- Hong Kong

- /

- Real Estate

- /

- SEHK:3380

Logan Group (SEHK:3380) Is Up 8.2% After Advancing RMB13.66b Onshore Debt Restructuring Plan

Reviewed by Sasha Jovanovic

- Earlier this week, Logan Group reported significant progress on its onshore debt restructuring plan covering RMB13.66 billion, using tools such as cash repurchases and asset-for-debt swaps to address a large share of its public bond obligations.

- This marks a key step in Logan Group’s efforts to tackle its financing pressures and gradually restore more normal operating conditions.

- We’ll now examine how this progress in onshore debt restructuring could influence Logan Group’s investment narrative and risk profile.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is Logan Group's Investment Narrative?

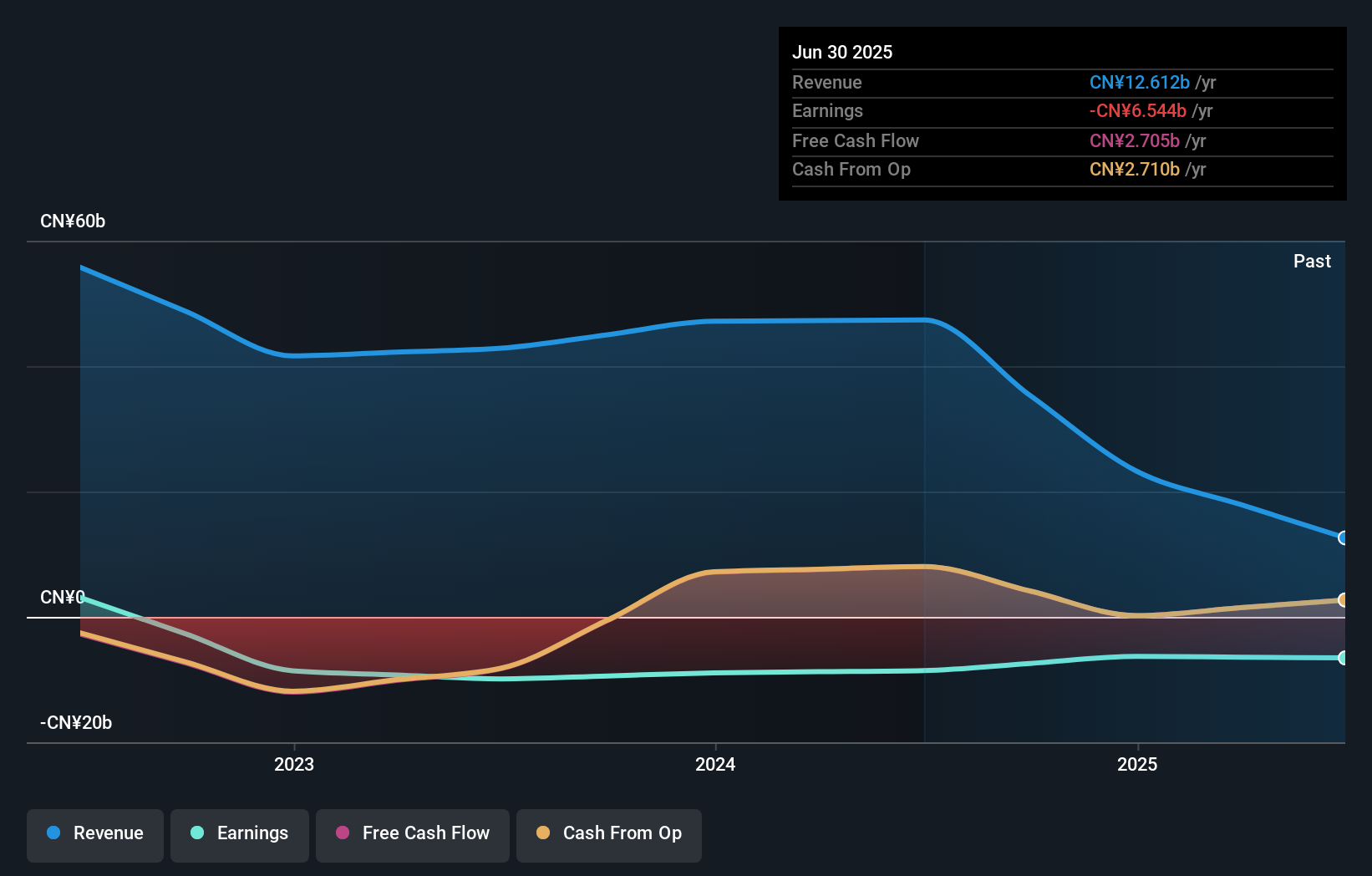

To own Logan Group today, you need to believe that its onshore restructuring progress can eventually stabilise a highly stressed balance sheet and keep the auditors’ going concern doubts from turning into a more serious outcome. The latest RMB13.66 billion onshore plan, already covering a majority of public bond principal, goes straight to the heart of the near term catalyst: regaining creditor confidence so operations can move closer to normal. It does not solve everything, though. Revenue has fallen sharply, losses remain large and debt is still not well covered by operating cash flow. The share price’s strong rebound over the past quarter suggests the market is already pricing in some restructuring success, which raises the bar for further positive surprises.

However, one key financing risk remains that investors should be watching closely. Logan Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Logan Group - why the stock might be worth as much as HK$0.607!

Build Your Own Logan Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Logan Group research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Logan Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Logan Group's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3380

Logan Group

An investment holding company, engages in property development and operation in the People’s Republic of China.

Imperfect balance sheet with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026