- Hong Kong

- /

- Real Estate

- /

- SEHK:6098

How Investors Are Reacting To Country Garden Services (SEHK:6098) Disclosure Lapses And Leadership Backing

Reviewed by Sasha Jovanovic

- Country Garden Services Holdings Company Limited recently disclosed that its subsidiary, Giant Leap Construction Technology Group Co., Ltd., received a warning from the Guangdong Securities Regulatory Bureau for failing to report significant changes promptly, highlighting past shortcomings in disclosure practices.

- Despite the regulatory rebuke, the board has publicly reaffirmed its confidence in chairman and non-executive director Ms. YANG Huiyan, underscoring leadership’s emphasis on continuity and governance credibility.

- We will now examine how this regulatory warning over disclosure controls shapes Country Garden Services Holdings’ investment narrative and perceived governance quality.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is Country Garden Services Holdings' Investment Narrative?

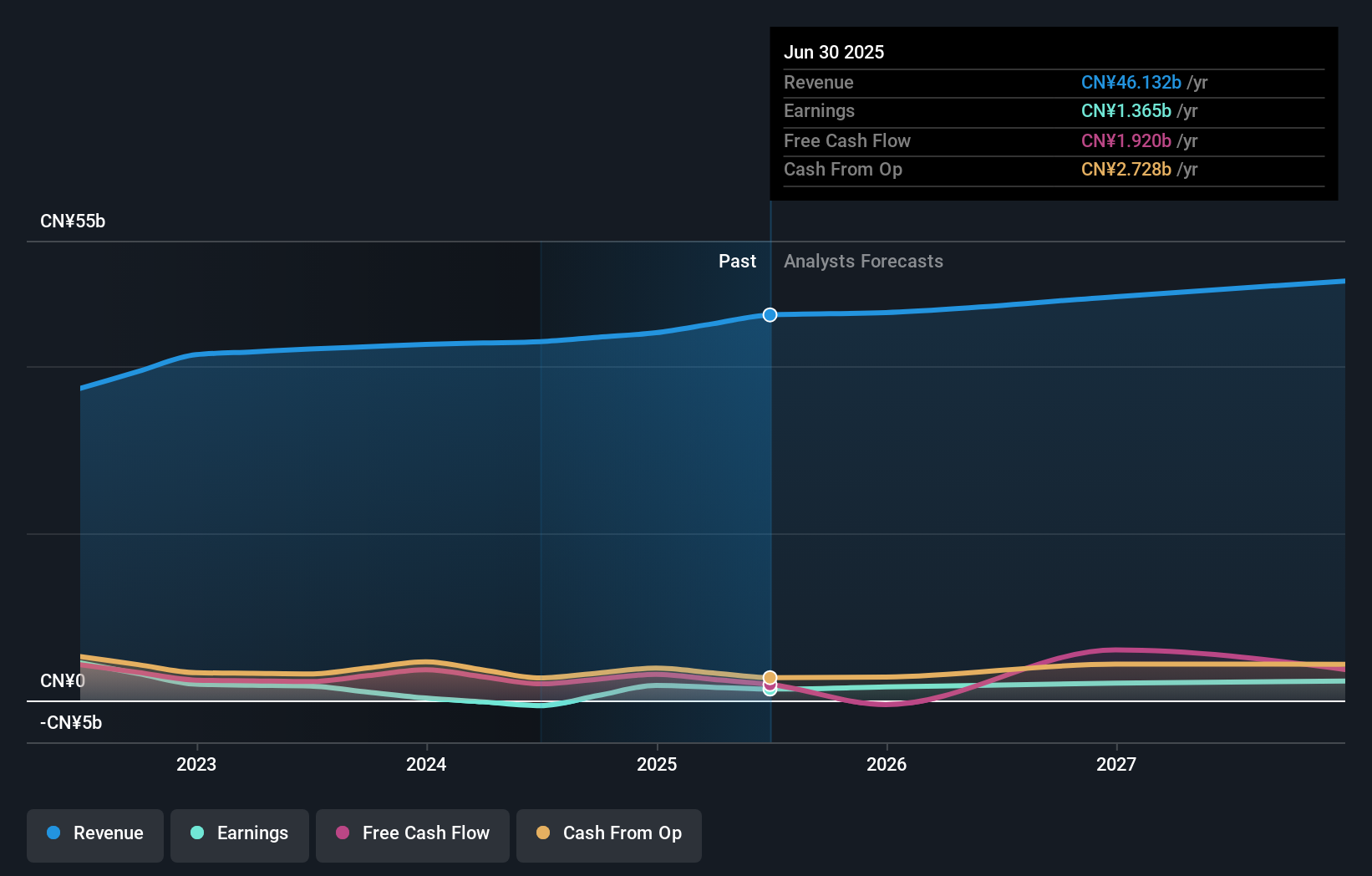

For anyone considering Country Garden Services Holdings, the big picture still comes down to whether you believe this is a fundamentally cash-generative, asset-light service business that can steadily grow while tightening its controls after a very difficult few years. Recent dividends and buybacks suggest management is comfortable returning cash, even as revenue growth looks modest and return on equity remains low. The warning to Giant Leap does not appear to have moved the share price much in the short term, which implies investors see it more as a governance blemish than a thesis-breaker, but it does nudge disclosure quality and compliance higher up the risk list. In the near term, the key catalysts remain earnings delivery, cash returns and any signs that one-off items and regulatory noise are being brought under control.

But behind the stabilising story, one governance-related risk stands out that investors should not ignore. Country Garden Services Holdings' shares have been on the rise but are still potentially undervalued by 26%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Country Garden Services Holdings - why the stock might be worth just HK$8.82!

Build Your Own Country Garden Services Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Country Garden Services Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Country Garden Services Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Country Garden Services Holdings' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6098

Country Garden Services Holdings

An investment holding company, provides property management services to property owners, residents, and property developers in Mainland China.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026