Land & Investment that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:688

China Overseas Land & Investment

An investment holding company, engages in the property development and investment, and other operations in the People’s Republic of China and the United Kingdom.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives